Can We Dramatically Lower Tax Rates by Closing a Few Egregious Loopholes?

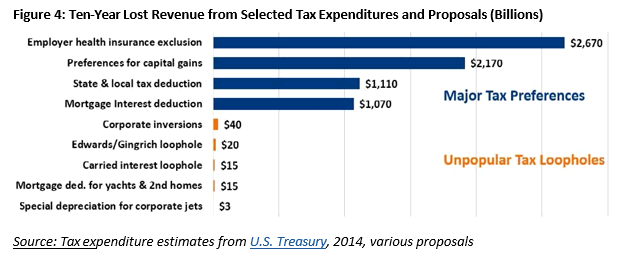

Candidates who propose tax reform plans that are revenue-neutral may suggest that the cost of tax rate reductions can be offset by closing egregious loopholes or tax breaks that benefit relatively few taxpayers. In reality, broadening the tax base enough to offset a significant rate reduction will require making tough choices regarding popular tax breaks. For example, the Simpson-Bowles illustrative tax plan – which reduced the top tax rate to 28 percent (from 35 percent at the time) – fully eliminated the deduction for state and local taxes, replaced the mortgage interest and charitable deductions with much smaller credits, taxed capital gains as ordinary income, capped and slowly phased out the tax exclusion for employer-provided health insurance, and repealed or reformed most other tax breaks in the code.

Certainly, tax writers can generate revenue by cracking down on tax avoidance strategies, getting rid of tax breaks for corporate jets and vacation homes, and repealing a variety of narrow tax breaks or loopholes. But to pay for significant rate reduction, a number of more widely-used and supported tax breaks will have to be on the table.

Ruling: Largely False