What’s in the Bipartisan COVID Relief Bill?

Lawmakers Monday released the full text of a $908 billion bipartisan stimulus package, which was released in summary form back on December 1. The package is split into two parts. The first $748 billion bill, the Emergency Coronavirus Relief Act of 2020 (ECRA), includes $300 billion in Paycheck Protection Program (PPP) second draw loans and other small business relief, around $180 billion for extended and expanded unemployment benefits, $45 billion to airlines, airports and other transit industries, $35 billion for health providers, $16 billion for vaccine development, supply, and testing and tracing programs, and more. The second bill provides $160 billion in relief for states, municipalities, and tribes as well as liability protections for businesses.

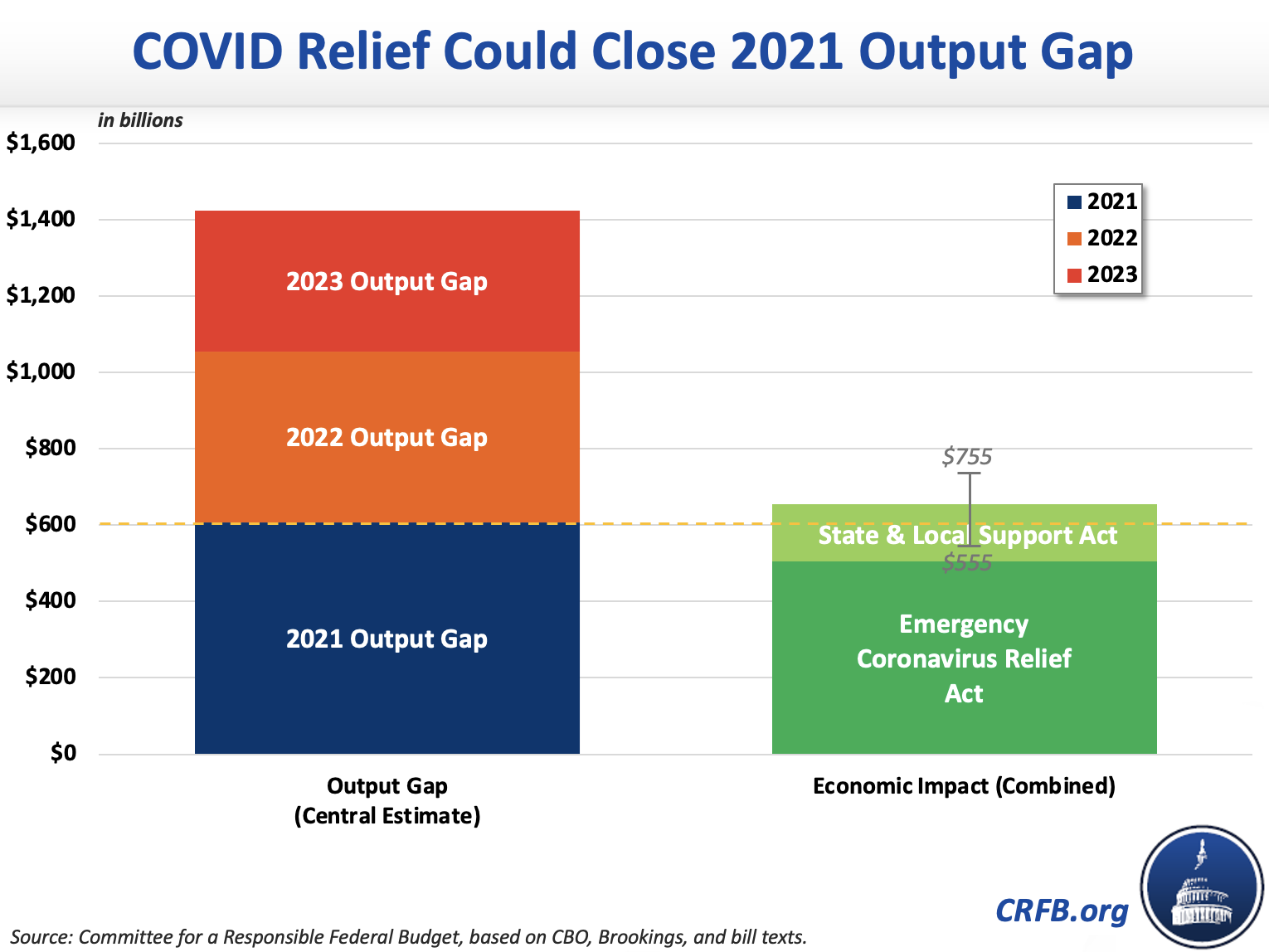

Last week we published an analysis that estimated the size of the output gap and the economic effect of the original $908 billion package. Using a similar methodology, we find that these two bills combined would boost GDP by between $555 billion and $755 billion, with a central estimate of $655 billion. The two bills would boost GDP equivalent to nearly half of the output gap over the next three years and more than the total output gap for 2021 under our central estimates.

