81 Percent of Spending Growth Will Come from Health Care, Social Security, and Interest

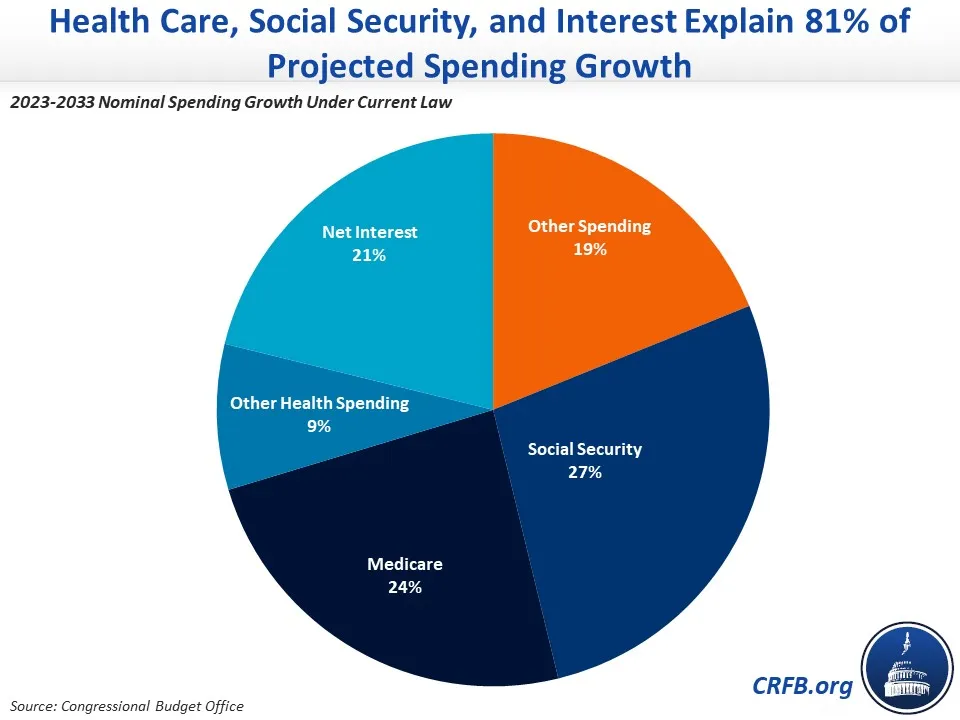

The Congressional Budget Office (CBO) projects that budget deficits will double from $1.4 trillion in Fiscal Year (FY) 2023 to nearly $2.9 trillion by 2033, as nominal spending rises from $6.2 trillion in 2023 to $9.9 trillion in 2033. The vast majority of this nominal spending growth – 81 percent – is driven by the growth of health, retirement, and net interest costs.

Social Security and health care spending will nearly double through FY 2033, while interest spending will more than double. Social Security will grow from $1.3 trillion to $2.4 trillion, while spending on major health care programs net of offsetting receipts will grow from $1.5 trillion to $2.7 trillion. Meanwhile, net interest costs will rise from $640 billion in 2023 to $1.4 trillion by 2033.

In other words, 27 percent ($1.0 trillion) of the projected $3.7 trillion increase in spending is due to the rising cost of Social Security, 24 percent ($899 billion) is from Medicare, 21 percent ($789 billion) is from rising interest costs, and 9 percent ($317 billion) is from Medicaid and other health care spending.

The remaining 19 percent is from all other parts of the budget, of which 91 percent ($639 billion) is from expected increases in the nominal cost of defense and nondefense discretionary spending.

Relative to the economy, overall spending will grow from 23.7 percent of Gross Domestic Product (GDP) in FY 2023 to 25.3 percent of GDP by 2033, over 4 percentage points higher than the 50-year historical average of 21.0 percent of GDP. Health care explains 73 percent (1.2 percentage points of GDP) of this growth, Social Security explains 56 percent (0.9 percentage points of GDP), and interest explains 74 percent (1.2 percentage points of GDP).

In other words, health, retirement, and net interest explain over 200 percent of total spending growth as a share of GDP while discretionary and other mandatory spending programs are projected to shrink relative to the economy.

The growth of health, retirement, and interest spending is even more pronounced when put in a historical context. Over the past two decades, nominal Social Security spending has tripled from $470 billion (4.2 percent of GDP) to $1.3 trillion (5.1 percent of GDP) today. Federal health spending has quadrupled from $410 billion and interest costs have quadrupled from $153 billion.

Going forward, spending growth will far outpace revenue, which is expected to increase $2.3 trillion between 2023 and 2033, as spending rises by $3.7 trillion. As a result, revenue will go from covering 77 percent of spending in FY 2023 to only 71 percent in 2033.

Addressing the rapid growth of health, retirement, and interest spending will require significant adjustments to bring spending and revenue in line. This could include changes to slow the growth of health and retirement spending, reductions in other areas of spending, increases in revenue, or some combination of the three. The sooner policymakers act and the more they can do to help the Federal Reserve fight inflation, the more they can do to help slow the growth of federal interest payments.