State and Local Governments Do Not Need Half a Trillion in COVID Relief

The American Rescue Plan currently making its way through Congress contains over $500 billion of aid to state and local governments.

A number of analysts and commentators have questioned the need for this much additional aid. While the economic downturn did take a toll on state and local revenue collections, that revenue decline has largely recovered on average — with some states doing better than others — and losses to date have mostly been covered by the $360 billion of federal aid to state and local entities enacted so far.

While more aid may indeed be needed, especially for the hardest hit state and local governments, it is not clear that assistance needs to be as large as what is currently under consideration.

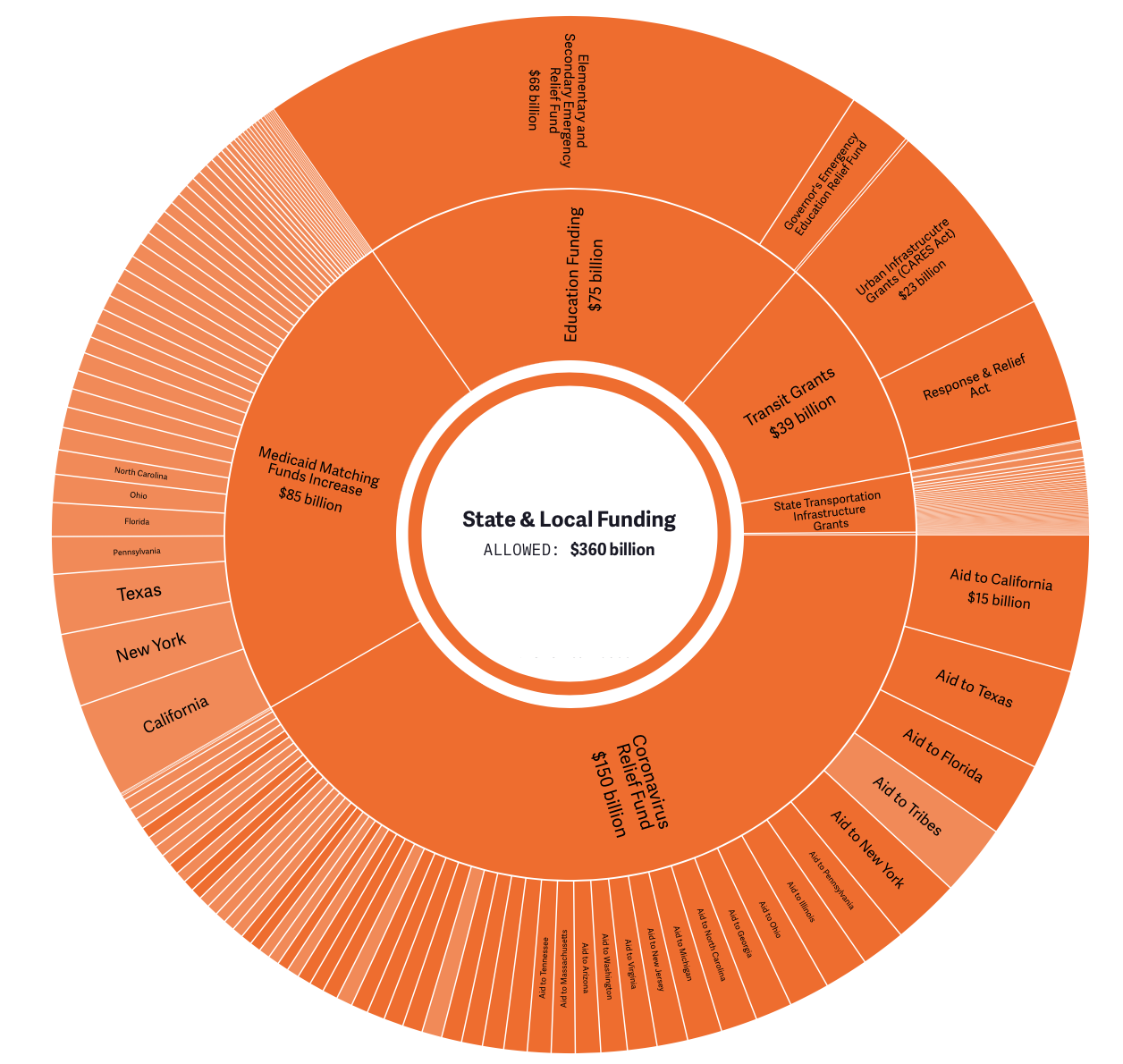

The Federal Government Has Already Enacted More than $360 Billion of Aid

The $4.1 trillion (with a $3.4 trillion net cost) of COVID relief funds enacted so far includes hundreds of billions of dollars for state and local governments.

By our count, the Families First Act, the CARES Act, and the Response & Relief Act allocated more than $360 billion to state and local governments through higher Medicaid matching percentages, the Coronavirus Relief Fund, public school funding, and aid to transit authorities. More than $300 billion of those funds has already been committed, and at least $235 billion has been disbursed.

Source: COVIDMoneyTracker.org

