The 30-Year Outlook Also Looks Gloomy

In addition to the Congressional Budget Office's (CBO) ten-year budget outlook, the agency also releases 30-year projections for spending, revenue, deficits, and debt. The ten-year budget picture shows deficits and debt increasing through much of the that time, it is therefore not surprising that debt projections get worse in the long term.

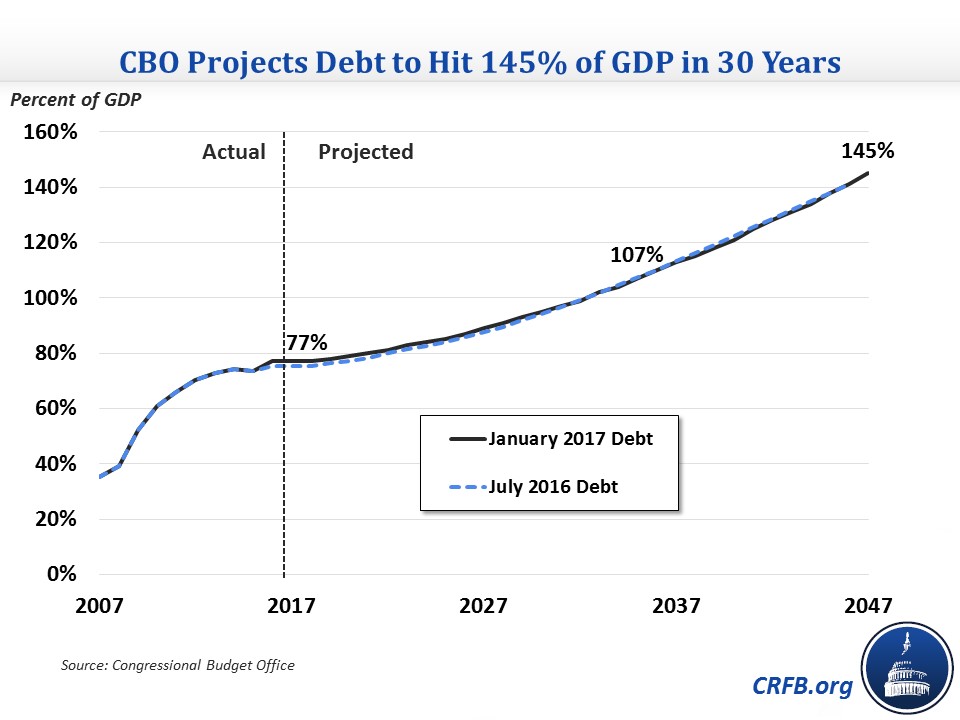

Debt held by the public, currently at 77 percent of GDP, is projected to reach its highest total since 1947 at 89 percent by 2027. It would surpass its all-time record of 106 percent of GDP by 2035 and would reach 145 percent by 2047. Meanwhile, deficits would increase from 2.9 percent of GDP in 2017 (around the 50-year historical average) to 5 percent of GDP by 2027, and over 9 percent by 2047. These numbers are very similar to CBO's July 2016 long-term outlook.

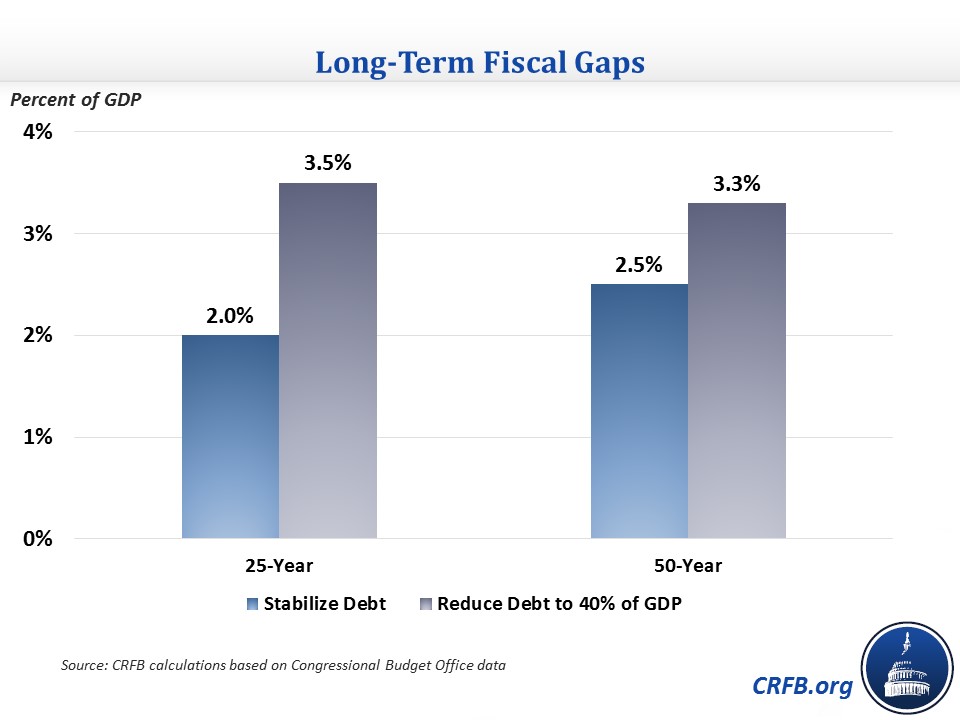

Another way to look at the growth of debt is the fiscal gap: the amount of spending cuts and/or tax increases necessary to stabilize debt at its current level (77 percent of GDP). Based on CBO data and our own extrapolations, we estimate that the 25-year fiscal gap is 2 percent of GDP, or the equivalent of $4.7 trillion over the next ten years, and the 50-year fiscal gap is 2.5 percent of GDP, or $5.9 trillion over ten years. (our 50-year number is a rough estimate, since CBO's official long-term estimates only go out 30 years).

If policymakers wanted a more aggressive target of reducing debt to its historical average of around 40 percent of GDP, the 25-year fiscal gap is 3.5 percent of GDP ($8.3 trillion over ten years) while the 50-year fiscal gap is 3.3 percent ($7.8 trillion over ten years).

CBO's long-term projections make it clear that the budget outlook will only get worse the longer it remains unaddressed. Waiting to implement changes makes it more difficult to stabilize the debt and reduce it as a share of the economy.