Restoring Trust Fund Solvency Would Reduce Long-Term Debt Growth

Restoring solvency to the major trust funds would reduce one-half to four-fifths of the projected debt-to-GDP growth over the next three decades.

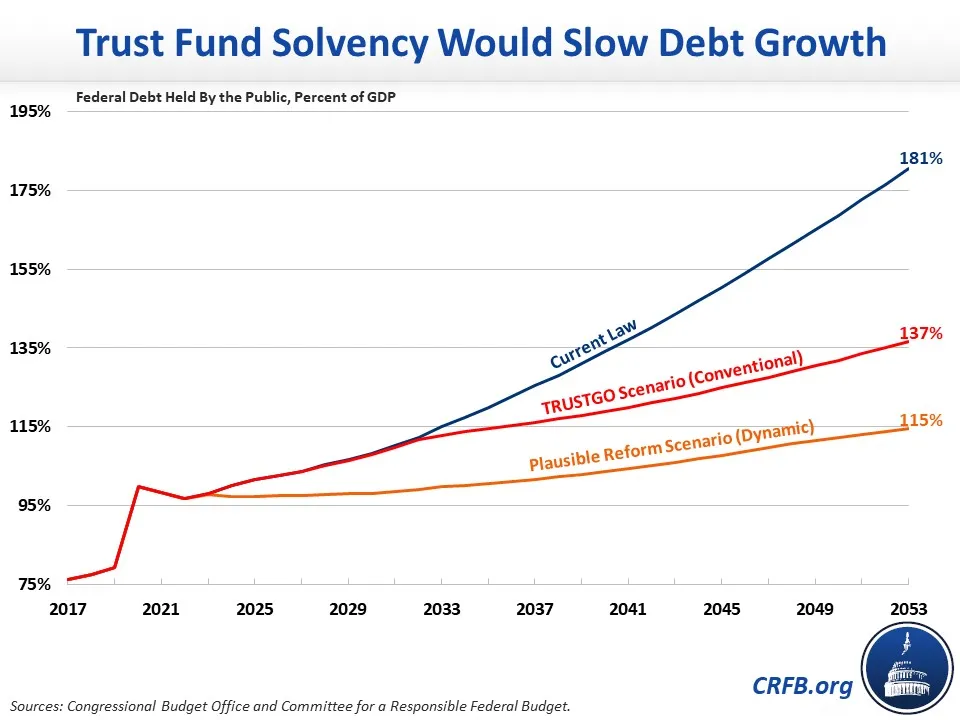

The Congressional Budget Office's (CBO) latest Long-Term Budget Outlook projects that federal debt held by the public will rise from 98 percent of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2023 to 181 percent of GDP by the end of 2053. Debt could rise to as high as 222 percent of GDP under an alternative scenario where various expiring provisions are extended. These budget projections assume that scheduled spending on Social Security, Medicare, and highways will continue even after the programs' trust funds deplete their reserves – though the law requires deep across-the-board cuts. As we've shown before, restoring solvency to the major trust funds would substantially improve the long-term fiscal outlook.

We estimate that under a TRUSTGO Scenario, which assumes highway, Medicare, and Social Security spending is limited to revenue plus trust fund reserves, debt would reach 137 percent of GDP by the end of FY 2053. Were policymakers to enact thoughtful pro-growth trust fund solutions in advance of the solvency deadlines, we estimate debt could plausibly be as low as 115 percent of GDP by the end of 2053 on a dynamic basis, which accounts for faster economic growth. Importantly, these scenarios also assume that lawmakers fully pay for any extensions of expiring policies or above-inflation growth in appropriations.

CBO currently projects that the Highway Trust Fund will deplete its reserves by FY 2028, the Social Security Old-Age and Survivors Insurance (OASI) trust fund will be exhausted by FY 2032, the Medicare Hospital Insurance (HI) trust fund will become insolvent by FY 2035, and the Social Security Disability Insurance (SSDI) trust fund will deplete its reserves by calendar year 2052 (The Social Security Trustees project OASI insolvency in 2033, the SSDI trust fund to remain solvent over the next 75 years, and the combined Social Security trust funds to run out by 2034, while the Medicare Trustees project HI trust fund insolvency by 2031). Though current law requires automatic spending or benefit cuts upon insolvency to bring trust fund spending in line with trust fund revenue, CBO's baseline essentially assumes that lawmakers will transfer general revenue into the trust funds as needed to prevent any benefit or spending cuts. Therefore, making changes to reduce trust fund spending or increasing trust fund revenue would reduce debt relative to CBO's baseline.

Our TRUSTGO Scenario assumes that policymakers act to bring trust fund spending in line with trust fund revenue the year each trust fund is projected to become insolvent. Under a conventional estimate that does not account for economic effects, debt would continue to increase as a share of GDP over the long term but at a much slower pace than projected under current law. By FY 2033, debt would total 113 percent of GDP instead of 115 percent. By 2043, debt would be 122 percent of GDP instead of 144 percent. And within three decades, debt would total 137 percent of GDP as opposed to 181 percent under current law. In other words, over half of the projected debt accumulation over the next three decades would be erased under the TRUSTGO Scenario.

Assuming lawmakers enact thoughtful, proactive, and pro-growth reforms to restore solvency, long-term debt could be even lower – particularly after accounting for their effects on economic growth and interest rates. Under one plausible scenario, where revenue and spending policies are phased in beginning next year and designed to support work, encourage savings, improve tax efficiency, and lower health costs, we estimate debt could be as low as 115 percent of GDP by 2053. In other words, thoughtful trust fund solutions could reduce projected debt by about 66 percentage points – preventing four-fifths of the projected increase in debt-to-GDP.

Restoring solvency to the major trust funds would significantly improve the long-term fiscal outlook while also providing certainty to the millions of beneficiaries that rely on these programs. Reforms could also boost household wages and incomes, lower out-of-pocket health care costs, improve our national infrastructure, and improve the physical, mental, and social health of millions of Americans.

Policymakers should work to enact trust fund solutions sooner rather than later to make the trust funds solvent over the long term.