Amy Klobuchar’s Plan to “Govern with Fiscal Responsibility”

Democratic presidential candidate Senator Amy Klobuchar (D-MN) put forward a Plan for the Future of Work and a Changing Economy in December. The plan includes a commitment to “Govern with Fiscal Responsibility” by reducing debt as a share of Gross Domestic Product (GDP) and “putting our country on a sustainable fiscal path.” To begin this process, Senator Klobuchar proposes to establish a dedicated fund to finance deficit reduction during normal times and stimulus during economic downturns, eliminate duplicative government programs, and move to biennial budgeting with a 25-year budget window.

The following policy explainer is generated as part of US Budget Watch 2020, a project covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers and factchecks here. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including but certainly not limited to their approaches on deficits and debt.

Setting a Debt Reduction Goal

Based on the latest projections from the Congressional Budget Office (CBO), a Klobuchar Administration would inherit debt equal to 82 percent of GDP by the end of fiscal year (FY) 2021. Under current law, debt is projected to reach 87 percent of GDP near the end of her possible first term in 2024 and 98 percent by the end of 2030. Senator Klobuchar's plan would seek to “reverse this trend with the goal of lowering the debt to GDP ratio by the end of her first term and putting our country on a sustainable fiscal path.”

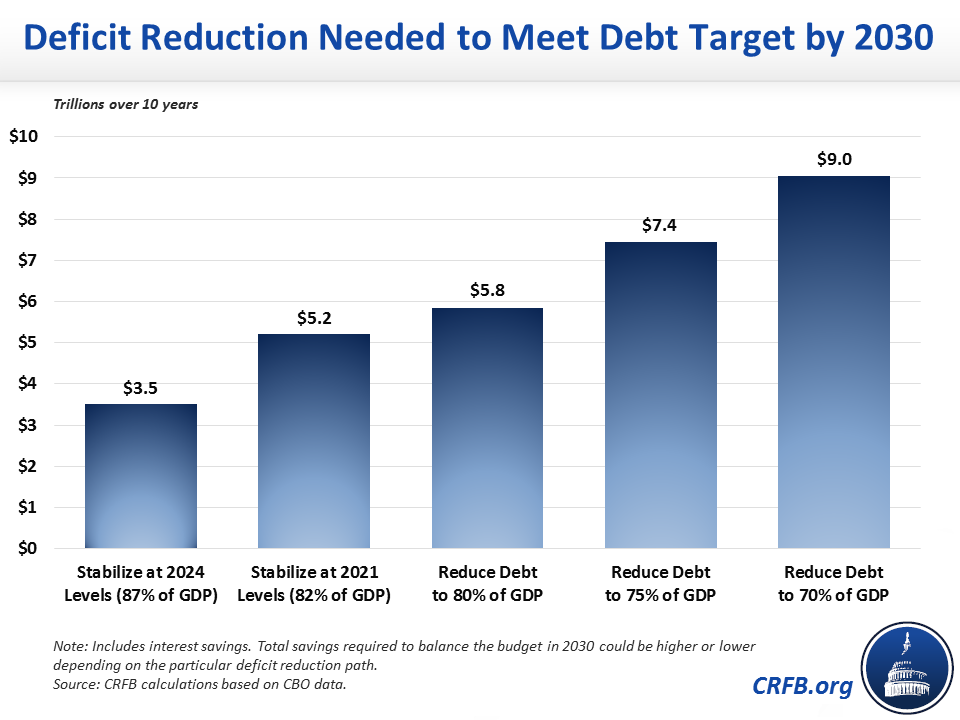

Achieving this goal would require a significant amount of savings. To stabilize the debt at 82 percent of GDP would require $5.2 trillion of deficit reduction through 2030. To keep debt at its projected 2024 level of 87 percent would require $3.5 trillion of deficit reduction. Reducing debt to 75 percent of GDP or 70 percent of GDP by 2030 would require $7.4 trillion or $9 trillion of deficit reduction, respectively.

A Dedicated Fund for Deficit Reduction and Stimulus

To help achieve her debt reduction goals and also finance economic stimulus when needed, Senator Klobuchar proposes to establish a new dedicated fund “to tackle U.S. debt and protect our economy.” During normal economic times, new revenue increases or cost savings dedicated to the fund would go toward deficit reduction. During economic downturns, the fund would automatically be tapped to increase funding for government programs that provide stimulus to the economy, such as “infrastructure spending, increased unemployment and nutrition assistance, and [increasing the] federal share of Medicaid and CHIP spending.”