This $360 billion figure should be considered a low-end estimate. It excludes between $150 billion to $200 billion allocated to state and local governments to cover disaster costs, community development, housing, health preparedness, vaccine administration, reimbursement of certain prior-law unemployment benefit costs, funding for public colleges and hospitals, and other similar spending. It also excludes $6.6 billion of loans to the State of Illinois ($3.2 billion) and New York's Metropolitan Transit Authority ($3.4 billion) issued by the Federal Reserve and supported by Treasury dollars. While a majority of these funds are for specific purposes and are not aid, the money is fungible and therefore portions of it could effectively serve as aid on top of our $360 billion estimate.

Our estimate also excludes the indirect effects of COVID relief on state finances. The $585 billion of unemployment benefits, $460 billion of rebate checks, and the nearly $2.5 trillion Gross Domestic Product (GDP) boost as a result of last year’s COVID relief bills substantially increased income and spending subject to state and local taxes. All told, state and local governments are more than half a trillion dollars better off as a result of the COVID relief legislation enacted so far.

On Average, State and Local Revenue Has Mostly Recovered

Early in the pandemic, state and local governments appeared to be in danger of losing hundreds of billions of dollars — or by some estimates upwards of $1 trillion — in revenue. This worst-case scenario has thankfully been avoided, due in large part to the robust federal response and a relatively strong but uneven partial economic recovery. While some state and local governments are still hurting, others are doing quite well and hardly any are doing as badly as feared.

