The Tax Break-Down: Individual Retirement Accounts

This is the ninth post in our blog series, The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform. Last week, we wrote about accelerated depreciation, the largest corporate tax break.

Individual Retirement Accounts (IRAs), first created in 1975, allow people to make tax-deferred contributions into special accounts designated for retirement. Unlike 401(k)s or 403(b)s, IRAs are managed by the individual and not provided by nor tied to an employer. IRAs hold more than 25 percent of all retirement assets in the nation.

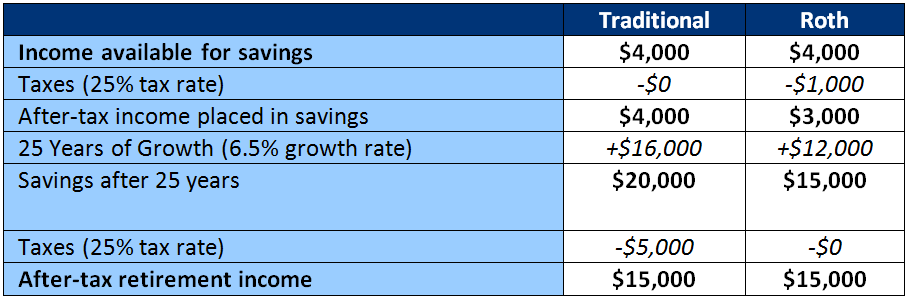

Absent preferential treatment, retirement contributions would be made with post-tax dollars, and then the interest, dividends, and capital gains would face further taxation. A traditional IRA allows contributions to effectively be paid with pre-tax dollars, with taxation of this contribution – along with any gains, dividends, or interest – deferred until the account-holder withdraws the funds at retirement.

In addition to traditional IRAs, most taxpayers since 1998 have had the option of contributing to a “Roth IRA,” named after its sponsor, former Sen. William Roth (R-DE). A Roth IRA works in reverse of a traditional IRA. Initial contributions are made with post-tax dollars, but then can be withdrawn tax-free. In theory, the tax benefit of the two accounts are equivalent if a taxpayer is in the same tax bracket throughout their life, though taxpayers can choose between plans (and convert between them in certain circumstances) to minimize their tax burden.

In addition to traditional and Roth IRAs, a host of smaller IRA options, including SEP, SIMPLE, and “deemed” IRAs, are available to small employers. Each of these accounts has its own set of rules and restrictions.

*This amount is indexed for inflation. The amount is for 2013. For Roth IRAs, an individual above the income limits cannot make any contributions. For traditional IRAs, an individual above the income limits can still make contributions, but they are not tax-deductible if the person also has access to an employer-sponsored plan.

How Much Does It Cost?

According to the Joint Committee on Taxation (JCT), all types of IRAs together will cost $15 billion in lost income tax revenue in 2013, or more than $250 billion over 10 years. OMB provides a similar estimate at $16 billion per year.

This benefit is smaller than many of the other large preferences for retirement savings. The tax exclusions for Social Security benefits and defined benefit plans each cost about twice as much at $33 billion in 2013. The exclusion for defined contribution plans, like 401(k)s, costs almost four times as much at $57 billion in 2013.

Importantly, repealing IRAs would result in far less revenue than JCT’s estimate of the tax expenditure cost – particularly in the short and medium run – perhaps only one-fifth as much in the first decade. In fact, eliminating Roth IRAs could actually reduce short-run revenue since those products encourage taxpayers to pay taxes in advance which could be deferred to future years.

Who Does It Affect?

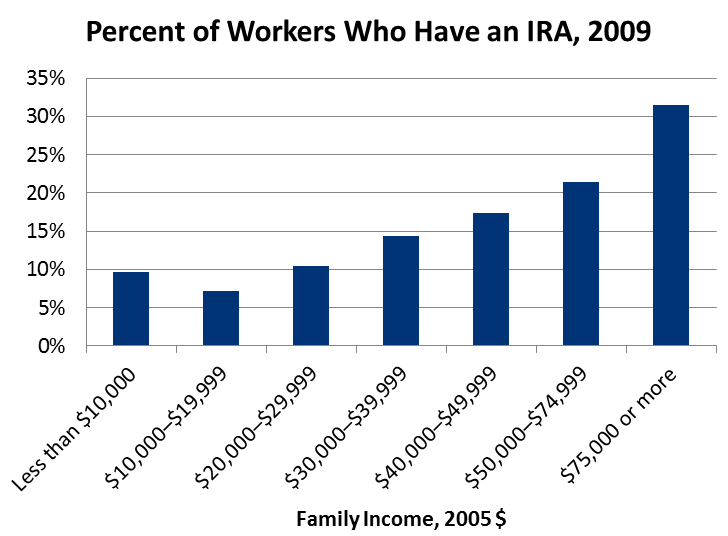

According to the Employee Benefit Research Institute, 16.6 million individuals have over $1.4 trillion invested in IRAs. Benefits are concentrated among a relatively small group of people; in 2009, only 5 percent of workers made a contribution to an IRA. Higher-income workers are more likely to have IRAs: over 30 percent of workers with family incomes above $75,000 have an IRA, compared with less than 10 percent for families making under $10,000. Of those who contributed to IRAs, over one-fifth contributed the maximum amount.

