Breaking Down CBO's Analysis of the President's Budget

The Congressional Budget Office (CBO) released its own estimate of the FY 2017 President's budget yesterday, a document that includes a 16-page report and several supplemental analyses. Our report on CBO's analysis breaks down the key budgetary takeaways, namely that while the budget does include substantive deficit reduction, it does not do enough to bring debt down as a share of GDP.

Click here to read our full report.

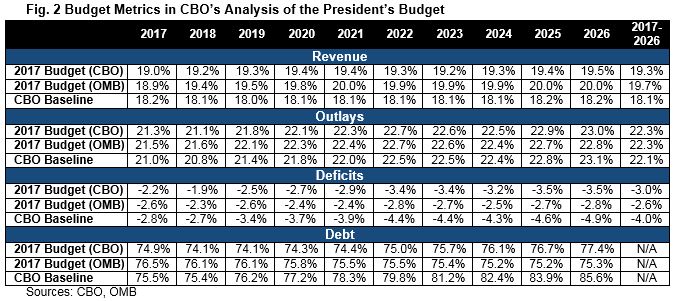

As detailed in our analysis, CBO sees a slightly more pessimistic picture for debt than OMB does in the latter part of the ten-year window, both in terms of the level and path. CBO estimates that debt under the budget would reach 77 percent of GDP in 2026, slightly higher than OMB's estimate of 75 percent, and that debt would be on a slightly upward path after 2018 rather than roughly stable as OMB expects. Deficits reflect the debt path, reaching a low of 1.8 percent of GDP in 2018 before rising to 3.5 percent by 2026, higher than the 2.8 percent deficit OMB estimates in the same year. Importantly, these higher debt and deficit numbers are the result of both higher nominal dollar totals and GDP differences.

The budget has both higher average spending and revenue than either CBO's current law baseline or historical averages. Spending would average 22.3 percent of GDP over the next ten years, compared to 22.1 percent in the baseline and the 50-year historical average of 20.2 percent, while revenue would average 19.3 percent, compared to 18.1 percent in the baseline and the historical average of 17.4 percent.

The budget contains $2.4 trillion of net deficit reduction, or $1.7 trillion excluding the war spending drawdown. Of this $1.7 trillion includes $2.6 trillion of gross tax increases and more than $300 billion of spending cuts (mostly health care savings) along with immigration reform and interest savings to offset $1.1 trillion of spending increases and $435 billion of tax cuts.

CBO's analysis generally jives with OMB's original estimate, so it lends itself to the same conclusion: the budget goes in the right direction but does not go nearly far enough to make debt truly sustainable.

Click here to read our full report.