CMS Finds Pickup in Health Care Spending Growth in 2014

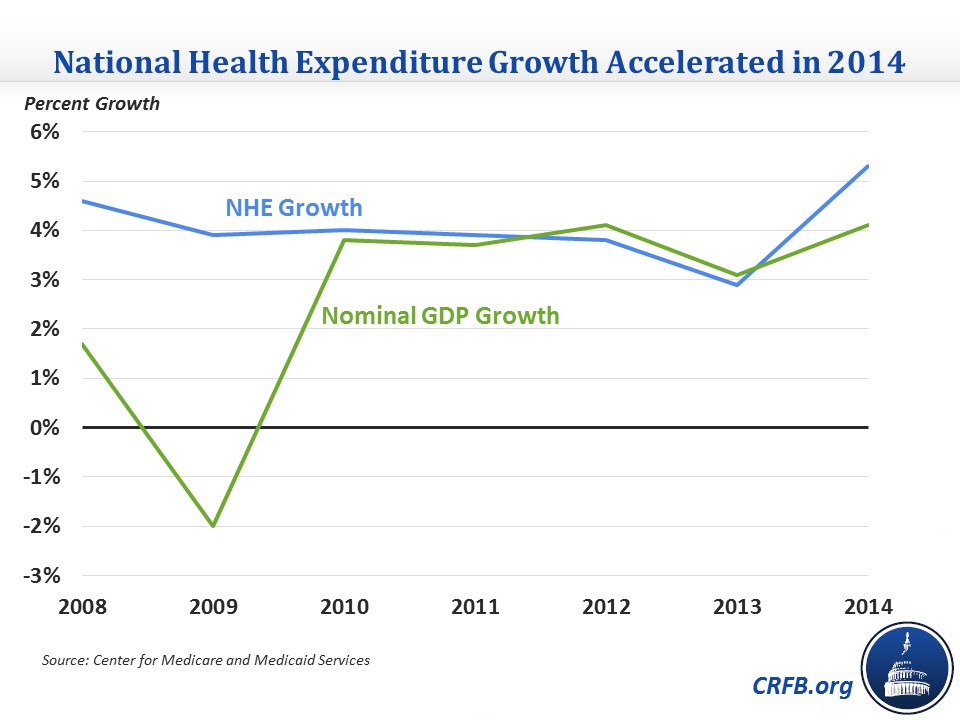

The Centers for Medicare and Medicaid Services (CMS) released its National Health Expenditure (NHE) numbers for 2014 today, showing an expected pickup in overall spending growth from 2.9 percent in 2013 to 5.3 percent in 2014. This growth rate comes after annual health care spending growth remained in the 3 to 4 percent range since 2009, an unusually low level of spending growth. The growth acceleration in 2014 (as they reported this summer) was fueled by the coverage expansions in the Affordable Care Act, which had been predicted since the legislation passed, along with a large jump in prescription drug spending buoyed by new expensive Hepatits C drugs coming to market.

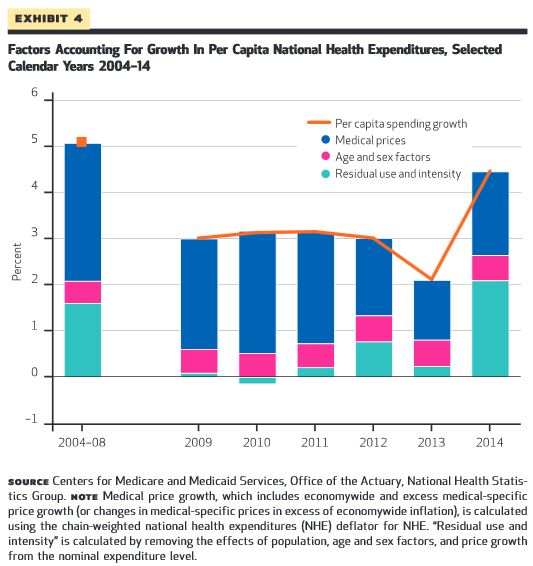

The 5.3 percent 2014 growth represents the first time health care spending has grown noticeably faster than Gross Domestic Product (GDP) growth since 2009 (GDP grew at 4.1 percent in 2014). As a result, spending as a share of GDP increased from 17.3 percent for most of 2009-2013 to 17.5 percent in 2014. Per-person spending grew by 4.5 percent in 2014, clearly up from 2013's 2.1 percent growth rate and 2-3 percent growth that has prevailed in the past five years.