The stimulus component of this plan would help discretionary fiscal policy act more like automatic stabilizers – something we propose in our Break Glass Here plan and highlighted in the Brookings Institution book Recession Ready.

Senator Klobuchar plans to “initially seed the fund" with $300 billion from raising the corporate tax rate and eliminating duplicative government spending. As we understand the policy, the majority of these funds would come from raising the corporate tax rate by 2 percent, which, on top of the four percentage point increase she proposes as part of infrastructure plan, would lift it from 21 percent to 27 percent. This would generate a little more than $200 billion over a decade, leaving spending reforms to cover the remainder of the seed money. Senator Klobuchar emphasizes that the $300 billion is simply a down payment and that further budgetary savings would be dedicated to the fund over time.

Eliminate Duplicate Government Spending

As part of her plan to put the country on a sustainable fiscal path, Senator Klobuchar would establish a new budget review process under which all cabinet-level secretaries would undertake a thorough review of their departments’ budgets with the goal of identifying duplicative and unnecessary programs. The Government Accountability Office’s (GAO) most recent Duplication & Cost Savings report identified nearly 100 new actions that could be taken to help improve efficiency and save billions of dollars.

Senator Klobuchar identifies defense spending in particular as an area ripe for cost savings. Defense spending accounts for slightly more than half of all discretionary spending, and the Department of Defense has the most partially- or not-addressed actions since 2011 of any federal agency according to GAO’s latest cost savings report, amounting to tens of billions of dollars in potential savings.

Move to Biennial Budgeting with a 25-Year Budget Window

To improve the budgeting process, Senator Klobuchar calls for a biennial budgeting cycle where discretionary spending decisions would be made every other year rather than every year. Under this process, the first year would be dedicated to appropriating federal dollars, with the second year dedicated to budgetary oversight and assuring dollars are being spent efficiently and effectively.

Moving to some form of biennial budgeting has bipartisan support. Senator Klobuchar is a cosponsor of former Senator Johnny Isakson's (R-GA) and Senator Jeanne Shaheen’s (D-NH) Biennial Budgeting and Appropriations Act, which would move both the budget resolution and appropriations process to a two-year cycle. In the committee-approved Bipartisan Congressional Budget Reform Act, Senate Budget Committee Chairman Mike Enzi (R-WY) and Senator Sheldon Whitehouse (D-RI) have proposed moving the budget process (but not the appropriations process) to a two-year cycle, and others in both parties have put forward similar ideas.

Senator Klobuchar also calls for lengthening the standard ten-year budgeting window to 25 years for both CBO and the Joint Committee on Taxation. This would apply not only to budget projections, but also for budget scorekeeping. Senator Klobuchar argues this will “better capture the long-term fiscal impact of federal policies.” In Improving Focus on the Long Term and Looking Beyond the Ten-Year Budget Window, we write about some of the benefits and challenges of this and similar approaches.

Where Can I Read More?

- Senator Klobuchar’s Campaign Website – Senator Klobuchar’s Plan for the Future of Work and a Changing Economy

- Raising the corporate tax rate to 25 percent – Amy’s Plan to Build America’s Infrastructure

- Federal News Network — Amid persistent accounting weaknesses, DoD fails to pass its first-ever financial audit

- Federal News Network — DoD’s second financial audit uncovers 1,300 new deficiencies

- Government Accountability Office (GAO) — Duplication & Cost Savings Report

- Legislative Text — Bipartisan Congressional Budget Reform Act

- Legislative Text — Bipartisan Budget and Appropriations Reform Act

- Legislative Text — Fix Funding First Act

- Committee for a Responsible Federal Budget — Playing By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

- Committee for a Responsible Federal Budget — Enzi-Whitehouse Budget Process Bill Includes Important Reforms

- Committee for a Responsible Federal Budget — Long-Term Budget Should Be Used to Strengthen Fiscal Responsibility, Not Avoid It

- Committee for a Responsible Federal Budget — Maya MacGuineas Testifies on Biennial Budgeting

- Committee for a Responsible Federal Budget — Charting a Responsible Path for Discretionary Spending

- Committee for a Responsible Federal Budget — The Better Budget Process Initiative: Improving Focus on the Long Term

- Committee for a Responsible Federal Budget — Report: Looking Beyond the Ten-Year Budget Window

****

With the 2020 campaign now in full gear, the presidential candidates are putting forward many ambitious proposals aimed at solving very real problems and concerns. The voting public deserves to know how these proposals would work, how much they would cost, and what they would mean for the debt we will be leaving to our children and grandchildren.

This policy explainer is part of our US Budget Watch series covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers and factchecks here.