Analysis of CBO’s September 2020 Budget Outlook

Today, the Congressional Budget Office (CBO) released its updated budget outlook – the first to incorporate the effects of the COVID-19 public health and economic crisis. CBO’s baseline, which is based on its July economic forecast, shows that the current crisis has substantially worsened an already unsustainable budget outlook. Under CBO’s current law baseline:

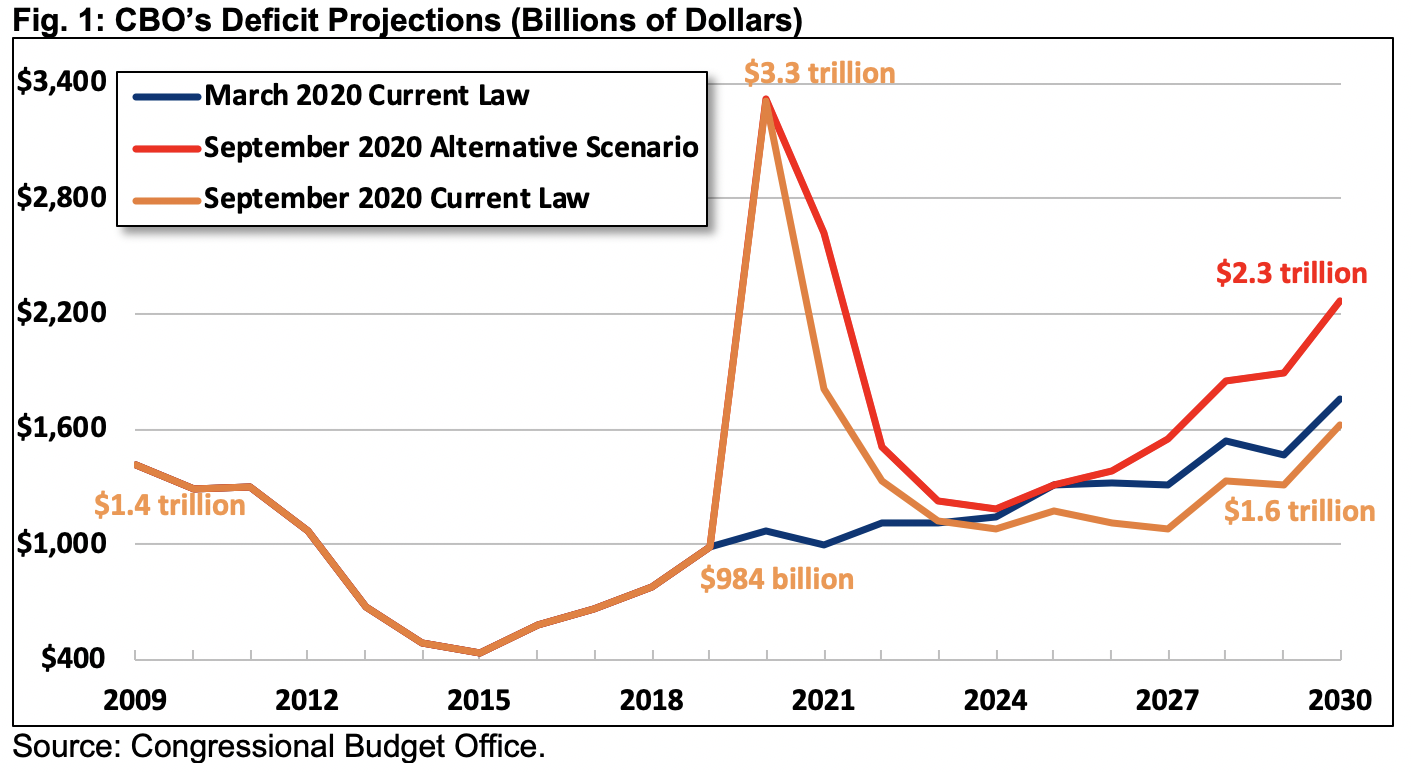

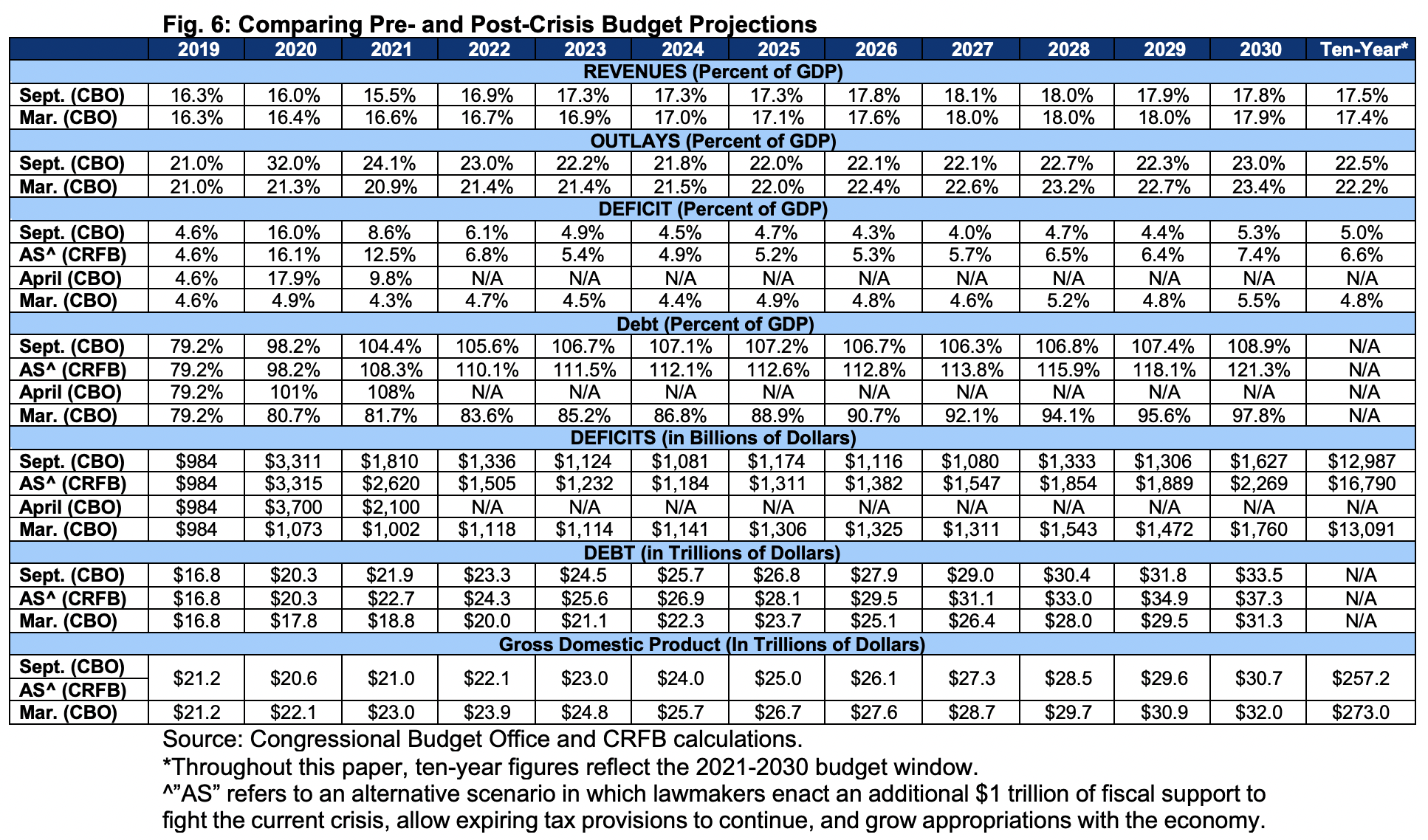

- The budget deficit will reach a record $3.3 trillion (16 percent of GDP) in Fiscal Year (FY) 2020 and total $13 trillion (5 percent of GDP) over the subsequent decade. The deficit will total $1.6 trillion (5.3 percent of GDP) in 2030 alone.

