Budget Scoring Proposals in Ryan's Budget

Although the primary purpose of a budget resolution is to set spending and revenue levels to govern the consideration of legislation by Congress, it can also contain provisions regarding budget rules and scoring procedures for legislation. The budget resolution reported by the House Budget Committee contains two particularly significant provisions dealing with accounting for costs of credit programs and general revenue transfers to the highway trust fund. While these provisions are technical and arcane, they could have a significant impact on legislation if they are adopted.

Section 507 of the budget resolution would require the Congressional Budget Office to provide a supplemental fair value estimate of legislation regarding loan programs at the request of the Chairman or Ranking Member of the Budget Committee. It also provides for fair value estimates of legislation regarding housing or residential mortgage programs. In general, fair value accounting incorporates market risks into estimates of the cost of legislation, which generally results in a higher estimated cost for legislation. Importantly, these fair value estimates of legislation may be used in determining whether legislation complies with budget allocations and other budgetary rules.

As we've written before, proposals regarding fair value accounting are very arcane and controversial. The Federal Credit Reform Act of 1990 (FCRA) required credit programs to discount the future expected cash flows to a present value estimate, a process which requires an interest rate. Under those reforms, federal programs would use the interest rate on U.S. Treasuries. In recent years, some organizations and experts have argued that the rules under FCRA are not a comprehensive measure of the cost the government incurs when it enters into loans and loan guarantees. They argue that using the Treasury discount rate does not fully account for the market risk the government is taking on and does not accurately portray the costs to policymakers. The Congressional Budget Office has stated that in its view "adopting a fair value approach would provide a more comprehensive way to measure the costs of federal credit programs and would permit more level comparisons between those costs and the costs of other forms of federal assistance."

| Budgetary Treatment of $100 Million Loan under the Three Approaches | |||

| Cash Accounting | FCRA | Fair-Value | |

| Year 1 | $100 million | -$1.6 million | $1.3 million |

| 10-Year Period | -$3 million | -$1.6 million | $1.3 million |

Note: See CBO's detailed version of this example in this report.

A "fair-value" approach to estimating the costs of federal credit programs would assign a "market risk premium" to bridge the gap between Treasury interest rates and the discount rate that private lending institutions would assign when assessing the costs of a loan. This approach is intended to measure the costs of those program at market prices. Fair-value accounting has been used for some government programs, including payments to the IMF and spending in the Troubled Asset Relief Program, but it is not widespread practice. CBO has applied the concept of reflecting market risk into estimates in other areas, most significantly for Social Security reform proposals for which CBO estimates and analysis provided risk-adjusted returns for individual accounts.

Opponents of switching to fair value accounting point out that these loans are funded through the issuance of Treasury debt, which means there is very little or no market risk, so it is appropriate to use the FCRA rules. They also argue that the additional cost that fair-value accounting records does not actually occur, requiring real offsets for costs which do not occur. Further, they argue that using this method would apply inconsistent budgetary treatment to credit programs versus other programs.

The valuation of federal credit programs can be an arcane topic. But at the same time policymakers need to decide what is the best way to reflect the costs or profits of the operations of the federal government. The Congressional Budget Office estimates that the $635 billion of loans and loan guarantees issued in 2013 alone would generate budgetary savings of $43 billion under current FCRA accounting but would have a cost of $11 billion under fair value accounting.

Section 508 of the budget resolution provides that transfers from the general fund to the Highway Trust Fund should be scored as a cost equal to the amount of the general revenue transfer. The Highway Trust Fund is afforded many special protections in the budget process because it is supposed to be a self-funded program financed by a dedicated revenue source, the gas tax. But gas tax revenues have not kept pace with increased spending on highway programs, resulting in the trust fund repeatedly coming close to exhaustion. Legally, the Highway Trust Fund is not allowed to run a negative balance and does not have authority to borrow money to cover obligations in excess of revenues after the trust fund has been exhausted. Therefore, transferring money to the Highway Trust Fund to extend trust fund solvency allows spending to be greater than it otherwise would have been.

But under current scoring conventions, CBO assumes in its baseline that spending on highway programs will continue at current levels regardless of the status of the Highway Trust Fund. As a result, general revenue to trust funds that are due to be exhausted, such as the Highway Trust Fund, are not recorded as costs even though those transfers allow lawmakers to spend more than they would if the trust funds were exhausted. This loophole, among the budget gimmicks we identified in a paper last year, allows lawmakers to take credit for extending the life of the Highway Trust Fund without being charged a cost for doing so or identifying new revenues or spending cuts to cover the shortfall.

