A Visualization of the CARES Act

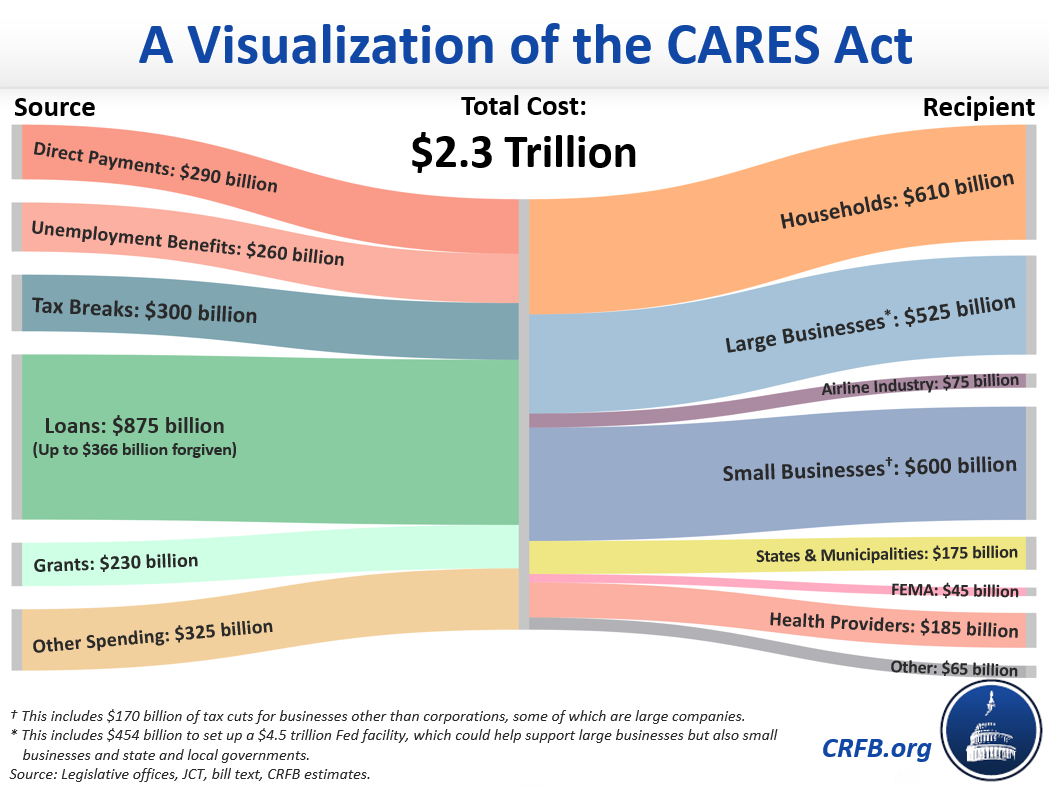

The President yesterday signed into law the CARES Act, a $2.3 trillion relief package aimed at ameliorating some of the effects of the economic slowdown and partial shutdown resulting from the coronavirus pandemic.

Much attention has been paid to the overall price tag, but the relief bill targets several very different groups. Households largely benefit from one-time direct payments and an expansion of safety net programs, while businesses will mostly benefit from tax breaks and federally-backed loans & grants. Other sectors of the economy, such as health providers and states, will receive federal support in the form of grants and additional funding to help tackle the current crisis.

We break down the sources and recipients of the $2.3 trillion stimulus below:

The visualization above is based on our understanding of the bill, which has not been formally scored yet by the Congressional Budget Office. Total deficit impact may differ from dollars allocated.

The CARES Act is certain to dramatically increase the deficit this year and have a substantial effect on our debt burden in the years to come. While the borrowing was necessary and appropriate given the public health and economic emergency, it will be crucial that such a vast amount of money is given proper scrutiny as these funds are disbursed.

Twitter

Twitter