CBO Releases 2020 Long-Term Budget Outlook

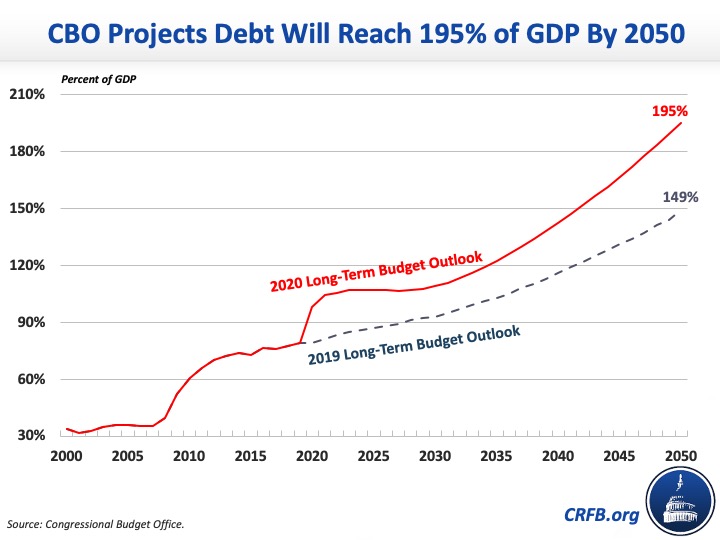

The Congressional Budget Office (CBO) just released its 2020 Long-Term Budget Outlook, showing the federal budget is on an unsustainable long-term trajectory. CBO's projections show an outlook considerably worse than in its previous projections. Specifically, CBO projects that under current law federal debt held by the public will grow roughly two and a half times, from about 79 percent of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2019 to 195 percent of GDP by 2050. CBO's previous estimates suggested debt would be closer to 150 percent of GDP in 2050. If lawmakers continue the practice of extending expiring tax provisions and increasing appropriations over time, debt could be much higher.

CBO estimates that under current law, budget deficits will rise from 4.6 percent of GDP in 2019 to 12.6 percent of GDP in 2050. CBO's 2050 deficit projection is lower than its 16.0 percent of GDP COVID-driven deficit for FY 2020, but over four times higher than the average deficit of 3 percent of GDP over the past half-century, and higher than any time in history outside of World War II or the current pandemic.

Rising budget deficits are driven by a disconnect between spending and revenue. Under current law, spending will rise from 21.0 percent of GDP in 2019 to 31.2 percent in 2050, while revenue will grow from 16.3 percent to 18.6 percent of GDP. In the interim, spending will temporarily spike and revenue fall as a result of the COVID-19 crisis. Long-term spending growth is largely driven by rising health, retirement, and interest costs. CBO estimates these three categories will grow by 11.7 percent of GDP between 2019 and 2050 – more than the projected increase – 10.3 percent of GDP – of total spending.

CBO warns that failure to confront our mounting debt will have adverse consequences. The unsustainable fiscal outlook slows income growth, increases interest payments and crowds out other priorities, places upward pressure on interest rates, weakens the ability to respond to the next recession or emergency, places an undue burden on future generations, and heightens the risk of a fiscal crisis.

At the same time, CBO projects five major trust funds will exhaust their reserves within the next 11 years. CBO projects the Highway Trust Fund (HTF) will deplete its reserves in FY 2022, the Medicare Hospital Insurance (HI) trust fund in FY 2024, the Social Security Disability Insurance (SSDI) trust fund in FY 2026, and the Social Security Old-Age and Survivors Insurance (OASI) trust fund in calendar year 2031. On a theoretical combined basis, the Social Security trust funds will run out of reserves in CY 2031 and face a 75-year shortfall of 1.6 percent of GDP, or 4.7 percent of taxable payroll.

While high near-term borrowing is a needed response to the current crisis, debt should not continue to grow at this pace over the long run. Policymakers must act to correct these imbalances. As CBO shows in its latest report, the longer policymakers wait to make these changes, the harder and costlier the necessary adjustments will be.

The Committee for a Responsible Federal Budget will release our full analysis of CBO's report later today.