CBO Releases Its Own Take on the President's Budget

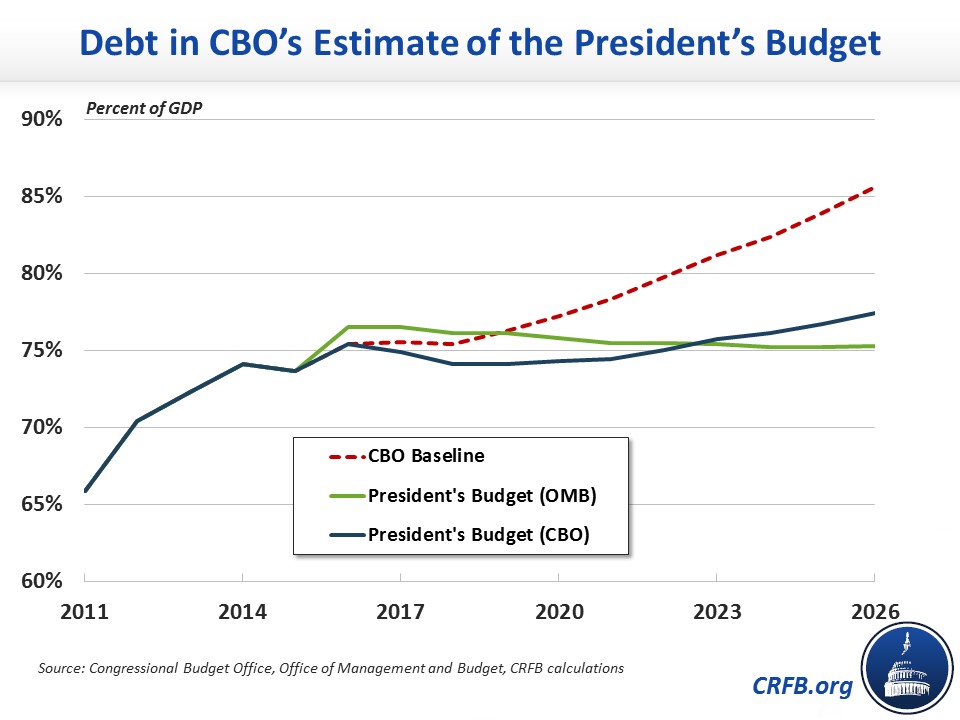

The Congressional Budget Office (CBO) today released its analysis of the Fiscal Year 2017 President's budget, finding that under the President's policies, the debt would rise slightly from today's post-World War II record-high 75 percent of Gross Domestic Product (GDP) to 77.4 percent by 2026. This is a significant improvement from CBO's current law baseline, which projects debt will rise to nearly 86 percent of GDP, but is worse than the Office of Management and Budget's (OMB) estimate that the President's budget would stabilize the debt at about 75 percent of GDP. Regardless which numbers are correct, it is clear the budget does too little to put the debt on a sustainable downward path.

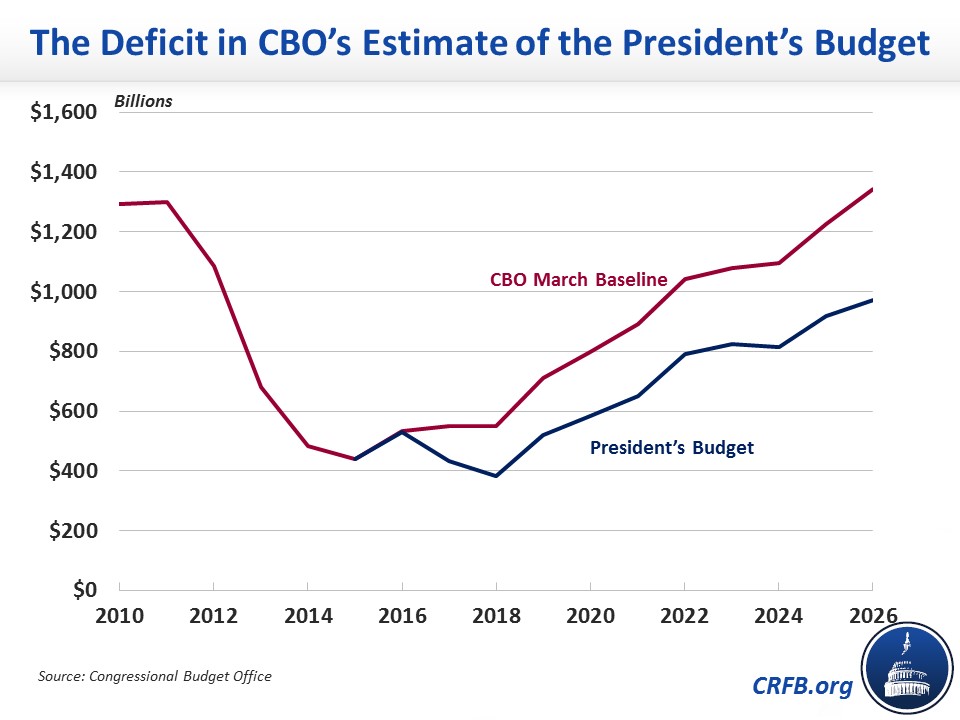

CBO's projection of rising debt under the President's budget is driven by annual deficits, which would decline over the next two years but then rise nearly continuously thereafter. Under the President's budget, CBO estimates deficits would fall from 2.9 percent of GDP ($529 billion) in 2016 to 1.9 percent ($383 billion) by 2018 before rising to 2.7 percent of GDP ($585 billion) by 2020 and 3.5 percent of GDP ($972 billion) by 2026. Trillion-dollar deficits would likely return by 2027.

Rising deficits are the result of spending increasing faster than revenue, although revenue is also increasing. Under the President's budget, CBO projects spending would rise from 21.1 percent of GDP in 2016 to 23.0 percent by 2026, while revenue would rise from 18.2 percent in 2016 to 19.5 percent in 2026. Over the past 50 years, spending and revenue have averaged 20.2 and 17.4 percent of GDP, respectively.

Total deficits under the President's budget would amount to $6.9 trillion over a decade, which is $2.4 trillion below CBO's current law baseline. This deficit reduction is the result of $2.8 trillion of net tax revenue and nearly $350 billon of interest savings, offset by almost $750 billion of net primary spending increases (or nearly $1.4 trillion when war savings are excluded). As detailed in our original analysis of the President's budget, the largest savings come from the 28 percent limit on the value of certain tax preferences, international tax changes, the oil tax, and tax increases on capital gains and dividends. The budget also includes nearly $400 billion of net Medicare savings (excluding the cost of repealing the sequester).

CBO's analysis shows that despite significant net deficit reduction, the President's budget would fail to reduce the debt from its current record-high levels, and in fact would allow it to continue to rise relative to GDP. To truly put the debt on a sustainable path, the budget would require more revenue, less spending, or a combination of the two. Given the changing composition of federal spending being directed towards entitlement programs such as Social Security and health care, a focus on containing entitlement spending growth would be especially helpful to solve our fiscal challenges.

A full analysis of CBO's re-estimate of the President's budget is forthcoming.