- Deficits through 2030 will be $2.1 trillion higher than estimated prior to the pandemic and debt-to-GDP will be 11 percentage points higher. COVID relief legislation accounts for more than the entirety of this increase. Lower interest payments and spending - stemming from reduced interest rates and inflation - more than offset lower revenue as a result of weaker economic output.

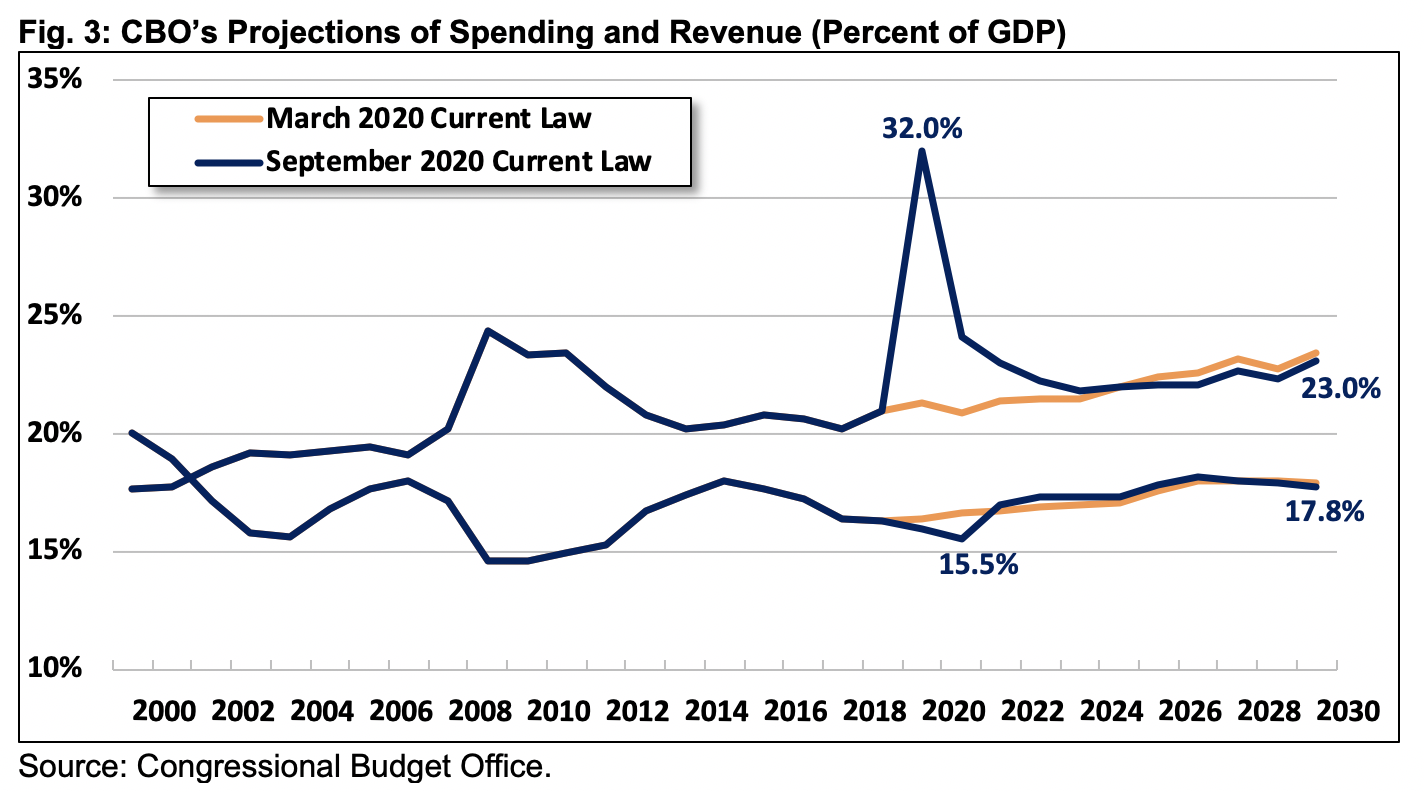

- The current crisis will substantially depress revenue and increase spending in the near-term. Revenue will total 16 percent of GDP in 2020 and average 17.5 percent over the subsequent decade – around its historic average of 17.4 percent. Spending will total 32 percent of GDP in 2020 and average 22.5 percent over the 2021-2030 window, above its historic average of 20.3 percent.

