Van Hollen Releases House Democratic FY 2016 Alternative

House Budget Committee Ranking Member Chris Van Hollen (D-MD) yesterday released the House Democratic alternative budget, which provides similar deficit reduction to the President's budget. The budget reduces deficits on net by just under $1.3 trillion compared to CBO's baseline, the majority of which comes from eliminating war spending after FY 2016.

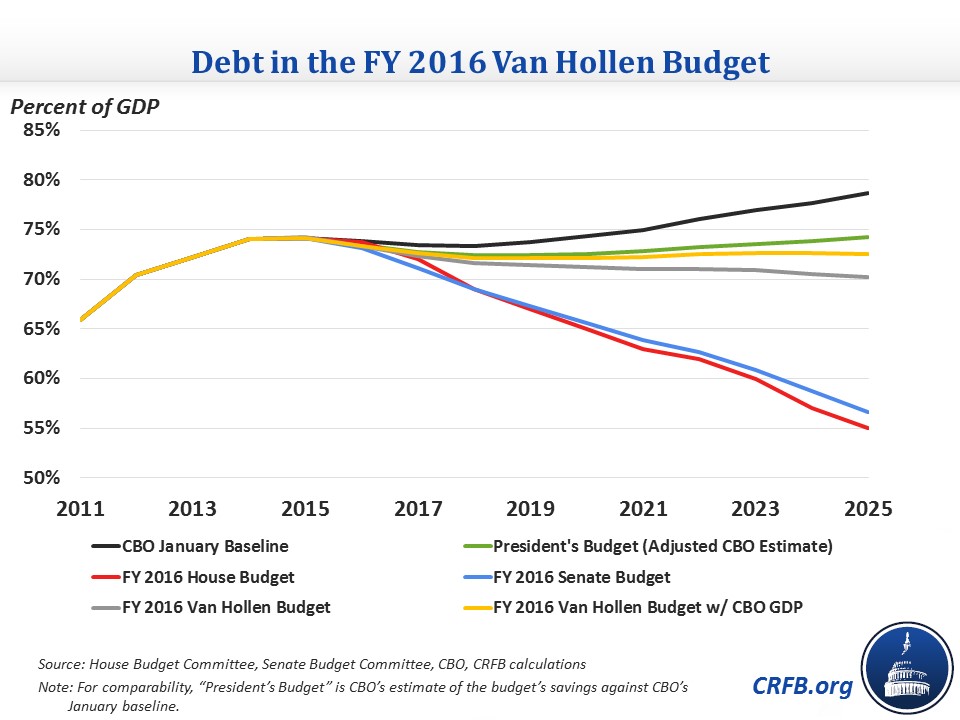

The budget would put debt on a downward path by its own numbers to 70 percent of GDP by 2025, down from 74 percent in 2015. However, it appears that the budget takes into account the economic benefits of immigration reform; using CBO's GDP numbers, debt would be on a stable (if not a slight upward) path at 72-73 percent in the latter part of the budget window.

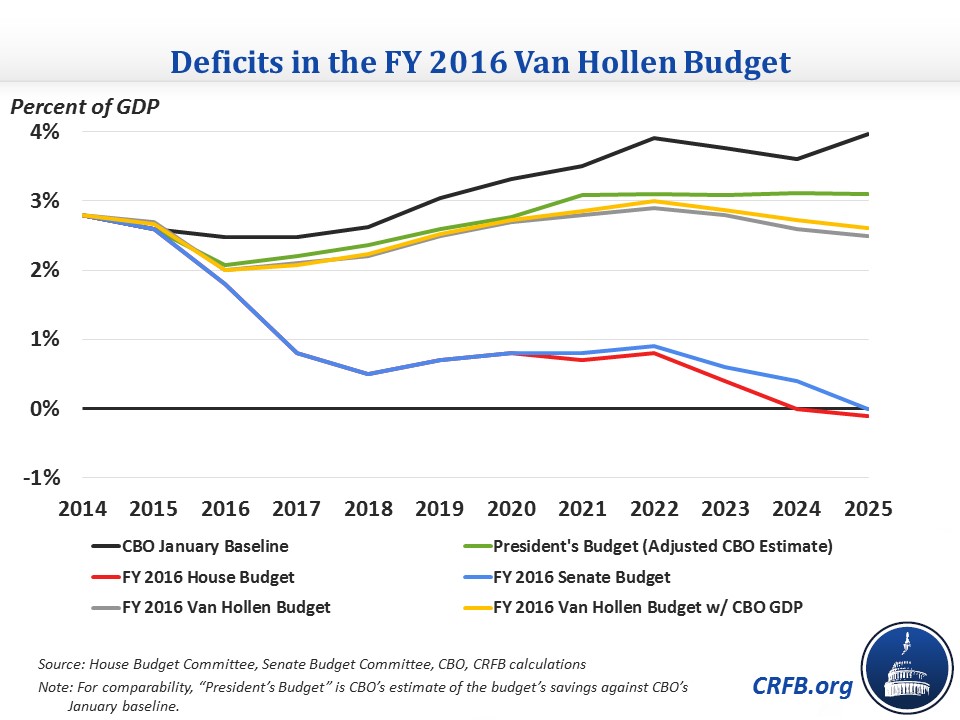

The budget causes the deficit to fall from 2.7 percent of GDP in 2015 to 2 percent in 2016, after which it grows somewhat but stays below 3 percent for the remainder of the budget window. The 2025 deficit of $717 billion (2.5 percent of GDP) is $84 billion lower than the deficit in the President's budget, entirely due to lower spending since the budget assumes the President's revenue level.

The Van Hollen budget does not specify all of its policy changes, but it provides some insight into how the savings are achieved. The budget supports the President's revenue levels but not necessarily the policies, expressing specific support for closing the carried interest and corporate jet loopholes, reducing incentives to shift income to low-tax countries, and limiting regressive tax breaks. It also supports expanding the Earned Income Tax Credit for childless workers and extending the refundable credit expansions that expire after 2017, while establishing a deficit-neutral reserve fund for middle-class tax cuts.

The budget matches the President's budget in terms of sequester relief, repealing the mandatory sequester entirely and providing significant upfront sequester relief that diminishes over time. It also includes $121 billion of Medicare savings, only about one-third of the President's budget, saying that the savings could be accomplished with the President's Part D drub rebate policy or by adopting measures recommended by various agencies to reduce overpayments and re-align provider incentives. Finally, the budget assumes the enactment of immigration reform which reduced deficits through 2025 by $175 billion in the President's budget.

The Van Hollen budget provides some improvement in the deficit situation, but it does not go far enough to ensure that debt would be on a clear downward path as a share of GDP.