A Roundup of Our Analysis on the Fiscal Cliff Package

Over the past week, CRFB has examined the composition, budgetary effects, and economic effects of the American Taxpayer Relief Act (ATRA), which replaced most of the fiscal cliff.

While ATRA represents a tremendous missed opportunity to replace the fiscal cliff with a gradual and intelligent plan to put the debt on a clear downward path relative to the economy, the package will nonetheless have a notable impact on the budget in the medium and long term. Our analysis of the plan was meant to answer a number of important questions, summarized below.

What Was in the Fiscal Cliff Deal?

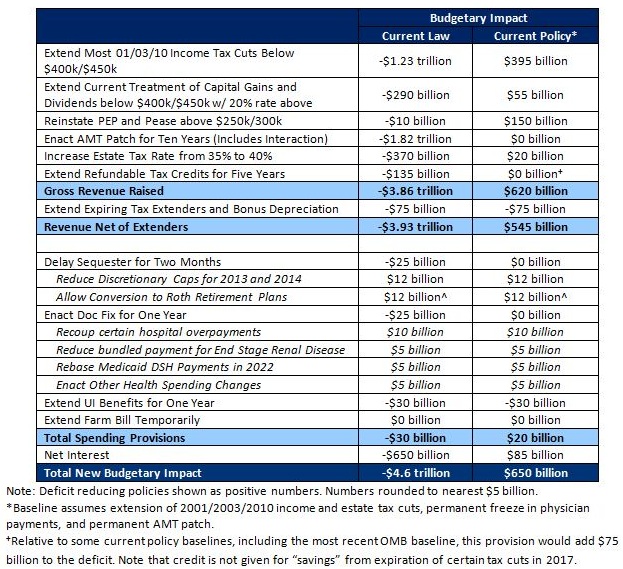

In The Good, the Bad, and the Ugly in the Fiscal Cliff Package, we show what there is to like and dislike in the fiscal cliff agreement, as well as our estimates of the package broken down into its various components. The bill avoids most of the economic harm of the fiscal cliff, raises $620 billion in revenue compared to current policy, and leaves in place an opportunity for lawmakers to discuss debt reduction further in negotiations to avoid sequestration in March. However, the bill did not address larger reforms to either the tax code or entitlement programs and falls short of what is needed to stabilize the debt and put it on a downward path as a shared of the economy -- the bare minimum of what is needed. We pointed out last week that kicking the can is a common trend in recent years when lawmakers have had an opportunity to enact a big deal. Instead, they have often passed legislation that has increased deficits dramatically or only had minor savings.

We estimated that including interest, the package would increase deficits by $4.6 trillion relative to current law (all the fiscal cliff policies take effect) and reduce deficits by $650 billion relative to current policy (most of the fiscal cliff policies do not take effect). ATRA extended most of the 2001/2003/2010 tax cuts for those below $400k for individuals and $450k for households, permanently patched the AMT, delayed the sequester for two months, extended temporary "tax extenders," and extended the "doc fix," among other changes.

Beside the headline provisions, ATRA contained many other items, a few of which we highlighted in Eight Things You Didn't Know Were In the Fiscal Cliff Deal. Some of these things include a one-year extension of the farm bill, reductions in discretionary spending caps, the repeal of the CLASS Act, establishment of a long-term care commission, and a tax break for racetracks.

Most glaring among these is the biggest budget gimmick of the bill, a provisions that allows individuals to more easily convert 401(k)s and 403(b)s to Roth retirement accounts, which was scored as raising $12 billion in revenue over the next ten years but will likely cost the government revenue in the long term.

How Does the Fiscal Cliff Deal Change Budget Projections?

Ten-year budget projections look markedly different after the passage of ATRA, which we detail in How Does the Budget Look Now? As the graph below shows, current law has converged sharply with current policy, with much of the deficit reduction that was to take place under the fiscal cliff being averted.

Under the new current law scenario, which would allow the sequester to go off in March and several temporary extensions under ATRA, including the "doc fix" and extended unemployment benefits to expire at the end of the year, debt would be 73 percent of GDP in 2022. Under a more realistic scenario that permanently waives the sequester and continues annual "doc fixes" and the refundable tax credits, debt would rise to nearly 79 percent of GDP by 2022. If tax extenders are also continued in perpetuity without being offset, debt would rise to 80 percent.

The deal also dramatically changes budget projections beyond the ten-year window, which we discuss in The Post-Deal Long Term Outlook. Our analysis showed that under three different budget baselines -- CBO's current law, CRFB Realistic, and CBO's Alternative Fiscal Scenario -- debt would be on a clear upward path and would rise well above the size of the economy over the coming decades. In particular, the extension of most of the 2001/2003/2010 tax cuts and permanent patch of the AMT will cause the current law projection to converge upward toward current policy. Our realistic projection of debt in the long-term shows a slight improvement as a result of ATRA, but much more clearly needs to be done for our fiscal path to be sustainable.

What Was the Economic Impact of the Fiscal Cliff Deal?

In The Economic Effects of Avoiding (Much of) the Fiscal Cliff, we look at the economic effects of ATRA compared to the fiscal cliff. According to our prior analysis based on CBO, the fiscal cliff would have represented a 2.9 percent hit on the economy by the end of 2013 (more in the first quarter). This plan, as written into law, would reduce that hit to about 1.3 percent. If we continue to delay sequestration beyond March 1, the hit would be further reduced to 0.7 percent. Note that these numbers are in line with what CBO estimated the economic effect of the deal would be.

The deal may have avoided much of the economic harm that would have occurred with the drastic and sudden tax increases and spending cuts of the fiscal cliff, but budget projections show that the agreement fell far short of putting our fiscal house in order.

To read more, see:

- The Good, the Bad, and the Ugly in the Fiscal Cliff Package (https://crfb.org/blogs/good-bad-and-ugly-fiscal-cliff-package)

- Washington’s Gift for the New Year: Another Kicked Can (https://crfb.org/blogs/washington%E2%80%99s-gift-new-year-another-kicked-can)

- Eight Things You Didn't Know Were In the Fiscal Cliff Deal (https://crfb.org/blogs/eight-things-you-didnt-know-were-fiscal-cliff-deal)

- How Does the Budget Look Now? (https://crfb.org/blogs/how-does-budget-look-now)

- The Post-Deal Long Term Outlook (https://crfb.org/blogs/post-deal-long-term-outlook)

- The Economic Effects of Avoiding (Much of) the Fiscal Cliff (https://crfb.org/blogs/economic-effects-avoiding-much-fiscal-cliff)

- Credit Rating Agencies and IMF Say More Needs to Be Done (https://crfb.org/blogs/credit-rating-agencies-and-imf-say-more-needs-be-done)