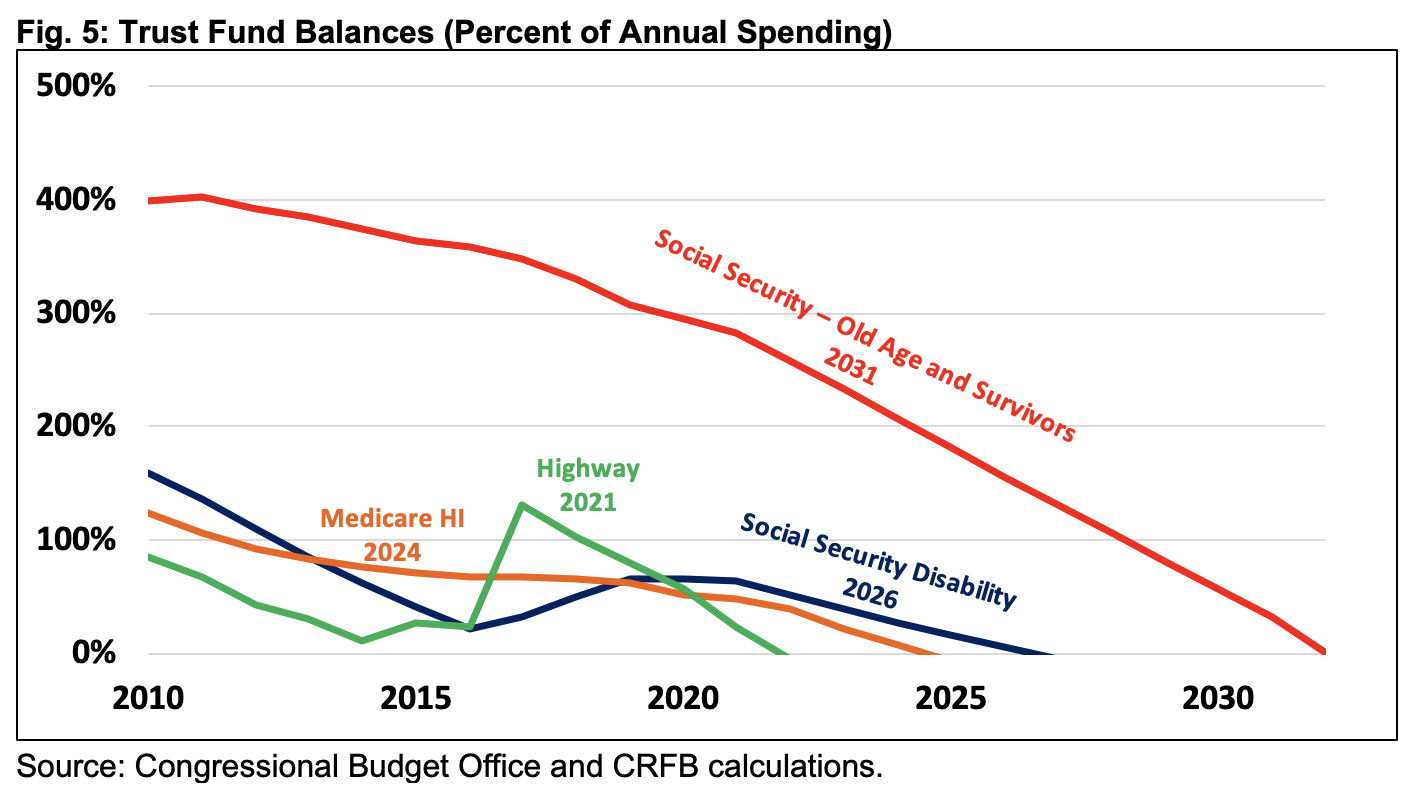

- All major trust funds will exhaust their reserves in the next 11 years. CBO projects Highway Trust Fund (HTF) insolvency by 2021, Medicare Hospital Insurance (HI) insolvency by 2024, Social Security Disability Insurance (SSDI) insolvency by 2026, and the Social Security retirement program by 2031.

