Analysis of the President’s FY 2021 Budget

The Trump Administration released its Fiscal Year (FY) 2021 budget proposal today, outlining the President’s tax and spending priorities over the next decade. By the Administration’s own estimates, the budget would balance within 15 years and put debt on a downward path relative to the economy after 2022.

We are pleased the President has put forward this fiscal goal and are encouraged by many of the thoughtful policies proposed in his budget. However, the budget relies heavily on inflated economic growth assumptions, unrealistic policy savings, and other gimmicks to paper over its failure to sufficiently reduce the nation’s structural deficits and counteract the trillions of debt the President has signed into law.

Our analysis and summary of the President’s FY 2021 budget shows that:

- The President’s budget estimates its proposals would reduce debt from about 80 percent of Gross Domestic Product (GDP) today to 66 percent by 2030. With more realistic economic assumptions, debt would instead rise to roughly 89 percent of GDP.

- The President’s budget estimates its proposals would reduce budget deficits from $1.1 trillion (4.9 percent of GDP) in 2020 to $261 billion (0.7 percent of GDP) by 2030. Using more realistic economic assumptions, the budget deficit would be about $1.2 trillion (3.7 percent of GDP) in 2030.

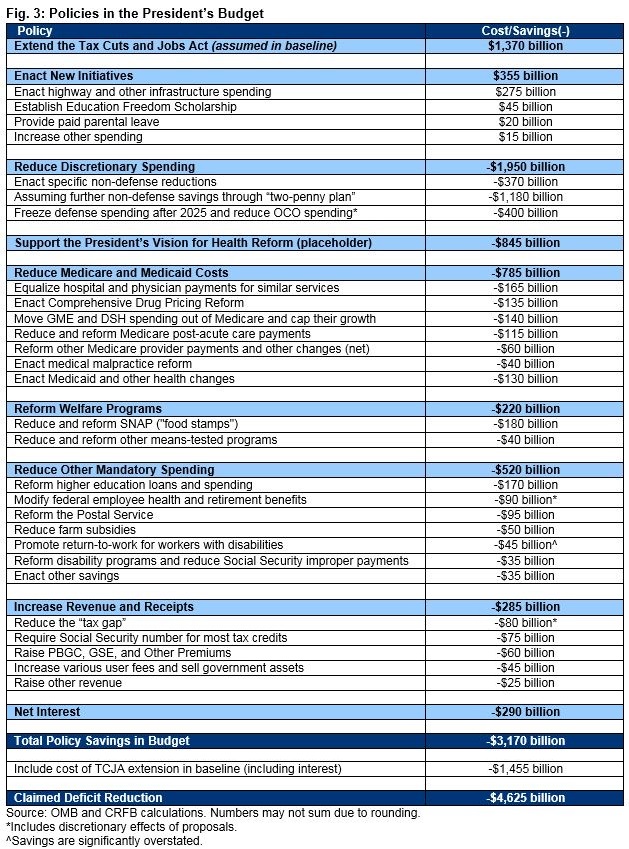

- The budget claims $4.6 trillion in net deficit reduction through 2030, including $1.6 trillion from health care, nearly $2 trillion of net discretionary savings, roughly $1 trillion of other net savings and revenue, and almost $300 billion in lower interest costs. Net of tax extensions assumed in its baseline, we estimate actual savings of $3.2 trillion in the budget.

- The budget proposes a number of thoughtful policy reforms – especially Medicare reforms that would reduce costs to beneficiaries and taxpayers.

- The fiscal outcomes in the President’s budget are heavily influenced by overly optimistic assumptions about economic growth. The budget assumes average real GDP growth of nearly 3 percent per year, while most forecasters project annual economic growth around 2 percent or less.

While we are pleased that the President’s budget aims to reduce debt and are encouraged by many of the budget proposals, the budget relies too heavily on gimmicks and makes too few tough choices to truly address the fiscal situation.

Debt, Deficits, Revenue, and Spending in the President’s Budget

According to its own estimates, the President’s budget would substantially reduce debt relative to projections. Under the budget, debt would grow from $17.2 trillion today to $23.9 trillion in 2030, compared to $28.5 trillion projected in the Office of Management and Budget’s (OMB) baseline and $31.4 trillion in the Congressional Budget Office’s (CBO) baseline.

