Actually, CBPP Says Don't Tune Out the Debt ... And They Are Right

Today, Wonkblog published a “Know More” feature arguing that “You Should Tune Out Politicians Who Are Still Talking about Government Debt.” As evidence for this claim, they cite the recent Center on Budget and Policy Priorities (CBPP) report that shows the long-term debt situation has improved relative to its 2010 projections, and quote the report’s assertion that "no deficit or debt crisis looms, and the weak labor market remains the nation’s most immediate economic concern."

Unfortunately, Wonkblog fails to quote the next line in the CBPP report, which states (emphasis added) that "policymakers and the public should not ignore the long-run budget problems, which remain challenging," and goes on to say that "[p]olicymakers should address the need both for immediate measures to strengthen the job market and for measures to reduce longer-term deficits, which should take effect when the economy has more fully recovered."

CBPP’s argument that policymakers should “not ignore” our long-term budget issues and recent testimony before Congress are in stark contrast to Wonkblog’s takeaway, that policymakers who talk about such problems should be tuned out.

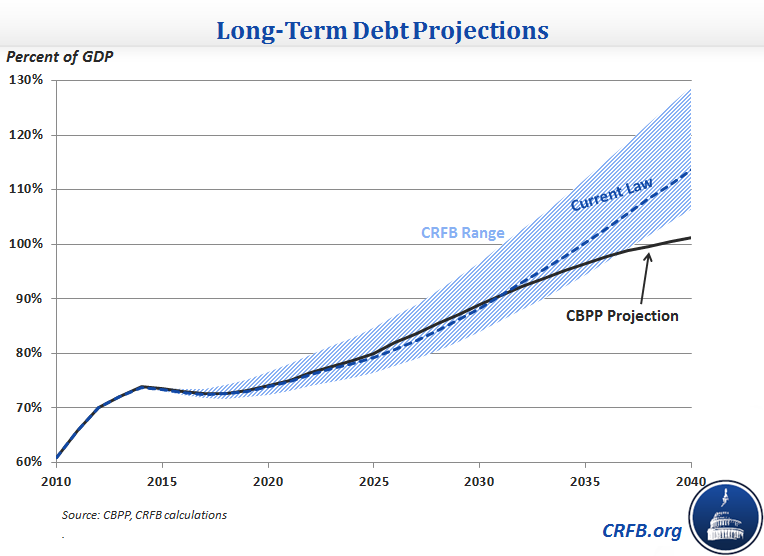

Under CBPP’s projections, debt levels will remain stable at their current post-war record highs through about 2020, but then rise gradually – exceeding 100 percent of Gross Domestic Product (GDP) by 2040. Even these estimates assume a level of fiscal responsibility which may not come to pass and are more optimistic than our extrapolation of the Congressional Budget Office's latest current law estimates. Under CRFB’s most recent projections, debt levels could be between 105 and 130 percent of GDP by 2040.

These rising debt levels are problematic, and should be addressed sooner rather than later. As CBPP writes, "a rising debt ratio in good times reflects an unsustainable budget policy that ultimately poses threats to financial stability and long-term growth." Rising debt levels will ultimately result in slower wage growth, higher interest rates, less flexibility to respond to new crises or meet new priorities, and an increased risk of eventual fiscal crisis.

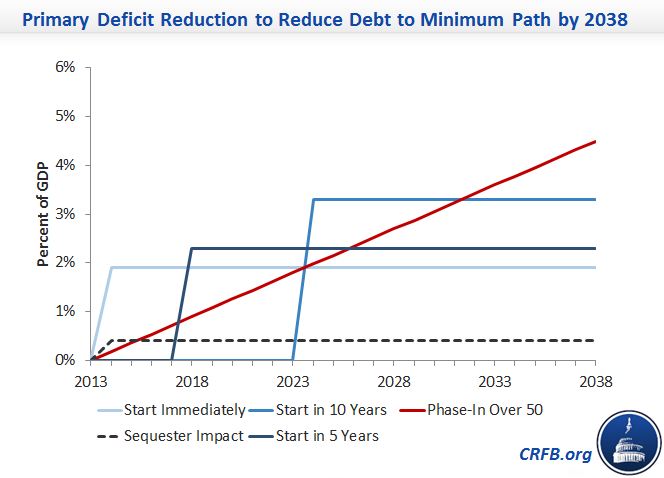

Moreover, the cost of inaction is high. The longer we wait, the larger any adjustments will have to be. And while there is a strong economic case to avoid implementing significant further net deficit reduction in the near term, there is no cost and many benefits to enacting such changes now to take effect later, giving individuals and businesses time to plan and adjust.

In the end, "tuning out" those individuals and organizations (including CBPP) who warn about the unsustainable long-term fiscal situation could turn out to be a costly mistake.