Source: Employee Benefit Research Institute

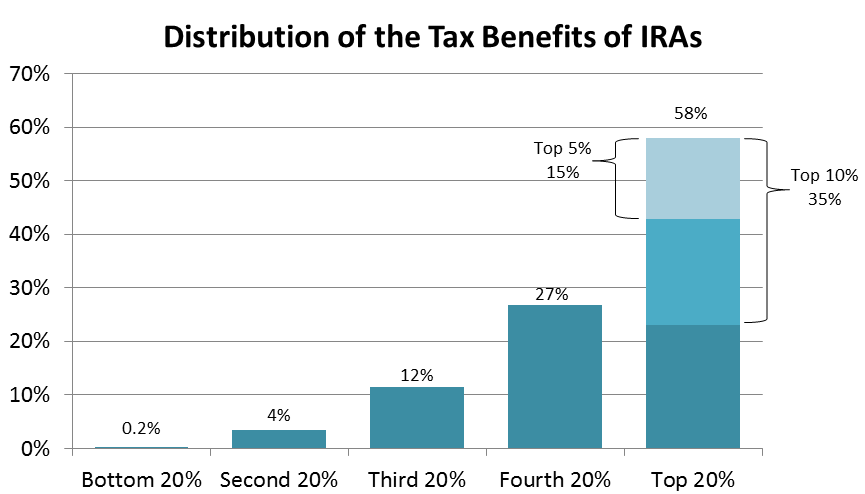

IRAs provide greater benefits to individuals at higher income levels who are able to save more, and individuals who are more tax-savvy and able to calculate the long-term benefit of deferred taxation. Also, the choice between Roth and traditional IRAs provides the most benefit to individuals with a large spread in tax rates between the beginning and end of their careers. In 2004, the Tax Policy Center estimated that roughly 60 percent of IRA tax benefits accrued to the top 20 percent of households, and that more than 85 percent of benefits accrue to the top 40 percent of households.

Source: Tax Policy Center

What are the Arguments For and Against Individual Retirement Accounts?

Proponents argue that IRAs are a critical part of retirement savings, which are still far lower than financial firms recommend. Private assets built up in accounts like IRAs form the foundation for retirement savings, along with Social Security and employer-sponsored plans. In addition, providing tax-free treatment of IRAs prevents a tax on savings. Many proponents of this argument would shift further to a consumption tax and exempt all savings from taxation.

Opponents point out that, while encouraging retirement savings is a laudable goal, current retirement incentives are poorly targeted and yield limited returns. They are a vehicle for wealthy individuals to convert a substantial share of their taxable assets into tax-free retirement assets. Further, opponents point to studies that find little evidence that IRAs increase saving; the only people that pay attention to tax benefits are those that would save anyway. Finally, they point to an analysis that ending Roth accounts would increase national saving, because any individual with an IRA and tax-preferred debt (such as a mortgage) is participating in a “shell game” and gets a tax-free windfall from the government.

What Have Other Plans Done and What Are the Options For Reform?

Many tax reform plans would consolidate the various types of retirement accounts. The Simpson-Bowles and Domenici-Rivlin plans contained the same model, limiting contributions to $20,000 or 20 percent of income. Wyden-Gregg would create one larger “Lifetime Savings Account,” nearly tripling the yearly contribution limit to $14,000. The consolidated account offered by President Bush's 2005 Tax Reform Panel offered a number of features to increase retirement savings: automatic enrollment and a savings percentage that increased for workers nearing retirement. The Center for American Progress would also consolidate accounts.

The New America Foundation would abolish all currently tax-favored retirement accounts, replacing them with one that offered automatic enrollment, and expand Social Security benefits. Both AARP and the Center for American Progress would replace the tax break with a refundable tax credit that was deposited directly in the retirement account.

The Heritage Foundation and the American Enterprise Institute would remove all taxes on savings, making IRAs unnecessary.

A number of smaller options are available to reform IRAs without repealing or dramatically reforming them. Yearly contribution limits could be decreased, or the value of deductions could be limited to 28 percent as proposed in the President’s Budget. Another option is to require inherited IRAs to be paid out within 5 years, which would prevent the tax benefits from being extended for decades by being passed to a very young beneficiary.

Options also exist to expand the tax preferences around IRAs. The minimum distribution requirements, which are designed to limit tax planning by large estates, could be eliminated for small accounts. The President has also proposed creating automatic IRAs, which would allow employees to contribute to IRAs through payroll deductions. Employees would contribute by default, but they could opt-out or change their contribution amount.

In a future post about other retirement vehicles, we will present further reform options along with budgetary estimates where available.

Where Can I Read More?

- Congressional Budget Office – Individual Retirement Accounts

- Employee Benefit Research Institute – Individual Retirement Account Balances, Contributions, and Rollovers, 2011

- The Hamilton Project – Better Ways to Promote Saving Through the Tax System

- AARP – New Ways To Promote Retirement Savings

- The Urban Institute – Why Not a “Super Simple” Savings Plan for the United States?

- AARP – The Case for Automatic Enrollment in Retirement Accounts

- Calvin Johnson – Repeal Roth Retirement Plans to Increase National Saving

- Joint Committee on Taxation – Present Law and Analysis Relating to Individual Retirement Arrangements

* * * * *

Individual Retirement Accounts have been a major part of some American’s retirement planning since 1975, especially for those who are not offered employer-sponsored retirement plans. Yet these accounts are only used by 5 percent of workers and the benefit accrues largely to the wealthiest taxpayers. Although many taxpayers have substantial assets built up in retirement accounts, studies indicate many of these taxpayers would have saved anyway, suggesting that the tax break is providing an unnecessary subsidy. Many tax reform plans have offered suggestions to consolidate accounts, incorporating features that would incentivize better retirement habits for a broader portion of the population, like auto-enrollment plans and contributions that grow as workers near retirement. Tax reform offers an opportunity to simplify retirement provisions, improve saving incentives, and raise revenue to reduce tax rates, reduce the deficit, or both.

Read more posts in The Tax Break-Down here.