List of Provisions in the Emergency Coronavirus Relief Act of 2020

| Provision | Ten-Year Cost |

|---|---|

| Aid to Small Businesses | $300 billion |

| Paycheck Protection Program (PPP) Second Draw | $268 billion |

| Economic Injury Disaster Loan Advances | $14 billion |

| Emergency Grants to Venues | $10 billion |

| Other Small Business Relief and Program Expenses | $9 billion |

| Deductibility of expenses paid for by PPP loans | ^ |

| Extend and Augment Unemployment Benefits (+$300/week) for 16 weeks | $180 billion |

| Education | $82 billion |

| K-12 Education Grants | $54 billion |

| Higher Education Grants | $20 billion |

| Governor's Emergency Education Relief Fund | $8 billion |

| Education Grants for Tribes and Territories | $0.5 billion |

| Health Care | $51 billion |

| Provider Relief Fund | $35 billion |

| Vaccine Development & Distribution | $6 billion |

| COVID Testing & Tracing | $7 billion |

| Transportation | $45 billion |

| Second Round Payroll Support Program for Airline Workers | $17 billion |

| Transit Infrastructure Grants | $15 billion |

| Grants to Transportation Service Providers Like Buses and Ferries | $8 billion |

| Airport Grants | $4 billion |

| Amtrak Funding | $0.6 billion |

| Other Spending | $88 billion |

| Nutrition and Agriculture Programs | $26 billion |

| Rental Assistance | $25 billion |

| U.S. Postal Service Loan Write-Off | $10 billion |

| Child Care Grants | $10 billion |

| Broadband Grants and Investment | $10 billion |

| Substance Abuse and Opioid Treatment Grants | $5 billion |

| CDFI/MDI Community Lender Support | $2 billion |

| Total | $748 billion |

| "Offsets" (reductions in previous budget authority) | -$560 billion |

| Net Total | $188 billion* |

Source: Bill text. Totals do not sum due to rounding.

^ This changes is likely to reduce tax revenues significantly relative to current law, but much of the cost was inadvertently scored in the original bills.

*Although the proposal rescinds funds from the PPP program and the Federal Reserve’s lending facilities, those funds would not have been spent anyway under current law so the actual deficit impact will be closer to $748 billion. The precise deficit impact is unknown — for example, unemployment benefits could cost more or less depending on unemployment levels and PPP loans may not be fully utilized.

For small businesses, the bill provides $268 billion to the Paycheck Protection Program, the forgivable loan program launched by the CARES Act and extended once already, $14 billion for the Economic Injury Disaster Loan advance grant program, which will provide up to $10,000 for businesses that continue to remain severely impacted by the ongoing slowdown. The bill also provides up to $10 billion in emergency grants for shuttered entertainment venues. The bill would also allow expenses to be deducted for tax purposes if they were paid for by PPP forgiven loans. PPP loans are not counted as taxable income, so typically the use of that money would not typically provide a deduction. This bill clarifies that business expenses paid for by PPP proceeds would be deductible, allowing those getting loans to get an additional tax benefit on top of the forgivable loan money they received. The Joint Committee on Taxation omitted the limitation on deductibility in the original score for PPP (thus overestimating the original cost), but the provision is likely to significantly reduce federal revenues for PPP loans that have already been issued plus the second draw.

For individuals, the bill extends the current temporary unemployment programs for gig workers (Pandemic Unemployment Assistance), those that have exhausted regular unemployment benefits (Pandemic Emergency Unemployment Compensation), temporary full federal funding for the first week of unemployment benefits for states without a waiting period, emergency unemployment for government entities and nonprofits, and other smaller temporary unemployment programs for four months starting from December 28 through April 19, 2021. In addition, persons receiving unemployment benefits will receive an additional $300 weekly payment on top of their regular state benefits over this period, half of the $600 federal weekly supplement that was in effect from April through July 31. The bill would also increase funding for and expand nutrition programs, including SNAP, provide rental assistance through states, and extends student loan forbearance through April 1.

While the Emergency Coronavirus Relief Act does not include the $160 billion to states and tribes in the original $908 billion proposal, there is about $75 billion in state and local aid in the larger bill, including more than $60 billion in education relief, which includes $54 billion for K-12 schools, $7.5 billion for the Governor's Emergency Relief Fund, which can be used at state governors' discretion on both K-12 and higher education, and $500 million for tribes and territories. Transit systems receive $15 billion in grants. State and local government finances would likely improve by closer to $100 billion when considering the additional revenue raised from (taxable) unemployment benefits and other policies which boost income or output.

There is also more than $40 billion that flows to states to distribute, though it is not necessarily aid for their budgets because it covers new costs. This includes $25 billion in rental assistance through the Coronavirus Relief Fund, $10 billion for vaccine distribution and testing and tracing programs, and $6 billion of broadband grants.

Other support includes $20 billion in grants for colleges and universities, $17 billion for a restart of the payroll support program for airline workers, $10 billion in grants to child care providers, forgiveness of the $10 billion loan to the U.S. Postal Service in the CARES Act, $5 billion towards substance abuse and mental health treatment, $4 billion in grants to airports, and $580 million for Amtrak.

The second bill, the Bipartisan State and Local Support and Small Business Protections Act, provides $160 billion to state and local governments and includes liability protection language regarding when businesses can be subject to COVID-related lawsuits.