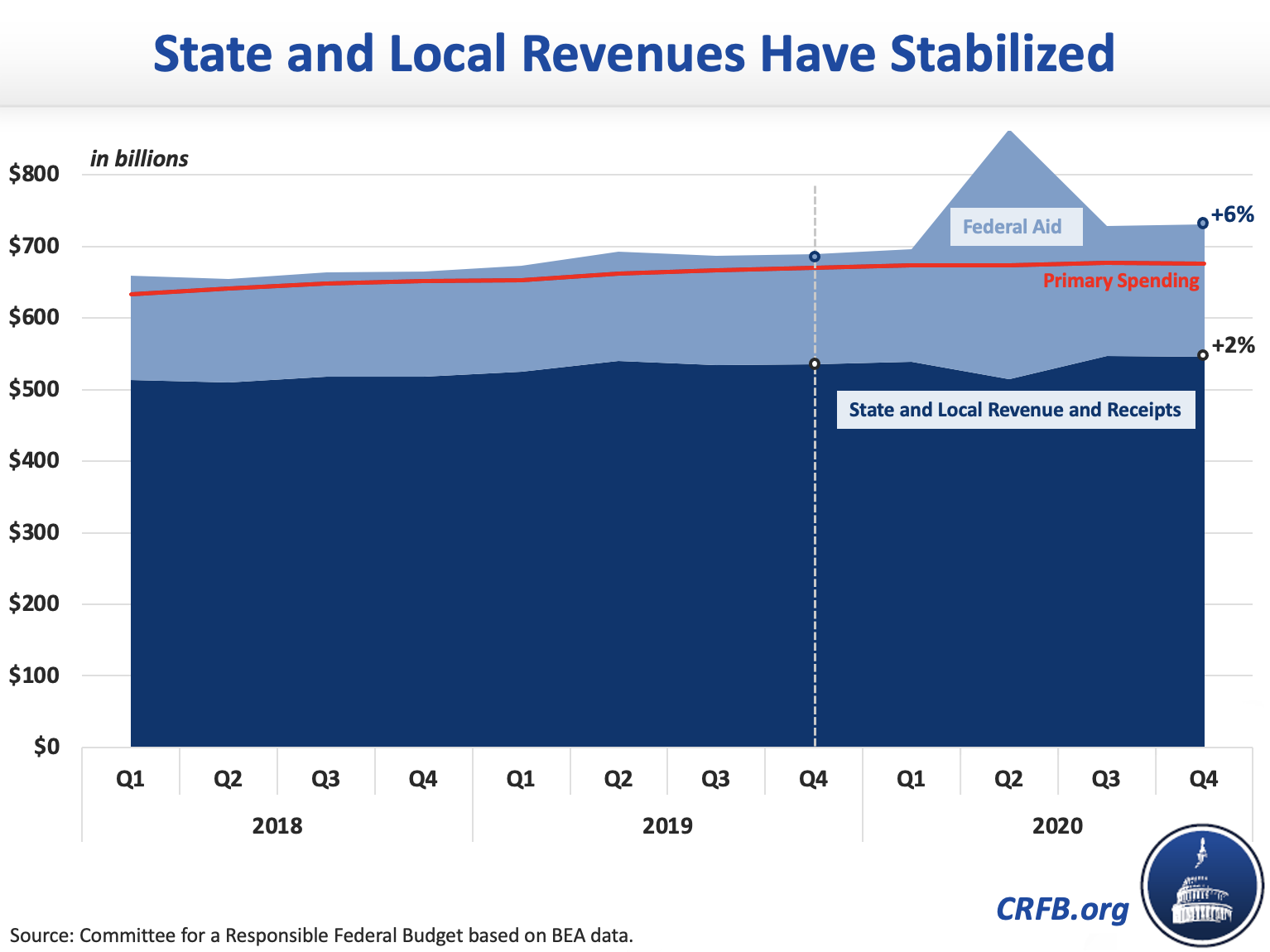

While no complete estimates of state and local revenue exist, data from the Bureau of Economic Analysis (BEA) can help shed some light on state and local finances (the Urban Institute also has a fantastic dataset for state revenues). Importantly, BEA's numbers for state and local revenue and expenditures are preliminary, are considered very rough, and are subject to significant uncertainty, so should be viewed with a wide error band. Nevertheless, they can help provide broad indications on the fiscal health of state and local finances.

Based on BEA's data, state and local tax collections fell by almost 5 percent in the second quarter of 2020 relative to the second quarter of 2019. Total revenue from April to December 2020, however, was roughly flat relative to 2019. Notably, revenue by the end of 2020 was up over 2 percent relative to the final quarter of 2019 (other estimates have been relatively similar).1

At 2019 levels or even 2 percent above it, average revenue would still be significantly below trend — with some state and local governments in far worse shape than others. However, this level of revenue loss is no where near as bad as the 9 percent reduction that state and local treasuries experienced between mid-2008 and mid-2009.

Inclusive of federal aid, state and local governments actually had higher average receipts in 2020 than 2019. We estimate total state and local receipts were 10 percent higher in 2020 than 2019, including 6 percent higher on a fourth-quarter-to-fourth-quarter basis. Meanwhile, spending remained relatively stable, rising by 2 percent on a year-over-year basis and 1 percent higher on a fourth-quarter-to-fourth-quarter basis, suggesting COVID-related costs have not surged net spending needs (though COVID-related needs may have crowded out other important priorities, contributing to layoffs at the state and local level).