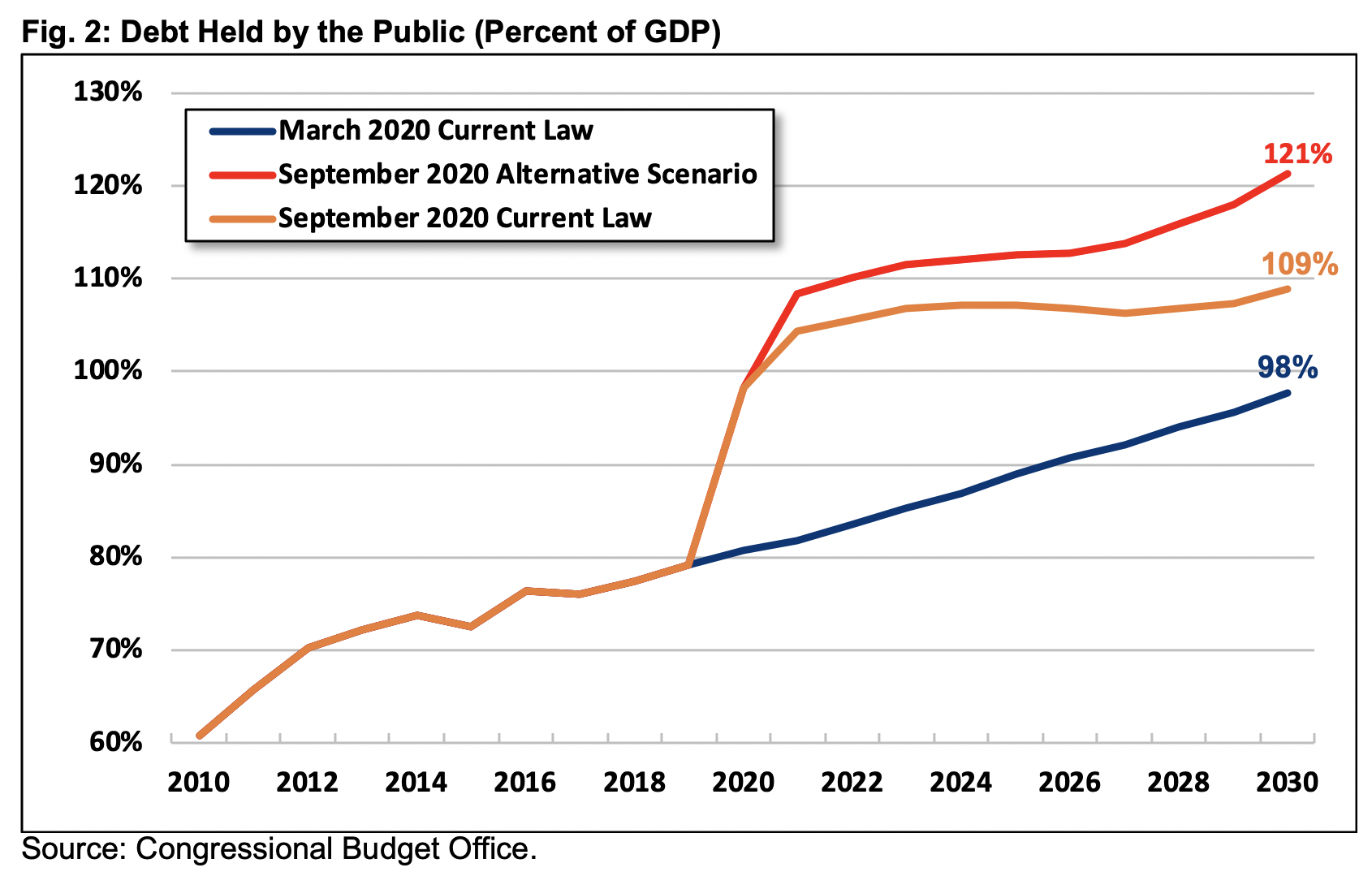

- Debt could grow even higher than projected. If policymakers enact $1 trillion of additional fiscal relief, extend expiring tax provisions, and increase appropriations with the economy, debt will reach 121 percent of GDP by 2030.

Today’s borrowing is largely appropriate and necessary in order to reduce and distribute over time the economic pain caused by the COVID-19 pandemic. But CBO’s newest figures show that our long-term course is unsustainable, and much worse than before. Once the current crisis ends, policymakers must turn their attention to long-term deficit reduction to put the country on solid fiscal ground.

CBO Projects Record Deficits

CBO estimates that under current law, budget deficits will more than triple, rising from $984 billion (4.6 percent of GDP) in 2019 to $3.3 trillion (16 percent of GDP) this year. Looking forward, CBO projects deficits to fall to $1.8 trillion (8.6 percent of GDP) in 2021, falling just below $1.1 trillion (4 percent of GDP) in 2027, before rising again to $1.6 trillion (5.3 percent of GDP) in 2030.

Deficits will total $16.3 trillion (5.9 percent of GDP) between 2020 and 2030, $2.1 trillion (1.1 percent of GDP) higher than CBO’s pre-pandemic estimates.

In nominal dollars, this year’s deficit will be almost 2.5 times higher than the previous record set in 2009 – $3.3 trillion versus $1.4 trillion. As a share of GDP, the deficit will be the fourth highest in history – eclipsed only by three years of borrowing to fight World War II.

Deficits could be even higher if lawmakers continue their pre-COVID streak of fiscal irresponsibility. In our alternative scenario, we assume lawmakers enact an additional $1 trillion of fiscal support to combat the current crisis, extend most expiring tax cuts, and grow appropriations with the economy rather than with inflation.

