Sanders's Paid Family Leave Plan, Explained

Government-Paid Family and Medical Leave

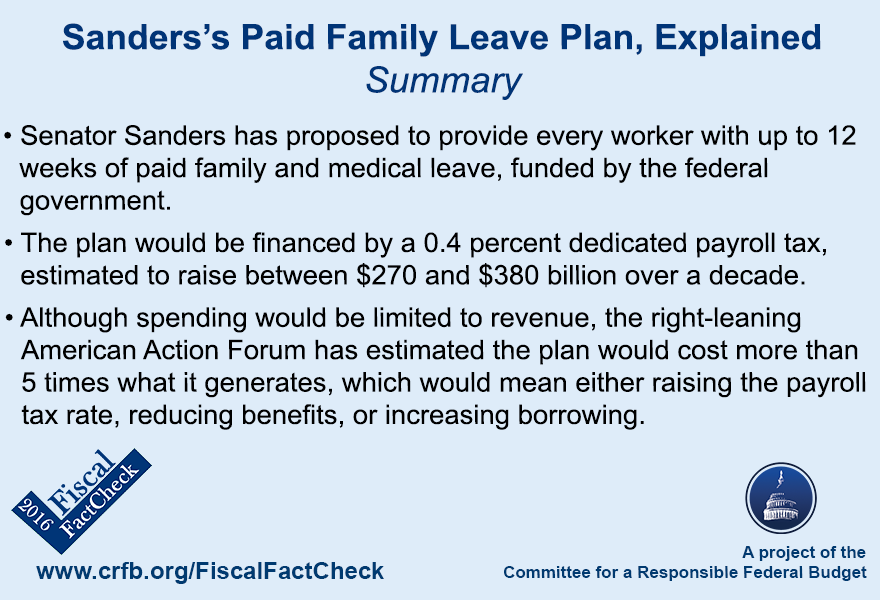

Sen. Sanders would provide every worker 12 weeks of annual paid family and medical leave at 66 percent of their monthly wages, capped at $4,000 per month. This policy is based upon the Family and Medical Insurance Leave (FAMILY) Act (a bill Sen. Sanders has co-sponsored) and is an extension of current law that guarantees 12 weeks of unpaid family and medical leave only if the worker has been employed for at least a year and the employer has 50 or more workers. Under Sen. Sanders’s plan, every worker would have the option of leave regardless of the size of their employer or how long they’ve been employed. A worker could use this leave to care for a baby, help a family member who is sick, or care for themselves if they become sick.

The plan would be paid for with a new 0.4 percent payroll tax split evenly between employers and employees or paid in full by the self-employed. This is similar to how payroll taxes are administered today. Contributions would be kept in an independent trust fund within Social Security called the Family and Medical Leave Insurance Trust Fund.

The deficit impact of this plan could range from zero to several hundred billion, depending on several factors. The cost of the plan would depend mostly on how many workers use it and for how long. The plan guarantees replacing benefits of at least $580 per month and at most $4,000 per month.

The Sanders campaign estimates the plan would raise $319 billion over ten years and implies it would spend a similar amount. Their revenue estimates are similar but not identical to those of the Tax Policy Center, Tax Foundation, and American Action Forum (AAF), who estimate the new payroll tax would collect $272 billion, $382 billion, and $306 billion, respectively. (Coincidentally, the average of those three estimates is almost exactly equal to the Sanders campaign estimate.)

At least one outside group believes the cost of paid family leave would significantly exceed revenue collection. The right-leaning AAF estimates the FAMILY Act would, on the low end, cost nearly $160 billion per year while raising only $30 billion in revenue. Over ten years, that would imply a $1.3 trillion deficit increase. And AAF argues that costs would actually be higher as a result of greater uptake – if all workers took paid family leave, they estimate it would cost about $1 trillion per year. However, even if the potential costs did outnumber the revenue, the deficit impact could be zero if benefits are restricted to revenues collected.

| New Spending | New Revenue | Deficit Impact | |

| Sanders Campaign | ~$320 billion | $319 billion | deficit neutral |

| American Action Forum | $1,596 billion* | $306 billion | $1.3 trillion* |

| Tax Foundation | n/a | $382 billion | n/a |

| Tax Policy Center | n/a | $272 billion | n/a |

*This represents a “lower bound” estimate. AAF assumes actual costs will be somewhat higher.

Employer-Provided Paid Sick and Vacation Leave

Sen. Sanders would also require employers to provide workers up to seven paid sick days per year to care for their own medical needs, care for a family member (including a domestic partner of the domestic partner’s parent or child), or seek help from domestic violence, sexual assault, or stalking for themselves or a relative. This proposal is also based on the Healthy Families Act, which Sen. Sanders has co-sponsored. Employees would earn an hour of paid sick time for every 30 hours worked as long as they work 20 or more weeks in a year at an employer with 15 or more employees. This would amount to 56 hours, or seven days, of paid leave per year. Employers would also be allowed to request documentation when an employee takes leave for more than three consecutive days. If an employer prevents employees from taking their earned time, they could be faced with civil actions for damages or equitable relief. Because the burden is being placed on employers, and not the federal government, to cover the cost of this bill this plan is not expected to have a large federal fiscal impact. In 2007, the late Sen.Ted Kennedy (D-MA) proposed a similar bill that the Congressional Budget Office estimated would cost the federal government between $30 and $40 million over ten years.

Finally, Sen. Sanders would also require employers to offer employees ten vacation days each year. The plan would apply only to employers who have 15 or more employees, and the benefit would be available only to those who have been with an employer for at least one year. Like the paid sick leave policy, the federal fiscal impact of this proposal would be negligible because this bill requires employers, not the government, to pay benefits, and federal employees are already eligible for paid vacation. This proposal is based on a bill Sen. Sanders has introduced, the Guaranteed Paid Vacation Act.

Other Proposals

Sen. Sanders’s opponent, former Secretary of State Hillary Clinton, also supports paid family and medical leave. Her plan would provide 12 weeks of paid family and medical leave and a minimum two-thirds wage replacement rate for workers using leave. Rather than financing the plan through a payroll tax and employer mandate as Sen. Sanders does, Sec. Clinton has said she would “ensure that the plan is fully paid for by a combination of tax reforms impacting the most fortunate.” We’ve written about several high income taxes Sec. Clinton has proposed so far, including a 30 percent minimum tax (Buffett Rule), a surtax on incomes over $5 million, and a higher estate tax, together raising $406 billion.