Comparing Spending Levels in the President’s 2025 Budget

President Biden proposes spending nearly $7.3 trillion in Fiscal Year (FY) 2025, or 24.8 percent of Gross Domestic Product (GDP), under his latest budget. In nominal dollars, this would be the largest amount ever spent – exceeding even COVID-era levels. As a share of GDP, spending would be larger than any time in history outside of World War II and the COVID-19 pandemic.

In this analysis of the President’s budget, we show that:

- Spending in FY 2025 would be 2.1 percent of GDP above 2023 levels, including a 1.2 percent of GDP increase in primary (non-interest) spending and a 0.9 percent of GDP increase in interest costs.

- Spending in FY 2025 would be 3.9 percent of GDP above 2019 levels, including a 2.4 percent of GDP increase in primary spending and a 1.5 percent of GDP increase in interest costs.

- By FY 2034, spending under the President’s budget would be 3.3 percent of GDP above 2019 levels, including 1.6 percent of GDP growth in primary spending and a 1.7 percent of GDP increase in interest spending.

- The growth in primary spending is largely attributable to Social Security and health care by FY 2034 but is due mainly to growth of other parts of the budget in 2025.

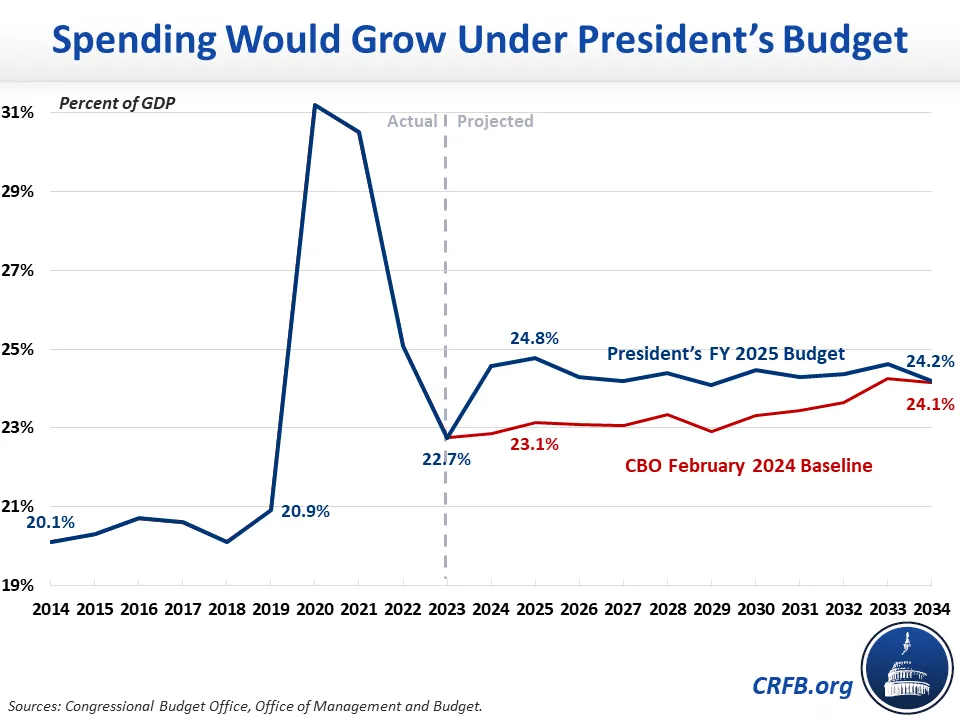

Federal spending has generally been on an upward trajectory since FY 2014 but has grown especially quickly since the COVID-19 pandemic and would grow even faster under the President’s budget. Specifically, spending grew from 20.1 percent of GDP in 2014 to 20.9 percent of GDP in 2019, spiked to about 30 percent of GDP in 2020 and 2021 as a result of costly pandemic relief, and then fell to 22.7 percent of GDP in 2023 – almost 2 percent of GDP above 2019 levels – after pandemic relief had largely disappeared.

Spending is projected to continue to grow under current law, reaching 23.1 percent of GDP in FY 2025 and 24.1 percent of GDP in 2034 under CBO’s baseline. Under the President’s budget, spending would grow even further, reaching 24.8 percent of GDP by 2025 and 24.2 percent of GDP by 2034.

In FY 2025, the President’s budget proposes to spend 3.9 percent of GDP more than we did in 2019, a 19 percent increase. This includes a 1.5 percent of GDP (83 percent) increase in interest payments but also a 0.3 percent of GDP (5 percent) increase in discretionary spending; a 0.7 percent of GDP (7 percent) increase in spending on Social Security, Medicare, and Medicaid; and a 1.4 percent of GDP (47 percent) increase in other mandatory spending.

Nearly half of the increase in primary spending – over 1.1 percent of GDP – is the result of new spending proposed in the President’s budget; more than half of that new spending comes from an expanded and fully refundable Child Tax Credit.

Spending under the President’s budget peaks as a share of GDP in FY 2025 under the budget’s estimates and would shrink to 24.2 percent of GDP by 2034 – though much of this reduction may fail to materialize in reality. By that year, under the budget’s estimates, interest costs will be 1.7 percent of GDP (93 percent) above 2019 levels while Social Security, Medicare, and Medicaid will be 2.3 percent of GDP (23 percent) higher. Other mandatory spending will be 0.8 percent of GDP (26 percent) higher than in 2019, and discretionary spending would be 1.5 percent of GDP (23 percent) lower.

Actual spending in FY 2034 would likely be higher assuming enactment of the President’s budget. The figures in the budget assume the proposed Child Tax Credit expansion arbitrarily expires after 2025 and that discretionary spending growth is limited to below the rate of inflation later in the budget window. It also assumes that many of the President’s new initiatives will have unusually little cost growth over time.

Under more realistic assumptions, spending could continue to grow beyond FY 2025 under the President’s budget. In addition to introducing new costly (though offset) initiatives, the President’s budget does little to stem the underlying growth in spending outside of some modest health care savings and user fees.

On net, the President’s budget increases spending by $1.7 trillion above its baseline over the decade to fund child care, education, paid leave, and many other initiatives. This comes on top of more than $3 trillion of spending that President Biden has already signed into law or implemented through executive action.

President Biden deserves credit for proposing to offset all new spending and calling for an additional $3.3 trillion of deficit reduction beyond that. However, his budget fails to address the true drivers of spending growth over the longer term – Social Security and health care, along with the rapid growth of net interest payments on the debt due to the high and rising national debt that we have already accrued. Without a plan to tackle spending growth – especially in the major health and retirement programs – it will be nearly impossible to get our fiscal house in order.