As a share of the economy, debt under the President’s budget would rise from over 79 percent of GDP in 2019 to 81 percent in 2022 before declining to 66 percent of GDP by 2030. By comparison, debt under OMB’s baseline will remain relatively stable and total 79 percent of GDP by 2030. Under the CBO baseline, debt will increase to 98 percent of GDP by 2030.

Debt reduction estimated in the President’s budget is largely the result of rosy economic assumptions. Using CBO’s more realistic economic assumptions, we estimate debt under the President’s budget would rise to roughly 89 percent of GDP by 2030.

Annual deficits, according to the budget’s own estimate, would fall over time under the budget. The budget deficit would drop from $1.1 trillion in 2020 to $261 billion in 2030. As a share of the economy, the deficit would fall from 4.9 percent of GDP today to 0.7 percent by 2030 and reach balance by 2035. For comparison, OMB’s baseline projects a deficit of 3.3 percent of GDP ($1.2 trillion) in 2030. CBO estimates the deficit will reach 5.4 percent of GDP ($1.75 trillion)

Again, the reduction in the deficit is largely driven by generous economic assumptions. Using CBO’s economic assumptions, we estimate the budget deficit in 2030 would be 3.7 percent of GDP, or $1.2 trillion, under the budget.

The projected fall in the deficit is the result of rising revenue and falling spending. The budget projects revenue will rise from 16.7 percent of GDP in 2020 to 17.6 percent by 2030. Spending under the budget would fall from 21.6 percent of GDP in 2020 to 18.4 percent in 2030. Over the decade, the budget projects revenue will average 17.2 percent of GDP while spending averages 19.3 percent. By contrast, revenue will average 17.1 percent of GDP under OMB’s baseline and 17.4 percent under CBO’s baseline.

Spending reductions relative to GDP are largely driven by assumptions of rapid economic expansion as well as cuts to nondefense discretionary programs. Reductions in the growth of Medicare, Medicaid, welfare programs, and other mandatory programs also help spending levels decline as a share of the economy.

Revenue increases, meanwhile, are driven by assumptions of rapid economic growth, along with certain elements of the Tax Cuts and Jobs Act that bring in revenue over the latter parts of the decade. There are several other provisions in the budget that also contribute to a growth in revenue, such as a larger enforcement budget for the Internal Revenue Service, a provision requiring valid Social Security numbers in order to collect tax credits, and a penalty for states not meeting an unemployment insurance solvency standard.

Proposals in the President’s Budget

The President’s budget estimates it would achieve roughly $4.6 trillion in deficit reduction through 2030. However, this estimate does not include the permanent extension of the 2017 Tax Cuts and Jobs Act (TCJA), which is instead embedded in the baseline. Adjusting for this assumption results in $3.2 trillion of deficit reduction over the next decade.

The vast majority of deficit reduction comes from steep cuts to discretionary spending ($1.95 trillion), but it also includes $785 billion of specified Medicare and Medicaid savings, $845 billion in placeholder savings from the President’s vision for health reform, $825 billion from reducing welfare and other mandatory spending, $270 billion from increasing revenue and offsetting receipts, and $290 billion in interest savings. This deficit reduction would be partially offset by extending the tax cuts and enacting $355 billion of new initiatives mostly focused on infrastructure, educational scholarships, and paid parental leave.

Extend the Tax Cuts and Jobs Act ($1.4 trillion). Under current law, most individual income tax and estate tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are scheduled to expire after 2025. The President’s budget assumes the TCJA’s individual and estate tax provisions are extended permanently in its baseline. Though it does not count this as a new initiative, it would have a significant cost, nearly doubling the cost of the TCJA.

Enact New Initiatives ($355 billion). The President’s budget proposes roughly $355 billion in spending and tax breaks on new initiatives. The most significant of the proposals is $275 billion for infrastructure, which includes a ten-year reauthorization of highway spending at an elevated level combined with $190 billion of investment in other infrastructure, including air, water, and surface transportation. The President also proposes to provide $20 billion for states to expand unemployment insurance to include paid parental leave, $45 billion for tax credits to encourage individual and corporate donations to scholarship programs, and $15 billion in other initiatives to create a Federal Capital Revolving Fund and combat opioid abuse, among other items.

