CBO Releases New 10-Year Budget Projections

The Congressional Budget Office (CBO) just released its February 2021 Budget and Economic Outlook, showing that the COVID-19 public health and economic crisis will add substantially to near-term debt levels and that debt will continue to grow rapidly over the long-term.

CBO projects the current law budget deficit will total $2.3 trillion this fiscal year - exactly as we recently estimated. This is lower than last year's record $3.1 trillion deficit but still over twice as high as the pre-COVID deficit of $984 billion in 2019. Deficits are projected to decline after 2021 to a low of $905 billion in 2024 before rising to $1.9 trillion in 2031 – totaling $12.3 trillion between 2022 and 2031. These figures are current law, and do not incorporate the $1.9 trillion COVID relief bill currently under consideration nor the possible extension of various expiring laws.

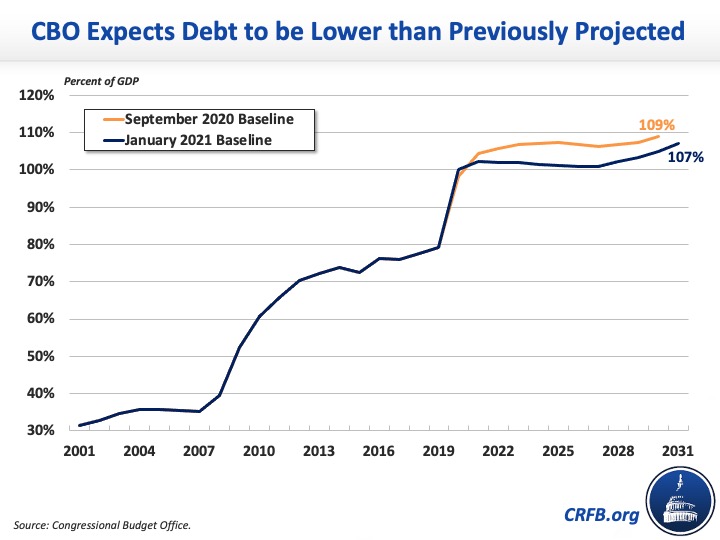

Relative to the economy, CBO estimates that debt will have risen from over 79 percent of GDP at the end of 2019 to over 102 percent of GDP by the end of FY 2021, and will continue increasing to over 107 percent by 2031. Debt will fall to a low of 101 percent of GDP in 2026 before rising again and ultimately exceeding its prior record of 106 percent of GDP set just after World War II. In nominal dollars, debt will total $35.3 trillion in 2031, a $13.6 trillion increase from today.

The February 2021 baseline is based on CBO’s latest economic forecast, which substantially improved from its July 2020 forecast, and marks the agency’s first set of ten-year budget projections that incorporates the fiscal effects of the December 2020 government funding and COVID relief package. Overall, CBO’s projections have improved slightly since the agency’s last ten-year baseline in September.

Specifically, CBO’s estimate for total deficits from 2021 to 2030 will be $345 billion lower than previously projected. While the direct and indirect effects of legislation will increase deficits by $1.42 trillion, economic improvements and technical changes will reduce deficits by a combined $1.77 trillion.

| Source of Change | 2021 | 2021-2030 |

|---|---|---|

| Deficits Projected in September 2020 Baseline | $1,810 billion | $12,987 billion |

| Legislative Changes | $891 billion | $1,424 billion |

| Technical Changes | -$155 billion | -$300 billion |

| Economic Changes | -$288 billion | -$1,469 billion |

| Deficits Projected in February 2021 Baseline | $2,258 billion | $12,642 billion |

CBO also released new trust fund projections, showing all major federal trust funds are headed toward insolvency. CBO estimates the Highway Trust Fund (HTF) will deplete in reserves in FY 2022 and the Medicare Hospital Insurance (HI) trust fund in FY 2026. Based on their projections, it appears the Social Security Old-Age and Survivors Insurance (OASI) trust fund will run out in calendar year 2032 and the Social Security Disability Insurance (SSDI) trust fund will deplete its reserves sometime in the 2030s.

As CBO shows, our fiscal situation will continue to deteriorate as a result of irresponsible tax and spending policies, rising health and retirement costs, and the necessary but expensive fiscal support enacted to address the COVID-19 crisis (which you can track at COVIDMoneyTracker.org). While policymakers are rightly focused on the fiscal response to the current crisis, they must turn their attention to long-term debt and deficit reduction to get the country on solid fiscal ground once the crisis ends.

The Committee for a Responsible Federal Budget will release our full analysis of CBO’s report later today.