Of course, these averages mask the huge disparity between states. Some state and local governments are doing better than others. Over the final three quarters of 2020, the Urban Institute estimates that 26 state governments saw general revenue declines while 21 states saw revenue gains (three were missing data). There are likely similar disparities at the local level.

States facing the largest revenue losses include Alaska, Hawaii, North Dakota, Texas, and Florida — with losses driven by the crash in oil prices, low tourism, and other state-specific factors. While the data show large losses in Oregon, this appears to be due to a one-time "kicker" rebate that refunds past surpluses and is unrelated to the current crisis. Meanwhile, a number of states such as Idaho, Utah, Colorado, and South Dakota have experienced large revenue gains over the course of the pandemic. Though its revenue was flat in 2020, California is now facing a $25 billion surplus (originally $15 billion, with $10 billion more) thanks in part to a windfall from capital gains tax collections.

These revenue estimates likely overstate structural losses and understate gains, since revenue has risen since the earliest parts of the pandemic when "shelter in place" and similar rules were in effect. The estimates also exclude federal aid to state and local governments.

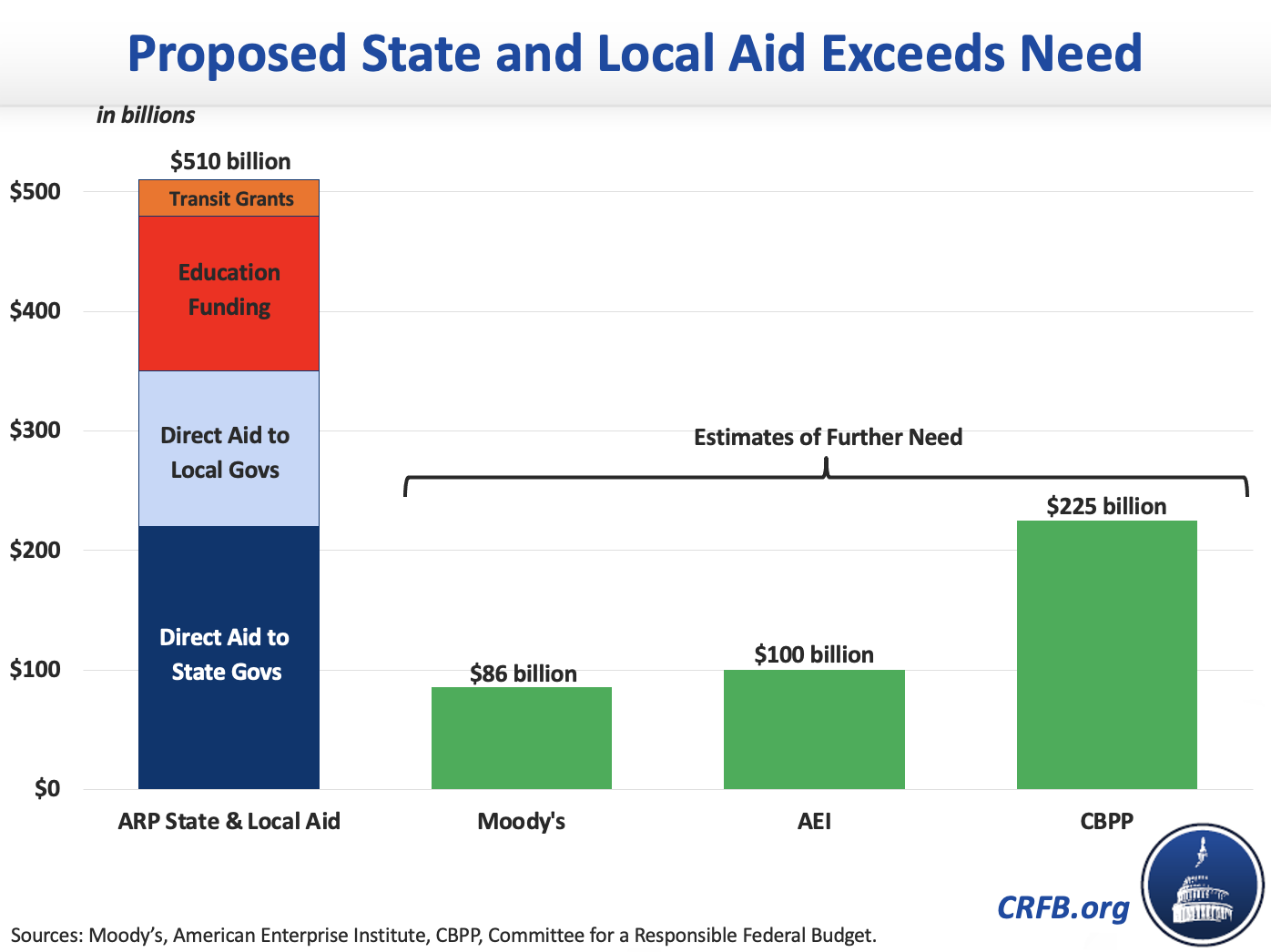

Even with many state and local governments still struggling, the overall outlook is much less dire than previously believed. For example, Moody’s Analytics recently estimated that an additional $86 billion of aid is needed to cover revenue losses, while a number of experts at the American Enterprise Institute (AEI) have argued an additional $100 billion of aid is warranted. Even the Center on Budget and Policy Priorities (CBPP), which has been a strong advocate of large state and local aid, estimates $225 billion of net revenue shortfalls (each of these estimates assume states will use their rainy day funds). Importantly, these are net figures — and there is no easy way to use surpluses from healthy states to cover deficits in struggling localities. On the other hand, if additional fiscal stimulus and ongoing vaccinations lead to a full recovery by the end of 2021, needs could prove even lower.