Under this alternative scenario, deficits will total roughly $20 trillion through 2030 as opposed to $16.3 trillion, and annual borrowing would rise to $2.3 trillion (7.4 percent of GDP) in 2030 as opposed to $1.6 trillion.

The National Debt Will Surpass World War II Levels

CBO projects debt will reach 98 percent of GDP this year and 104 percent of GDP in 2021, eclipsing the size of the economy for the first time since right after World War II. Debt will set an all-time record of 107 percent of GDP by the end of 2023. Assuming a robust but extended economic recovery over the next decade, CBO projects debt will stay relatively stable at this new record level through 2029, rising to 109 percent of GDP by the end of FY 2030.

In nominal dollars, CBO projects debt will double, from $16.8 trillion at the end of 2019 to $33.5 trillion in 2030. This is significantly larger than the $14.5 trillion increase CBO projected over the same timeframe in its March baseline.

The comparably modest growth in projected debt-to-GDP between 2021 and 2030 is partially a function of temporary accelerated economic growth as the economy recovers from the current crisis under CBO’s economic forecast. As a share of potential GDP, debt will rise to 94 percent of GDP this year, to 99 percent of GDP next year, and to 108 percent of GDP by 2030.

Debt levels could be significantly higher if lawmakers enact additional fiscal support, extend various expiring tax cuts, and grow appropriations with the economy. Under this alternative scenario, debt would grow by $20.5 trillion over the next decade to $37.3 trillion, reaching 121 percent of GDP by 2030.

Spending and Revenue Will Continue to Diverge

Rising debt and deficits are driven by a disconnect between spending and revenue. As a result of the current crisis and efforts to combat it, CBO projects spending will rise from $4.4 trillion (21.0 percent of GDP) in 2019 to $6.6 trillion (32.0 percent of GDP) in 2020 while revenue will fall from $3.5 trillion (16.3 percent of GDP) in 2019 to $3.3 trillion (16.0 percent of GDP) in 2020.