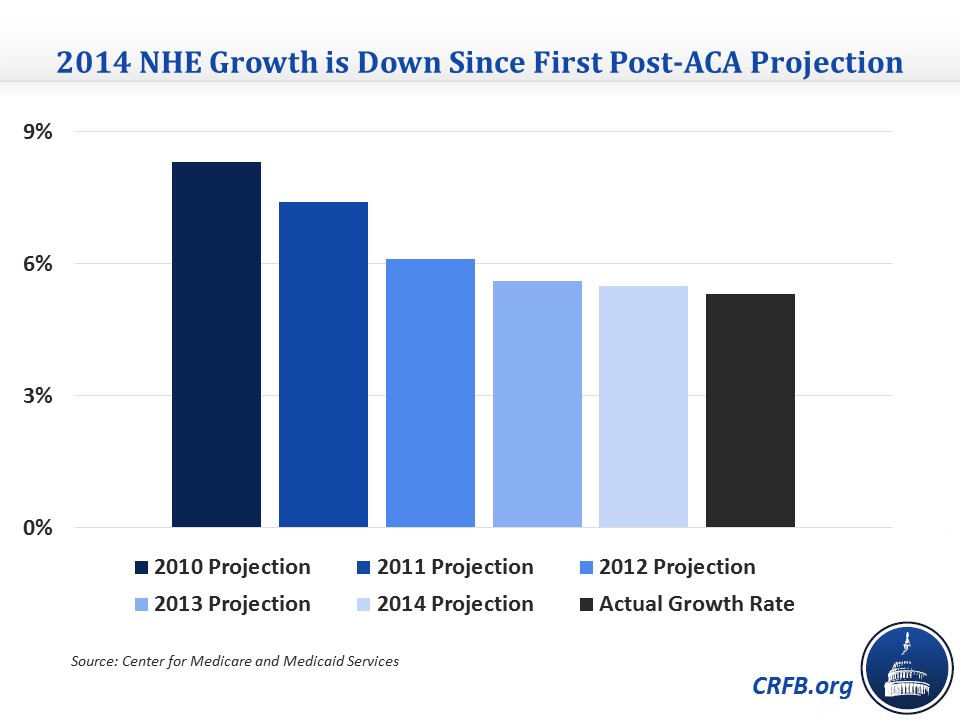

While health care spending grew faster in 2014 than in the past five years, growth was down slightly from what CMS expected back in July, when they projected total growth of 5.5 percent, and well below the 8.3 percent they had predicted back in 2010.

Broadly, the increase in spending growth came from a rebound in the use and intensity of health care, which on a per-person basis grew at 2.1 percent compared to the near-zero rates that had occurred since 2009. This increase was driven by the coverage expansions, which saw newly-insured patients using more services, and new expensive specialty drugs that came to market, which in their first year are classified as a utilization rather than price change (since they did not exist the prior year, thus did not experience a price jump). Medical price inflation also rebounded slightly from 2013 levels to 1.8 percent in 2014, though this is still below the 2004-2008 average of about 3 percent.

Looking more closely, a sharp acceleration in prescription drug spending growth as expected was a major factor in the overall growth numbers. This category grew at 12.2 percent in 2014, a sharp increase from the below-3 percent growth that had happened since 2010 and the largest annual increase since 2002. CMS attributes this increase to new specialty drugs, fewer patent expirations, brand-name drug price increases, and the coverage expansions.

Spending from each source of insurance coverage also accelerated in 2014. Medicaid spending not surprisingly grew at a brisk 11 percent pace, as the coverage expansion increased enrollment by 13 percent (nearly 8 million people). Medicare saw a 5.5 percent growth rate in 2014, up from a very low 3 percent in 2013, driven by prescription drugs and physician and clincal services. Private insurance spending grew at 4.4 percent, up from 2013's growth rate but in line with previous years. System-wide trends like prescription drugs contributed to the increase as did an increase in physician and clinical service spending as more people gained insurance through the exchanges.

Overall, health care spending growth picked up in 2014 as CMS previously estimated. Some of the growth is due to the expansion of health insurance coverage, a temporary effect that was anticipated, but some of it is more concerning, particularly the prescription drug growth. Considering that was a central factor in the health care slowdown, it is something worth monitoring going forward. It will be important in determining whether 2014 is a blip in the trend of slower health care spending growth or a return toward the growth we have seen in the past.