The American Rescue Plan Would Pay Huge Windfalls

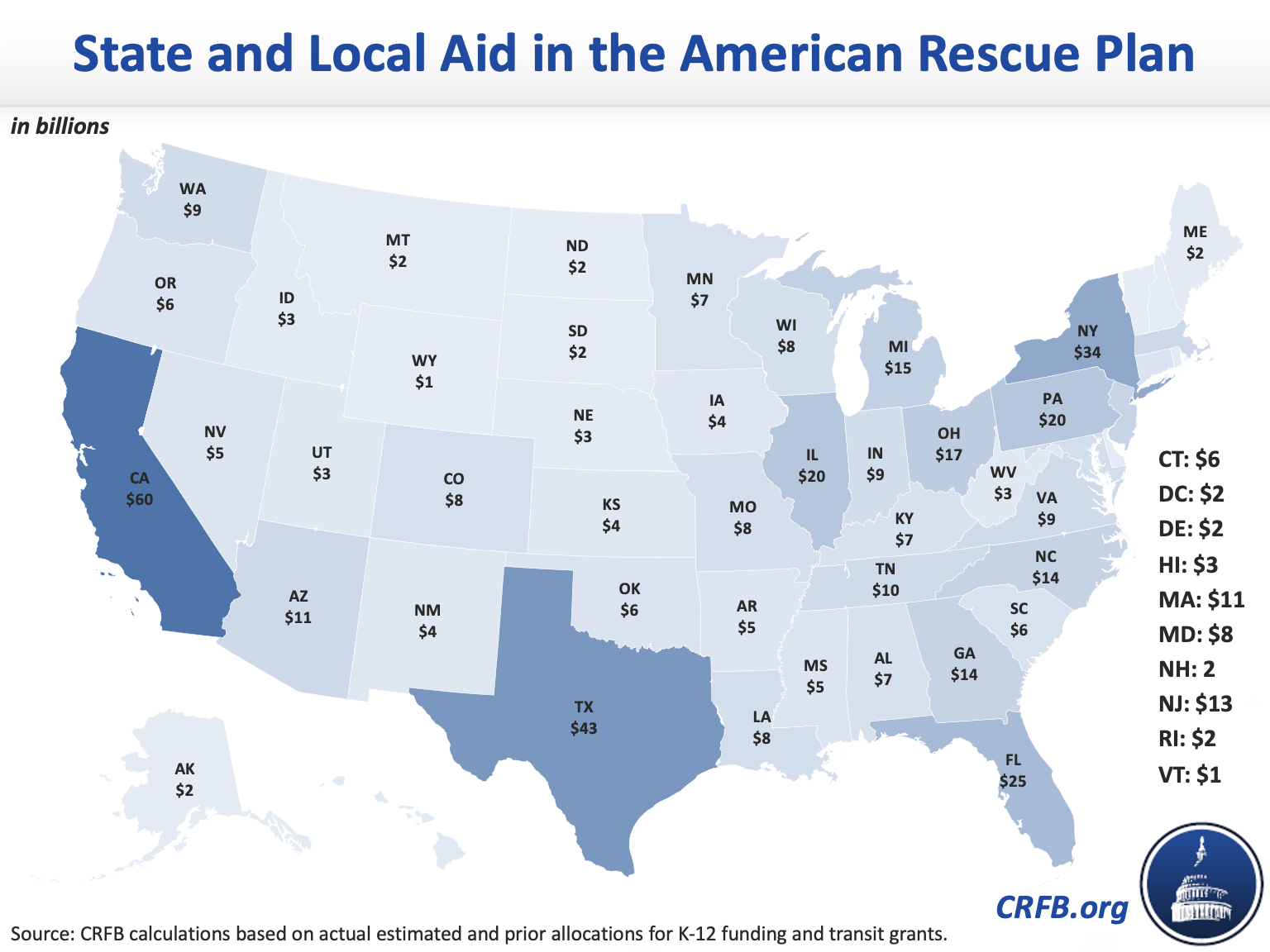

The American Rescue Plan would provide over $500 billion of aid to state and local governments (including the District of Columbia, tribes, and territories), including $350 billion of direct aid — $220 billion to state governments and $130 billion to local governments, nearly $130 billion for public schools, and $30 billion to transit authorities (as contained in the reconciliation package currently before Congress). These figures are a low estimate, since they don’t count other types of funding funneled to state and local governments, nor the indirect benefits of higher (taxable) unemployment benefits, checks, and other fiscal support.

Much of this money would go to state and local governments with little or no need. For example, despite its surpluses we estimate California governments would receive $60 billion, including $26 billion at the state level. Similarly, we estimate Idaho, which is forecasting a record budget surplus of $600 million would receive around $3 billion, almost 50 percent of which would be allocated at the state level.

Even states clearly in need may end up more than covering their losses. Florida, which is facing a $3.3 billion revenue shortfall spanning two fiscal years would receive $25 billion of federal aid, including over $10 billion at the state level, and Illinois’ roughly $3 billion deficit would be more than matched by around $20 billion of federal aid, including around $7 billion at the state level.

Policymakers Should Right-Size State and Local Aid

