House Passes Historic Debt Increase

For Immediate Release

The House of Representatives passed a tax cut package today that will add $1.5 trillion or more to the national debt. The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

The House approved debt-financed tax cuts based on predictions of magical economic growth that defy history and all credible analyses.

Tax reform should grow the economy and not add to the debt. Unfortunately, lawmakers are assuming faster economic growth will pay for that debt increase when there is no evidence it will cover more than a fraction of the tax bill’s costs.

The last time Congress added 10-figures worth of tax cuts to the debt in 2001, it blew a hole in the budget and helped erase our surpluses — despite claims that economic growth would cover the cost. The growth fairy did not appear then, and it would be unwise to assume she will this time around.

What is so stunning is that we are considering trying this again at a truly unprecedented moment in our fiscal history. When the tax cuts of 2001 were passed, debt was 31 percent of GDP, the nation was running budget surpluses, and we were on track to pay off our debt. Today, debt is 77 percent of GDP — higher than any time in history other than just after World War II — and trillion-dollar deficits are on track to return by 2022.

Already, we are projected to borrow another $10 trillion over the coming decade. The answer must not be to pile more debt on top of that.

This bill is a lost opportunity to truly reform the tax code in a way that would maximize economic growth by broadening the base and eliminating special interest tax breaks while lowering rates and modernizing our tax code.

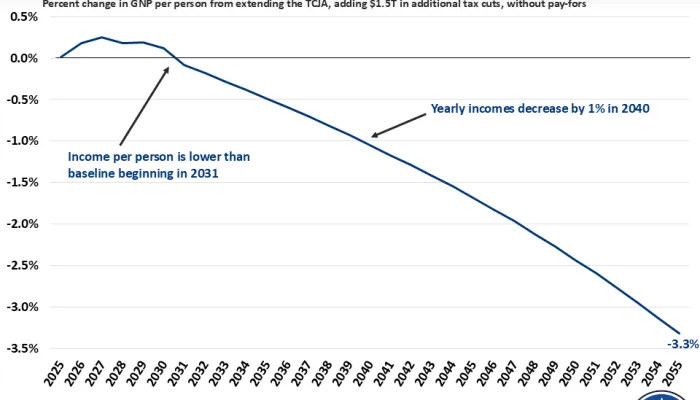

Instead of trickling down economic growth, the House plan will unleash a tidal wave of debt that will ultimately slow wage growth and hurt the economy.

###

For more information contact Patrick Newton, Press Secretary, at newton@crfb.org.