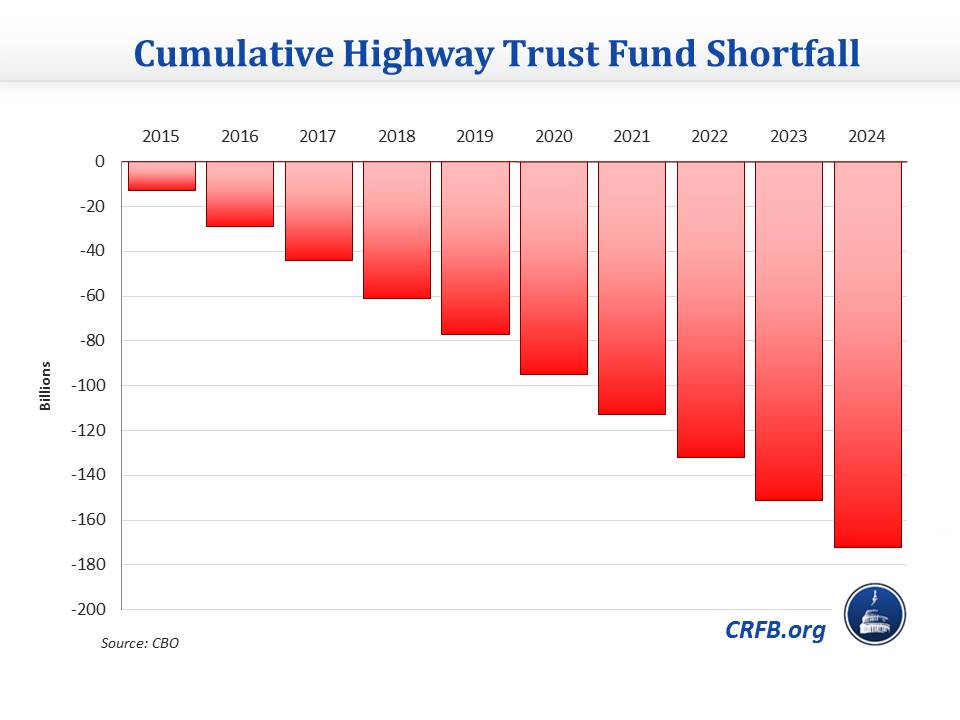

Requiring general revenue transfers covering shortfalls in the Highway Trust Fund to be offset would have a significant impact given the $172 billion cumulative shortfall facing the Highway Trust Fund over the next decade.

The budget resolution does not provide for any general revenue transfers to the Highway Trust Fund and assumes that the entire shortfall is made up by reducing spending from highway trust fund by $172 billion over the next decade, including no new contract authority in 2015. However, the resolution does include a reserve fund allowing highway spending levels to be increased as part of deficit-neutral legislation which either increases dedicated revenues into the trust fund or provides a general revenue transfer to the trust fund that is offset.

Congress has enacted four general revenue transfers to the Highway Trust Fund totaling $53.3 billion to avoid trust fund exhaustion since 2008. Only one of these transfers, an $18.8 billion transfer in the 2012 highway bill was (mostly) offset. Despite these transfers, the Highway Trust Fund is once again facing exhaustion. The Congressional Budget Office estimates projects that the HTF will be exhausted in 2015 and the Department of Transportation may be required to begin slowing reimbursements to limit spending from the HTF as early as the latter half of 2014 without additional revenues into the trust fund. House Speaker John Boehner has publicly rejected another bailout of the trust fund, which suggests that he would oppose any general revenue transfers to the Highway Trust Fund even if they were offset by savings elsewhere in the budget.

But the tax reform discussion draft released by Ways and Means Committee Chairman Dave Camp relied on current scoring rules to direct revenues from the tax repatriation provision in his bill to the highway trust fund while also using those revenues to offset the lower rates in his proposal. Under the rule proposed in the budget resolution, depositing revenues into the HTF would be scored as a cost, and those revenues could not be used to offset other costs in the bill as well.

While Congress is not expected to adopt a budget resolution conference report this year, the House could deem all or parts of the House budget resolution to be in effect in the House for enforcement of budget rules. If either of these provisions are included in such a deemer, the impact on legislation regarding highway spending and credit programs would be significant.