The Cost of Delay: Employer Mandate Edition

Early this month, the Obama Administration announced that it would delay enforcement of the employer mandate penalty in the Affordable Care Act for 2014. The employer mandate would have required employers with 50 or more full time workers to pay $2,000 to $3,000 per employee if any of their workers did not receive an affordable offer from the employer and instead obtained subsidized health insurance coverage through a health insurance exchange. The first 30 workers are exempted in calculating the penalty.

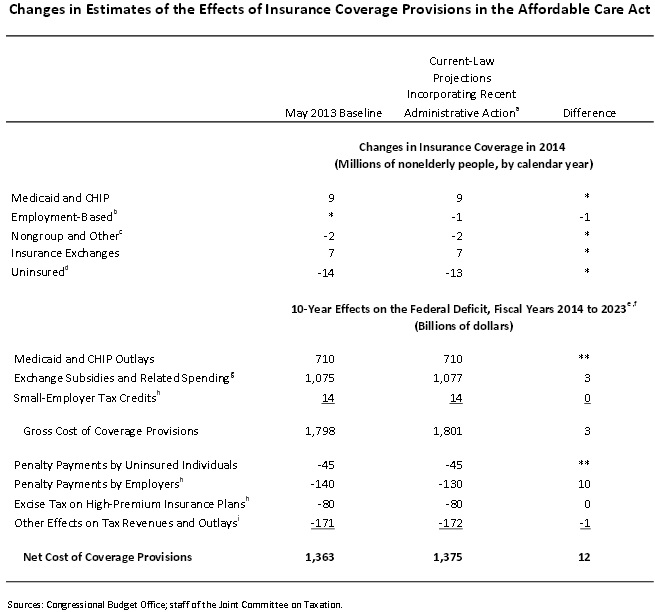

At the time, we estimated that the delay would increase spending in the exchanges by about $3 to $5 billion, in addition to revenue losses from fewer penalties of about $10 billion. All-in-all, we estimated about $13 to $15 billion in costs. Now, CBO has put its official score out, estimating that the action would increase the net cost of the ACA's coverage provisions by $12 billion over ten years -- very close to what we roughly estimated!

CBO also estimated the effect for delaying the implementation of an additional layer of income verification for exchange subsidy applicants but found that the effect would be almost negligible.

The bulk of the $12 billion difference, $10 billion to be precise, comes from the lack of employer penalties themselves as 1 million fewer people would receive coverage through their employer. About half of those people would then receive coverage through the exchanges or through Medicaid. As a result, CBO estimated that a $3 billion increase in exchange subsidies. CBO also estimates a $1 billion revenue gain from the lessening employer coverage as employees make up for their loss of health insurance coverage by increasing their taxable compensation.