Reduce Discretionary Spending (-$1.95 trillion) – Between 2017 and 2020, discretionary spending increased by 17 percent due to legislation passed on a bipartisan basis and signed by President Trump. In his budget, the President would reverse these increases on the nondefense side – reducing nondefense spending by 5 percent between 2020 and 2021 and an additional 2 percent annually thereafter (“two-penny plan”). The President puts forward specific policies to achieve the initial 5 percent cut – which would save nearly $400 billion – including eliminating the Community Development Block Grant, ending the Low Income Home Energy Assistance Program, and streamlining foreign assistance accounts as well as administrative and civil service reforms design to reduce overall agency costs. The additional $1.2 trillion of cuts are largely unspecified. On the defense side, the President would fold Overseas Contingency Operations (OCO) spending into the base defense budget, grow spending with inflation through 2025, and then freeze spending levels thereafter. These changes would save about $400 billion over a decade, with a significant share coming from the elimination of nondefense OCO spending.

Support the President’s Vision for Health Reform (placeholder; -$845 billion). The President’s budget includes a placeholder for savings from a future health reform plan (the original score was roughly $600 billion but included tax cuts that have since been enacted). The budget provides very few details on what this reform would entail, but it says that it would “protect the most vulnerable, especially, those with pre-existing conditions, and provide the affordability, choice, and control Americans want, and the high-quality care that all Americans deserve.” In past years, the budget has proposed to replace most Affordable Care Act (ACA) spending with grants to states while also capping Medicaid spending growth. While this proposal is likely to differ, the bulk of the savings would most certainly come from Medicaid and ACA subsidies.

Reduce Medicare and Medicaid Costs (-$785 billion). The President’s budget includes $785 billion of specific health savings. Most of this savings comes from Medicare reforms that would reduce the cost of the program for beneficiaries and taxpayers. Among the policies include bipartisan ideas such as equalizing payments for similar services offered in hospitals and physician’s offices ($165 billion), slowing the growth of post-acute care payments ($115 billion), reducing payments for bad debts ($35 billon), and reforming other provider payments ($25 billion). The President also proposes removing payments for medical residents (graduate medical education) and uncompensated care (disproportionate share hospital payments) out of Medicare and into their own programs while capping their growth ($140 billion). In addition, the President’s budget includes a $135 billion saving allowance for prescription drug proposals, specifically supporting current Congressional efforts to reduce Medicare Part D costs, lower drug prices, and encourage the use of generic and biosimilar medications. The President’s budget also proposes significant Medicaid savings by requiring work and community engagement activities, reintroducing asset limits, and otherwise tightening eligibility requirements for able-bodied adults – resulting in about $130 billion of savings. Finally, the President’s budget proposes medical malpractice liability reform, which would save money through the health system ($40 billion in federal savings).

Reform Welfare Programs (-$220 billion). The President’s budget would scale back and reform several safety net programs. Most significantly, it would tighten eligibility for the Supplemental Nutrition Assistance Program (SNAP or “food stamps”) by requiring at least 20 hours of work, training, or community engagement weekly in order to receive benefits. It would also achieve SNAP savings through home-delivered food boxes and program integrity improvements, for a total of $180 billion of savings. The budget also proposes cutting Temporary Assistance to Needy Families (TANF) block grants, tightening states’ ability to use TANF funds, eliminating the TANF Contingency Fund, and ending the Social Services Block Grant, among other changes to means-tested programs, resulting in about $40 billion in savings.

Reduce Other Mandatory Spending (-$520 billion). The President’s budget includes various policies aimed at reducing spending on non-health, non-welfare mandatory spending programs. The largest savings would come from reforming student loans into a single income-based repayment program and ending the Public Service Loan Forgiveness program, for a combined $170 billion in savings. The President also proposes reforming and reducing federal employee retirement and health benefits ($90 billion), reforming the U.S. Postal Service ($95 billion), and reducing farm subsidies ($50 billion). In addition, the budget includes significant changes aimed at reforming federal disability programs, including about $35 billion in tangible policy savings from Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). On the other hand, it estimates about $45 billion in savings from promoting work among SSDI and SSI beneficiaries, which are unlikely to materialize at such a large scale. Finally, it includes $35 billion of other savings from several different cost reduction policies.