Revenue will cover only half of spending this year, with the other half financed through borrowing.

Beyond 2020, CBO expects revenue will recover as the economy recovers, economic stimulus ends, and various tax cuts eventually expire. Specifically, CBO projects revenue will grow from 15.5 percent of GDP in 2021 to 17.8 percent of GDP by 2030.

As a share of the economy, spending will shrink between 2020 and 2024 – to a low of 21.8 percent of GDP – as stimulus phases out and low interest rates reduce debt service payments. Starting in 2025, spending will rise as a result of growing health, retirement, and interest costs, reaching 23 percent of GDP by 2030. Growth is likely to accelerate in the 2030s.

If lawmakers enact further fiscal relief, extend various expiring tax policies, and increase annual appropriations with the economy, spending would be higher and revenue lower than projected. By 2030, under such an alternative scenario, we project revenue would reach only 16.6 percent of GDP while spending would reach 24.0 percent of GDP.

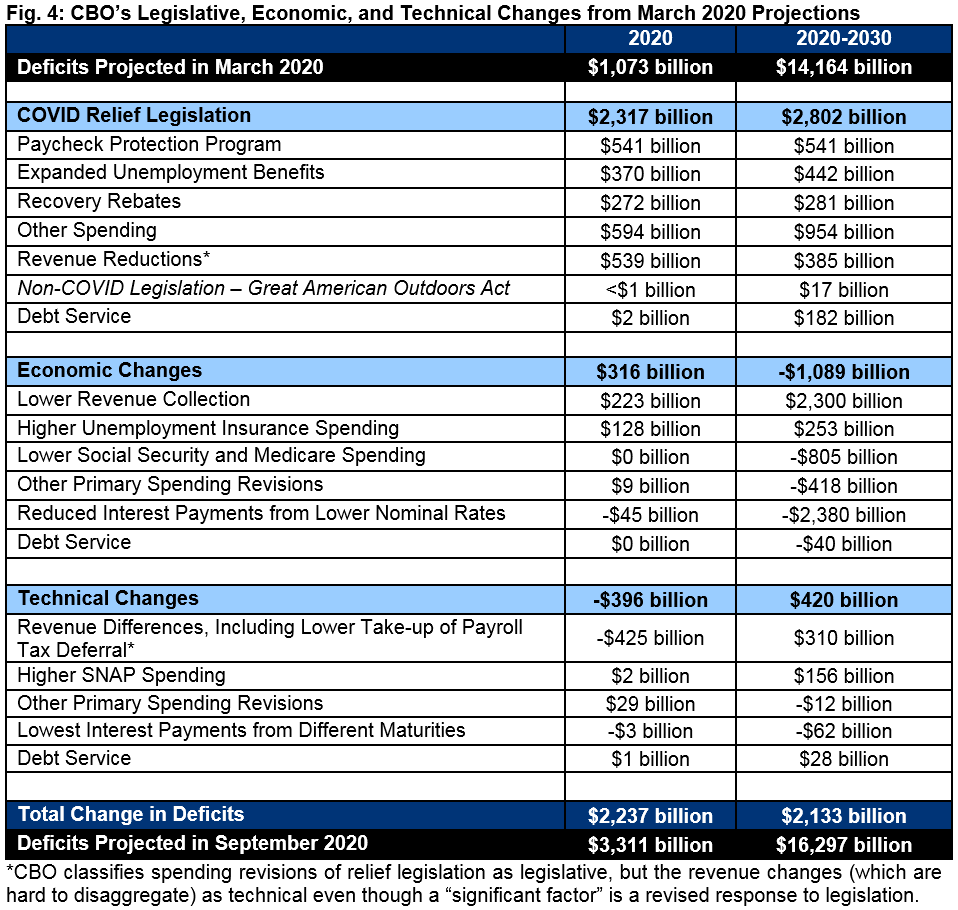

The COVID-19 Pandemic Significantly Worsened the Budget Outlook

CBO’s projections have worsened substantially since March due to the response to the current health and economic crisis. Specifically, CBO now projects total deficits from 2020 to 2030 will be $2.1 trillion higher than projected in March - $16.3 trillion as opposed to $14.2 trillion. CBO also projects debt in 2030 will be 11 percent of GDP higher – 109 percent as opposed to 98 percent.

