Social Security, Medicare, & Interest Drive 3/4 of Spending Growth

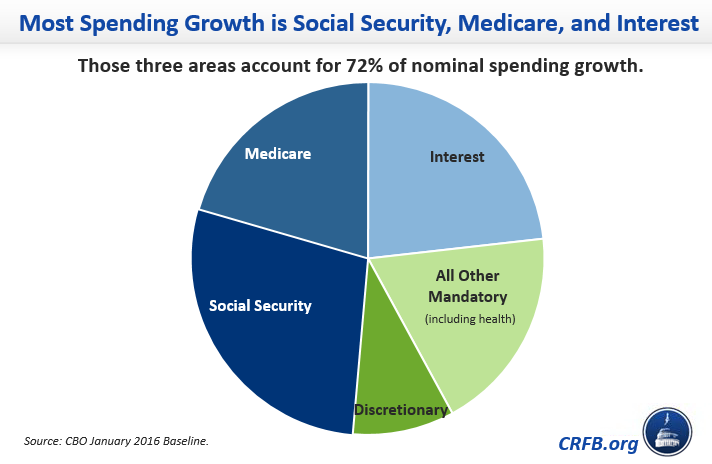

The deficit will grow from less than $550 billion in 2016 to $1.4 trillion in 2026, according to this week's report by the Congressional Budget Office (CBO), driven by a $2.5 trillion rise in spending that is only partially offset by a $1.7 trillion revenue increase. And according to CBO, nearly three-quarters of that spending increase comes from just three items – Social Security, Medicare, and interest on the debt.

CBO projects that Social Security spending will increase by about $700 billion over the next 10 years, while Medicare spending will increase by about $500 billion over the same period. These two programs account for 50 percent of the spending increase. Meanwhile, interest spending will rise nearly $600 billion over the decade – accounting for another quarter of the spending increase.

Although CBO does not quantify it in its latest report, non-Medicare health spending (for example, Medicaid spending) will likely rise by an additional $300 billion. That means that all other spending – on defense, education, farm subsidies, foreign aid, federal employment, infrastructure, welfare and unemployment benefits, homeland security, and the like – is responsible for only about one-sixth of the total projected spending increases.

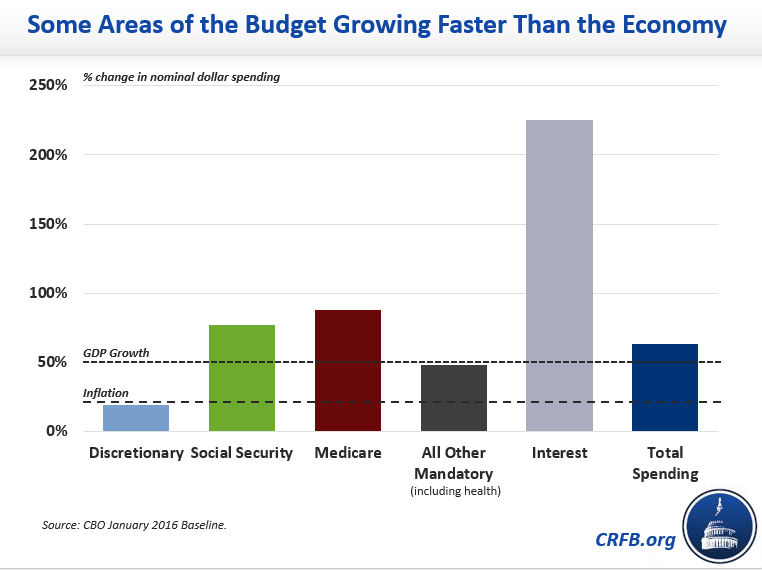

The reason for this is quite simple. Entitlement programs and interest spending are, together, the largest and fastest growing items in the budget, growing much faster than the economy. Social Security – the largest single program – will grow by over three-quarters in the next decade. Medicare spending will grow by nearly 90 percent. And interest on the debt will grow in size by a whopping 225 percent. By comparison, all other mandatory spending – including non-Medicare health spending – will grow by about 50 percent, which is roughly the same rate that the economy is expected to grow. The discretionary spending portion is projected to grow by less than 20 percent, a bit slower than inflation.

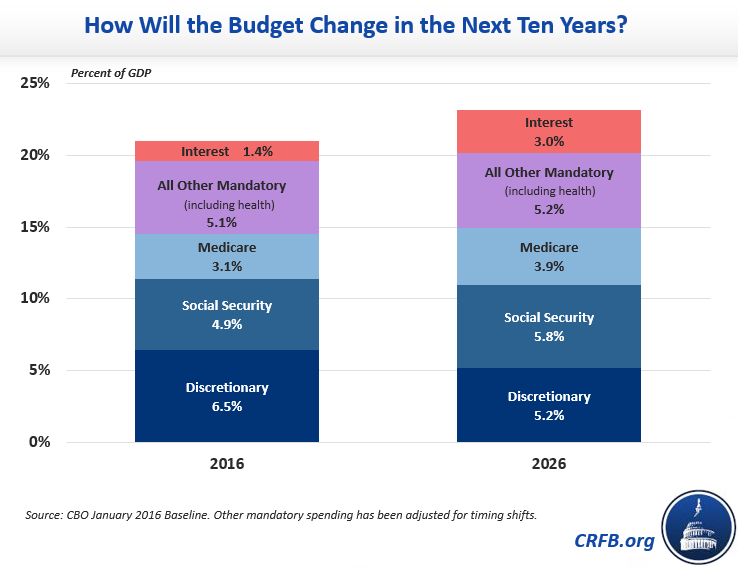

Another and sometimes more helpful metric to understand changes in the size of spending programs is the growth of a spending program relative to the economy. For example, discretionary spending as a percentage of Gross Domestic Product (GDP) will actually shrink by 1.3 percent points over the next decade to the lowest amount in at least 50 years. On the other hand, Social Security and Medicare spending will increase by 0.9 and 0.8 percentage points of GDP, respectively, for a total growth of 1.7 percentage points, which more than makes up for the decrease in discretionary spending. Likewise, interest spending will more than double as a share of GDP, from 1.4 percent to 3 percent. All things considered, CBO projects total spending to increase by 1.9 percentage points, reaching 23.1 percent of GDP by 2026.

Although spending increases are not the sole driver of the deficit's growth over the next decade, the budget is increasingly being taken up by mandatory programs. Lawmakers need to take a serious look at entitlement spending programs as well as tax reform options in order to return us to a fiscally responsible path.