Is Trump's Tax Cut the Largest Since Reagan?

During the first Presidential debate on September 26, Republican Presidential candidate Donald Trump said "my tax cut is the biggest since Ronald Reagan." While there are a few different ways to measure the revenue effect, we find this statement to be largely true.

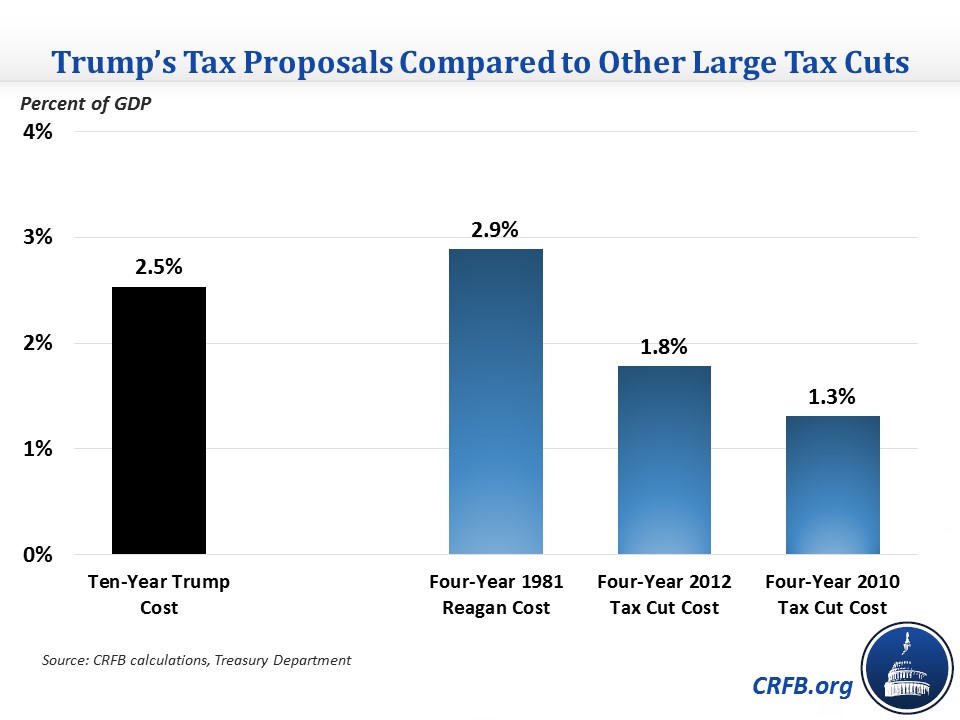

According to our recent estimates, Donald Trump's proposed tax changes -- from his tax and health plans -- would reduce revenue by $5.8 trillion over ten years, which is 2.5 percent of GDP over that time. Jerry Tempalski of the Treasury Department has compiled the revenue estimate made at the time of passage of every major tax bill going back to 1940, both in inflation-adjusted dollars and as a percent of GDP. As a percent of GDP, the ten-year cost of Trump's tax plan exceeds the four-year cost of every tax cut since the Economic Recovery Tax Act of 1981, the major tax cut passed in the first year of Ronald Reagan's Presidency that cost 2.9 percent of GDP over four years. The four-year cost, as a percent of GDP, of Trump's tax plans is likely similar or slightly less to the ten-year cost, so the statement likely holds true on an apples-to-apples basis as well.

The next largest tax cut since 1981 was the American Taxpayer Relief Act of 2012, which permanently extended most of the 2001/2003 tax cuts and cost 1.8 percent of GDP over four years. The other tax cut that cost more than 1 percent of GDP over four years was in 2010, which temporarily extended those tax cuts (among other things) for two years.

It's worth noting that President Reagan and Congress subsequently raised taxes in 1982, 1983, and 1984, at least partially in response to increasing deficits in the early 1980s.

Donald Trump is correct that his tax proposals would be the largest tax cut since Reagan, and they would be even larger than Reagan's when taking into account tax increases subsequently enacted during the 1980s. Thus, we find Trump's statement to be largely true.