List of Provisions in the Bipartisan State and Local Support and Small Business Protections Act

| Provision | Ten-Year Cost |

|---|---|

| Aid to States | $91 billion |

| Aid to Counties and Municipalities | $61 billion |

| Aid to Tribes | $8 billion |

| Liability Protections | N/A* |

| Total | $160 billion |

Source: Bill text.

*We assume minimal or no cost to the federal government.

The bill provides $160 billion to states and tribes through the Coronavirus Local Community Stabilization Fund. According to the allocation plan, states would receive $91 billion, counties and municipalities would receive $61 billion, and tribes would receive up to $8 billion. Two-thirds of a state's allocation will be based on revenue losses and one-third will be based on the state share of the overall population. Governors must distribute 40 percent of the state's funding to local government units within the state based on proportional population, proportional revenue loss, or both, and and the funds cannot be used to fund public pension plans.

How Much Will Each Bill Boost GDP?

Last week we published an analysis of the economic effect of the combined $908 billion package using low and high fiscal multipliers by each category. Our estimates have changed slightly since the release of the full bill text, because we now have a clearer picture of the distribution and categorization of the spending proposals. Importantly, we do not account for the effects the plans might have on expediting the end of the COVID pandemic nor the impact of other non-fiscal policies such as the changes to COVID liability rules.

The proposed stimulus can be broken down into four distinct categories: small business relief, expanded and extended unemployment benefits, state and local aid, and other. Using these categories, we generate a low-impact estimate using the same category fiscal multipliers estimated by CBO for already-enacted COVID relief. For our high-impact estimates, we use multipliers suggested by Wendy Edelberg and Louise Sheiner at the Brookings Institution, increasing the assumed PPP and small business multiplier to account for increased targeting. Based on these categorical multipliers, we estimate the Emergency Coronavirus Relief Act would have an overall multiplier of 0.56x to 0.80x and the state and local support bill would have a multiplier of between 0.88x to 1.00x. We estimate the Emergency Coronavirus Relief Act would boost GDP by between $415 to $595 billion, with a central estimate of $505 billion, while the State and Local Support Act will boost GDP by between $140 to $160 billion, with a central estimate of $150 billion.

Estimated GDP Boost From COVID Relief Proposals (billions)

| Emergency Coronavirus Relief Act | State and Local Support Act | |||||||

|---|---|---|---|---|---|---|---|---|

| Category | Fiscal Impact | Low | Central | High | Fiscal Impact | Low | Central | High |

| Unemployment Benefits | $180 | $120 | $175 | $235 | $0 | N/A | N/A | N/A |

| Paycheck Protection Program and Other Small Business Support | $300 | $110 | $130 | $150 | $0 | N/A | N/A | N/A |

| State and Local Aid (including Education and Transit Funding) | $75 | $70 | $70 | $75 | $160 | $140 | $150 | $160 |

| Other Spending and Revenue | $190 | $120 | $125 | $135 | $0 | N/A | N/A | N/A |

| Total | $748 | $415 | $505 | $595 | $160 | $140 | $150 | $160 |

| Overall Multipliers | 0.56x | 0.68x | 0.80x | 0.88x | 0.94x | 1.00x | ||

Totals may not sum due to rounding. CRFB calculations based on CBO data.

Based on CBO's July projections and more recent economic data, we believe the output gap is on course to total between $300 and $900 billion in 2021, with our central estimate at just above $600 billion. The range of uncertainty is even wider over the three-year period, given tremendous uncertainty over how fast the economy will recover as people start to get vaccinated, but our midpoint estimate is roughly $1.4 trillion. Based on our central estimates, the Emergency Coronavirus Relief Act would boost economic output enough to close over a third of the output gap over the next three years, or nearly 85 percent of the output gap for 2021. The State and Local Support Act would close 10 percent of the output gap over three years, or around a quarter of the output gap for 2021. Combined the two bills would boost output equivalent to nearly half of the output gap over three years and more than the total output gap for 2021 under our central estimates.

Assuming our midpoint estimate for the economic boost and underlying GDP, the stimulus in the Emergency Coronavirus Relief Act would be enough to boost GDP by roughly 2 percent in 2021, and the state and local aid in the State and Local Support Act would be enough to increase output by 1 percent in 2021.

Our output gap figures are based on recent CBO projections, but there is reason to think the actual gap could be somewhat higher. We discuss our methodology in full at the bottom of our recent piece, Could a COVID Relief Deal Close the Output Gap?

So far, Congress has enacted the equivalent of $2.7 trillion of net COVID relief, most of which has already been spent (see more at www.COVIDMoneyTracker.org). This money has largely been spent and more support is needed. The Emergency Coronavirus Relief Act is appropriately targeted, of sufficient scale to have a noticeable impact on GDP, and will help close the current output gap. As mentioned, the bill contains contain around $75 billion in state and local aid, but given the high multiplier for this category of fiscal stimulus, passage of the State and Local Support Act will help boost output in the short-run. Combined, the two bills will boost output equivalent to fully closing the output gap for 2021.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.