Increase Revenue and Receipts (-$285 billion). The President’s budget includes various proposals aimed at increasing offsetting receipts and improving revenue collection. The largest additional revenue would come from requiring valid Social Security numbers to collect tax credits ($75 billion), for instance, preventing undocumented parents from claiming the Child Tax Credit for their U.S. citizen children. More revenue would come from reducing the “tax gap” through additional tax enforcement funds and other reforms (net savings of $80 billion). The budget would also raise premiums related to the Pension Benefit Guaranty Corporation (PBGC) and Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, generating $60 billion. Additionally, the budget would generate nearly $45 billion in revenue from new user fees on immigration, customs, and food inspection and by selling or leasing various government assets, including wireless spectrum. Finally, the President’s budget would raise about $25 billion by ending several tax breaks for renewable energy and setting a solvency standard for unemployment insurance with a financial penalty for missing it.

Overly Optimistic Economic Assumptions

A budget’s economic assumptions single every estimate it provides. The medium-term assumptions in the President’s budget follow the trend of the past three budgets in that they are overly optimistic and far outside of mainstream forecasts. While it is certainly reasonable that the President’s budget assumes its policies will have an impact on macroeconomic conditions, this budget’s growth assumptions, which average nearly 3 percent over the decade, are outside the consensus and highly unlikely to materialize.

OMB projects real (inflation-adjusted) GDP growth of 2.8 percent in 2020 and 3.1 percent in 2021, eventually tapering back down to 2.8 percent in 2027 and beyond.

The economic projections in this budget are much more optimistic than those of other forecasters, especially over the medium and long terms. The economy grew by just 2.3 percent in 2019 despite benefiting from the stimulative effects of recent tax cuts and spending hikes. Even assuming the economy continues to avoid a recession, the aging of the population suggests growth is likely to average less than 2 percent over the next decade.

CBO estimates real GDP growth will average just 1.7 percent over the next decade. Similarly, the Federal Reserve projects long-term sustained growth of 1.9 percent per year, and the Blue Chip average for sustained growth is only slightly higher at 2.0 percent. Similarly, the International Monetary Fund projects long-term growth of 1.6 percent, while nine other forecasters we’ve identified estimate growth between 1.6 percent and 2.2 percent. Given the aging of the population and other economic trends and realities, no independent forecast finds a growth rate anywhere close to the 2.8 percent assumed in the President’s budget.

Over time, OMB’s rosy growth assumptions lead to projections of a much larger economy than other forecasters do. For example, OMB estimates GDP would total nearly over $36 trillion in 2030 – a full 13 percent above CBO’s $32 trillion projection.

These differences allow OMB to assume much smaller levels of debt. Using CBO’s economic assumptions instead, we estimate (very roughly) that debt would reach 89 percent of GDP by 2030 under the President’s budget instead of falling to 66 percent.

Strangely, OMB’s unusually high GDP growth estimates are not coupled with higher interest rate assumptions. Typically, a percentage point of faster growth would lead to about a percentage point increase in interest rates, all else equal, dampening some of the positive fiscal feedback from faster growth (since it would mean higher interest payments). Yet OMB projects three-month and ten-year Treasuries would settle at 2.5 percent and 3.2 percent, respectively – in line with CBO’s estimates of 2.4 and 3.1 percent.

The other economic indicators in the President’s budget are also roughly in line with – though a bit more optimistic than – other forecasts. OMB projects the unemployment rate to average 3.6 percent in 2021 and stabilize at roughly 4.0 percent beyond 2023. By comparison, CBO projects unemployment will rise to about 4.5 percent, the Federal Reserve estimates 4.2 percent, and the Blue Chip average is about 4.1 percent.

OMB projects inflation as measured by the GDP deflator to remain basically flat at 2.0 percent, similar to projections made by other forecasters.

Conclusion

The President deserves credit for setting the goal of reducing debt as a share of GDP over time and for putting forward a number of thoughtful policies to help achieve that goal. However, the budget is far less responsible than meets the eye – it relies rosy economic growth estimates, unrealistic or unspecific policy assumptions, and other gimmicks to make the fiscal outlook appear stronger than it is.

Ultimately, actions speak louder than words – and the president has already signed into law $4.7 trillion of new debt. To put the debt on a more sustainable path, this trend must be reversed.

The President must take the lead in pushing for incremental or comprehensive legislation to control spending, lower health care costs, secure trust funds, raise new revenue, and promote economic growth without borrowing more to do so. Many of the proposals in the president’s budget can serve as the basis for such legislation, but more must be done.

The national debt is on an unsustainable path and headed to uncharted territory. Policymakers should work together to correct course.

What's Next

-

-

Image

-