What's in the Fourth Coronavirus Package?

The Senate yesterday passed the Paycheck Protection Program and Health Care Enhancement Act by unanimous consent. The bill is the fourth piece of legislation aimed at providing economic relief in the wake of the COVID-19 outbreak.

The $483 billion package is the second largest of the four legislative relief bills so far in terms of dollar cost and mostly builds on programs established in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law on March 27, 2020.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

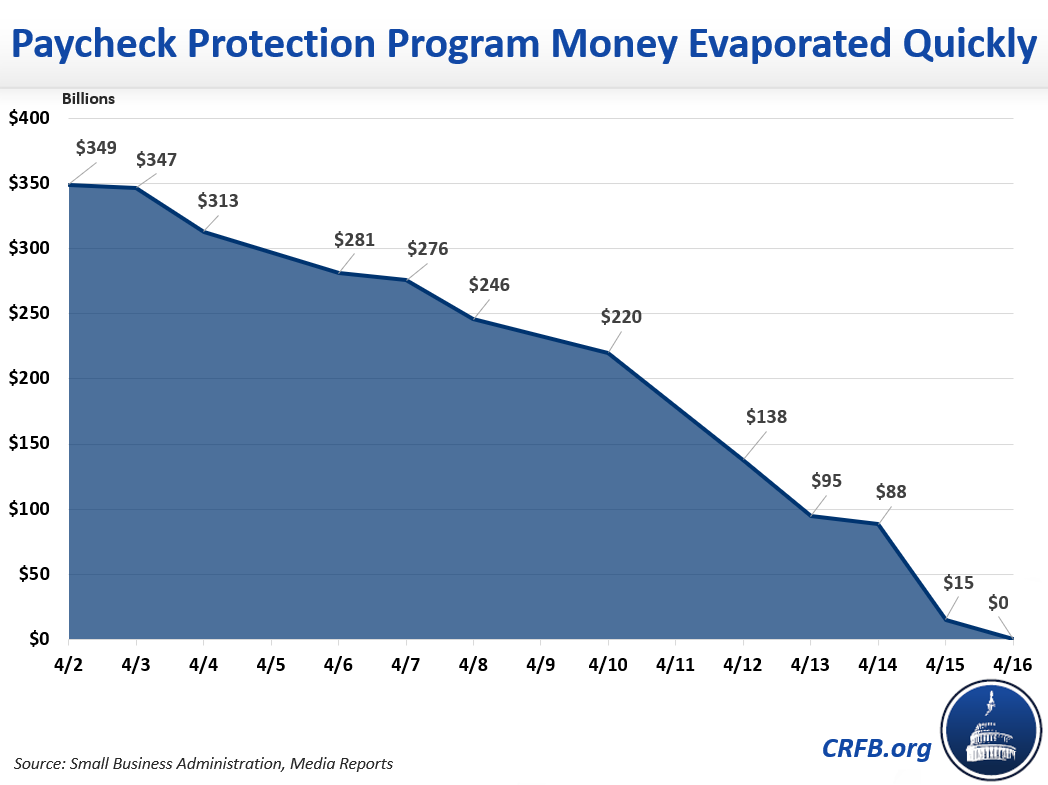

The legislation increases funding for the forgivable small business loan Paycheck Protection Program (PPP) established under the CARES Act; the program exhausted its initial appropriation of $349 billion last week. The Paycheck Protection Program and Health Care Enhancement Act increases the total appropriated funding for the program from $349 billion to $670 billion — a $321 billion increase. The bill stipulates that $60 billion in loans are to be made by small banks, community financial institutions, and credit unions with under $50 billion in consolidated assets.

The bill provides more assistance to small businesses by appropriating an additional $50 billion for the Economic Injury Disaster Loan (EIDL) program, which has been estimated to support around $300 billion in loans. The bill boosts funding for the EIDL grant program by $10 billion; the grant program provides up to $10,000 in cash advances to small businesses materially affected by the nationwide lockdowns. The Small Business Administration (SBA) will also receive $2.1 billion in additional funding to support their operational capacity.

The bill also allocates an additional $100 billion for health care, with $75 billion available for health providers to prepare and respond to the COVID-19 outbreak, and $25 billion for increased testing capacity. Of the $25 billon allocated for testing, $11 billion is earmarked for states, localities, territories, and tribal communities.

| Policy | Allowed | Disbursed/ Committed | Deficit Impact |

|---|---|---|---|

| Increase funding for forgivable small business loans (Paycheck Protection Program) | $321 billion | N/A | $321 billion |

| Expand health provider emergency grant fund program for COVID-19 preparedness and expenses | $75 billion | N/A | $75 billion |

| Provide emergency grant fund program for COVID-19 testing | $25 billion* | N/A | $25 billion |

| Increase small business emergency loan (EIDL) authorization | $300 billion^ | N/A | $50 billion |

| Increase funding for small business emergency grants (EIDL) | $10 billion | N/A | $10 billion |

| Increase funding for Small Business Administration | $2 billion | N/A | $2 billion |

| Paycheck Protection Program and Health Care Enhancement Act | $733 billion | N/A | $483 billion |

*$11 billion is earmarked for states, localities, territories, and tribal organizations.

^The legislation appropriates $50 billion toward the Economic Injury Disaster Loan (EIDL) program, which Senate Minority Leader Chuck Schumer (D-NY) has said would be enough to support an estimated $300 billion in loans. This claim is consistent with a subsidy rate of roughly 17%.

Source: Congressional Budget Office, CRFB calculations.

Overall, the bill would allow for as much as $733 billion in spending and loans, which the Congressional Budget Office (CBO) has estimated will add $483 billion to the deficit over ten years. In combination with earlier legislation, we estimate Congress has provided up to $3.6 trillion of support at a net cost of $2.5 trillion over a decade.

See our COVID Money Tracker blog for an up-to-date list of all the actions taken by Congress, the White House, and the Federal Reserve in response to the COVID-19 crisis.