Of the $2.1 trillion increase in projected deficits, more than all of it – $2.8 trillion – is a result of legislation enacted to respond to the current crisis. We are tracking these measures at COVIDMoneyTracker.org. A weaker economy increased 2020 deficits as a result of lower revenue and higher unemployment benefits. But over the decade, lower interest rates and price levels are projected to reduce the cost of Social Security, health care programs, and interest payments more than lower output will reduce revenue.

Major Trust Funds Are Headed Toward Insolvency

A number of important federal programs are financed through dedicated revenue sources and managed through federal trust funds. Under CBO’s new baseline, all major trust funds would exhaust their reserves within 11 years.

Specifically, CBO projects the Highway Trust Fund (HTF) will deplete its reserves in FY 2021, the Medicare Hospital Insurance (HI) trust fund in FY 2024, and the Social Security Disability Insurance (DI) trust fund in FY 2026. CBO estimates the Social Security Old-Age and Survivors Insurance (OASI) trust fund will be exhausted in calendar year 2031.

All of these trust funds will run out of reserves earlier than CBO previously projected (but in line with our recent estimates). CBO’s most recent projections showed the HTF depleting its reserves in fiscal year 2022, the HI trust fund in 2026, the DI trust fund in 2028, and the OASI trust fund in 2032.

Absent new legislation, CBO estimates that highway spending will be cut by 25 percent, Medicare spending by 17 percent, and Social Security disability spending by 11 percent immediately upon insolvency of their respective trust funds. Based on CBO's figures, Social Security’s retirement benefit would be cut by roughly one-quarter in 2031. In other words, today’s youngest retirees will face a sharp 25 percent drop in their benefits when they turn 73.

These earlier depletion dates are mainly driven by declining tax revenue as a result of the economic crisis. Disability and early retirement claims are also expected to rise, which will increase Social Security costs, while trust fund assets grow at a lower interest rate. These effects will be partially offset by lower spending, especially on Social Security and Medicare.

Conclusion

CBO’s latest budget projections confirm what we have warned about for some time: our country is on an unsustainable fiscal path and the budget outlook will continue to deteriorate as a result of irresponsible tax and spending policies and the growth of health and retirement spending. The response to the COVID-19 public health and economic crisis, though necessary to stabilize the economy and limit human suffering, has further increased deficits and debt.

Under current law, budget deficits will reach a record-high of $3.3 trillion (16.0 percent of GDP) this year before falling to $1.6 trillion (5.3 percent of GDP) by 2030.

Similarly, debt will reach new heights. CBO projects that debt will eclipse the size of the economy next year, surpass the all-time record set just after World War II by 2023, and reach 109 percent of GDP by 2030. If lawmakers enact additional fiscal support to fight the current crisis and extend costly tax and spending policies, debt would rise to 121 percent of GDP by 2030. In either case, debt will rise unsustainably over the long term.

Meanwhile, all major trust funds face depletion within the next 11 years. The structural imbalances faced by the Highway, Medicare, and Social Security programs have only worsened with the current crisis.

Once the current pandemic ends and the economy is well on its way to recovery, policymakers must turn their attention to long-term debt and deficit reduction to get the country on solid fiscal ground. This includes action to secure Social Security and other trust funds headed toward insolvency, limit the growth of health care and other costs, and raise additional tax revenue.

Policymakers should also work to put the country in a better fiscal and economic position so that we can be better prepared for whatever challenges await us.

Appendix

Update 9/3/2020: Figure 4 was revised after publication to show the costs of parts of COVID response legislation, rather than the changes to those costs since CBO's last estimate. The table's totals and subtotals are unchanged.