Many state and local governments continue to suffer financially as a result of the COVID-19 pandemic and economic crisis. Additional aid would be wise, not only to support these states, but to prevent and help reverse the type of large-scale state and local layoffs that prolonged the last recession. The size of this aid may need to be larger than aggregate estimates of need, since gross needs exceed net needs and it may be impossible to target spending as precisely as would be desirable.

However, there appears to be little justification for issuing more than half a trillion of aid, on top of the $360 billion already offered. These excessive funds will unnecessarily add to the federal debt or crowd out other priorities (such as continuing emergency unemployment benefits beyond August). They could also lead many states to enact damaging tax cuts or spending programs that ultimately undermine their long-term finances.

It would be therefore be wise for Congress to scale back the size of its state and local aid, or issue it over time conditioned on state and local needs. In our Break the Glass plan, we proposed a two-sided trigger which would increase the federal Medicaid match for states when they face low rates of employment, while reducing the match when state economies are booming. A proposal like this would assure states receive the support they need, without paying windfalls that ultimately weaken state and federal finances over the long term.

1 Our estimates of 2020 collection are based on Bureau of Economic Analysis (BEA) data, which is rough and subject to revision. BEA data for the fourth quarter of 2020 excludes corporate tax collections, but this represents a relatively small portion of state tax receipts — we assumed corporate tax collections similar to the fourth quarter of 2019.