CBO: Consequences of a Growing National Debt

In addition to showing the path of future debt, CBO's Long-Term Budget Outlook described the consequences of a large and growing federal debt. The four main consequences are:

- Lower national savings and income

- Higher interest payments, leading to large tax hikes and spending cuts

- Decreased ability to respond to problems

- Greater risk of a fiscal crisis

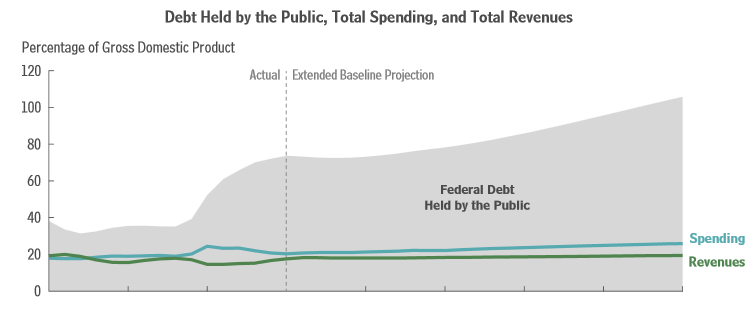

According to the report, debt held by the public will rise dramatically in the coming decades, reaching 106 percent of GDP by 2039. The below graph shows the projected increase of the federal debt held by the public from 2014 (dashed line) through 2039 under CBO's extended baseline.

Debt rising to this nearly unprecedented level will have many negative consequences for the economy and policymaking.

Lower National Savings and Income

Large sustained federal deficits cause decreased investment and higher interest rates. With the government borrowing more, a higher percentage of the savings available for investment would go towards government securities. This, in turn, would decrease the amount invested in private ventures such as factories and computers, making the workforce less productive. As the CBO notes, this would have a negative effect on wages:

Because wages are determined mainly by workers' productivity, the reduction in investment would reduce wages as well, lessening people's incentive to work.

It is worth noting that the higher interest rates would increase incentives to save. But, the CBO qualifies:

However, the rise in savings by households and businesses would be a good deal smaller than the increase in federal borrowing represented by the change in the deficit, so national saving (total saving by all sectors of the economy) would decline, as would private investment.

Although deficits increase demand for goods and services in the short-term, this boost would not be sustained once the economy fully recovers. Stabilizing forces such as price or interest rate rebounds and actions by the Federal Reserve would push output back down to its potential growth path.

Interest Payments Creating Pressure on Other Spending

As interest rates return to more typical levels from historically low levels and the debt grows, federal interest payments will increase rapidly. As interest takes up more of the budget, we will have less available to spend on programs. If the government wants to maintain the same level of benefits and services without running large deficits, more revenue will be required. As the CBO states:

That could be accomplished in different ways, but to the extent that such increases occurred through higher marginal tax rates (the rates that apply to an additional dollar of income), those higher rates would discourage people from working and saving, thus further reducing output and income. Alternatively, lawmakers could choose to offset rising interest costs at least in part by reducing government benefits and services.

If these cuts reduced federal investments, they would reduce future income further. If lawmakers continue running large deficits to provide benefits without raising taxes, CBO warns that larger deficit reduction will be needed in the future to avoid a large debt-to-GDP ratio.

Decreased Ability to Respond to Problems

Governments often borrow to address unexpected events, like wars, financial crises, and natural disasters. This is relatively easy to do when the federal debt is small. However, with a large and growing federal debt, government has fewer options available. For example, during the financial crisis several years ago, when the debt was just 40 percent of GDP, the government was able to respond by increasing spending and cutting taxes in order to stimulate the economy. However, as a result, the federal debt increased to almost double its share of GDP. As CBO warns:

If the federal debt stayed at its current percentage of GDP or increased further, the government would find it more difficult to undertake similar policies [another stimulus] under similar conditions in the future. As a result, future recessions and financial crises could have larger negative effects on the economy and on people's well-being. Moreover, the reduced financial flexibility and increased dependence on foreign investors that accompany high and rising debt could weaken U.S. leadership in the international arena.

Given the potentially devastating effects of various types of crises, it is important maintain our country's ability to respond quickly. High and rising federal debt, however, decreases the ability to do so.

Greater Risk of a Fiscal Crisis

If the debt continues to climb, at some point investors will lose confidence in the government's ability to pay back borrowed funds. Investors would demand higher interest rates on the debt, and at some point rates could rise sharply and suddenly, creating broader economic consequences:

That increase in interest rates would reduce the market value of outstanding government bonds, causing losses for investors and perhaps precipitating a broader financial crisis by creating losses for mutual funds, pension funds, insurance companies, banks, and other holders of government debt - losses that might be large enough to cause some financial institutions to fail.

Though there is no sound mechanism for determining if and when a fiscal crisis will occur, according to the CBO, "All else being equal...the larger a government's debt, the greater the risk of a fiscal crisis."

* * *

The longer Congress waits before addressing our debt, the larger the changes will have to be. Avoiding large disruptions through timely action is in our best interest.

See our paper summarizing CBO's long-term outlook or the other entries in our blog series for more analysis.