There's a New Cap in Town

Yesterday, Rep. Connie Mack (R-FL) introduced deficit reduction legislation -- the One Percent Spending Reduction Act -- that is based on the "One Cent Solution." The proposal is a simple one: cut non-interest spending by one percent each year for six years starting in 2012. After that time period, spending would be capped at 18 percent of GDP (it would be 18.3 percent of GDP in 2017). Basically, one could think of it as an amped-up version of the Corker-McCaskill spending cap (which calls for capping all spending at 20.6 percent of GDP by the end of the decade), except that this proposal would provide a glide path down to 18 percent.

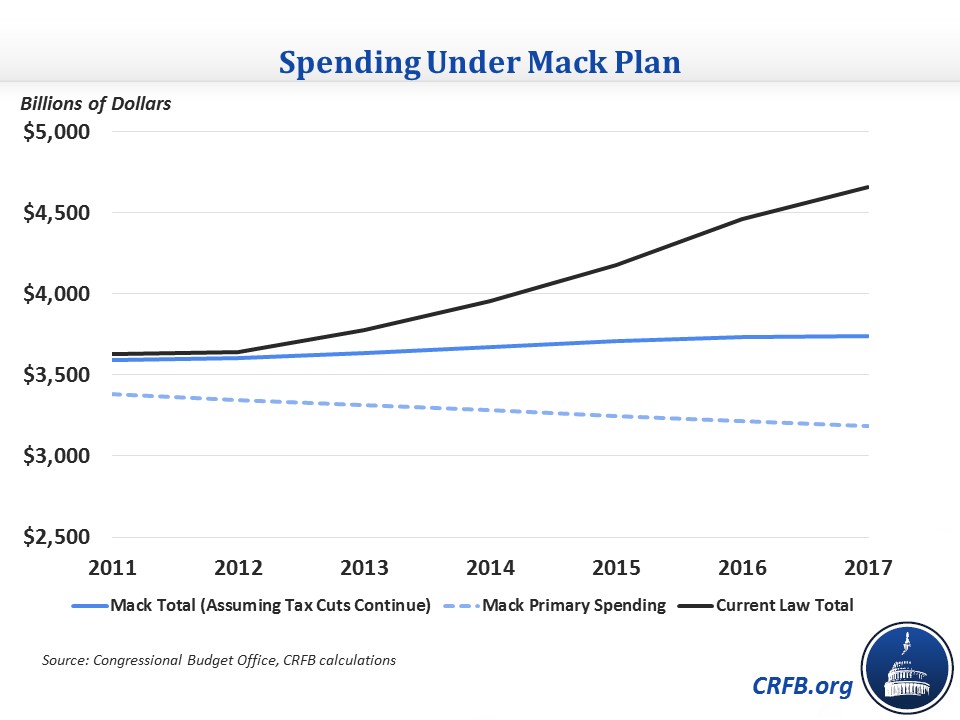

It should be noted that the One Cent Solution would cut nominal non-interest spending levels, not spending as a percent of GDP. Thus, from 2011 through 2017, non-interest spending would fall from $3.38 trillion to $3.18 trillion. Overall spending inches up from $3.59 trillion to $3.67 trillion, although this could vary based on the baseline revenue used, which affects spending on interest. If all of the 2001/2003 tax cuts were extended, spending would rise to $3.74 trillion by 2017.

Assuming that spending is exactly 18 percent of GDP from 2018-2021, the spending cuts from the proposal (even with all the tax cuts extended, which increases interest costs relative to current law) would be substantial: $7.5 trillion according to the One Cent Solution's website and $7.6 trillion relative to current law, according to our calculations. Mack also claims that the plan would balance the budget by 2019, which our estimates also seem to confirm.

The graph below shows what primary (non-interest) spending would be under the plan and what total spending would be if the tax cuts were extended. These numbers are compared with CBO's March 2011 current law numbers.

In addition, the One Cent Solution would come with a trigger that would make across-the-board spending cuts if the one percent reduction was not met. Thus, not only would spending be capped at 18 percent of GDP in 2018 and beyond, but the one percent reductions would also serve as overall spending caps. There are no more specifics provided about the sequestration, so the exact mechanics are not clear.

The critical challenge facing lawmakers is to agree to a bipartisan fiscal plan with broad support. Spending caps can be an essential element to controlling future deficits and in attracting bipartisan support (see the Fiscal Commission's plan) and will likely play a part in any final consensus between lawmakers. While Rep. Mack's proposal would certainly reduce deficits and debt, it's unclear if it would be able to garner bipartisan support.