The Response & Relief Act Would Boost Income To Record Levels

Unlike in past recessions, personal income has grown during the current crisis as a result of the aggressive fiscal and monetary actions taken to combat the crisis. While that support is wearing off, enactment of the Response & Relief Act which passed Congress by overwhelming majorities would again lift income to record levels.

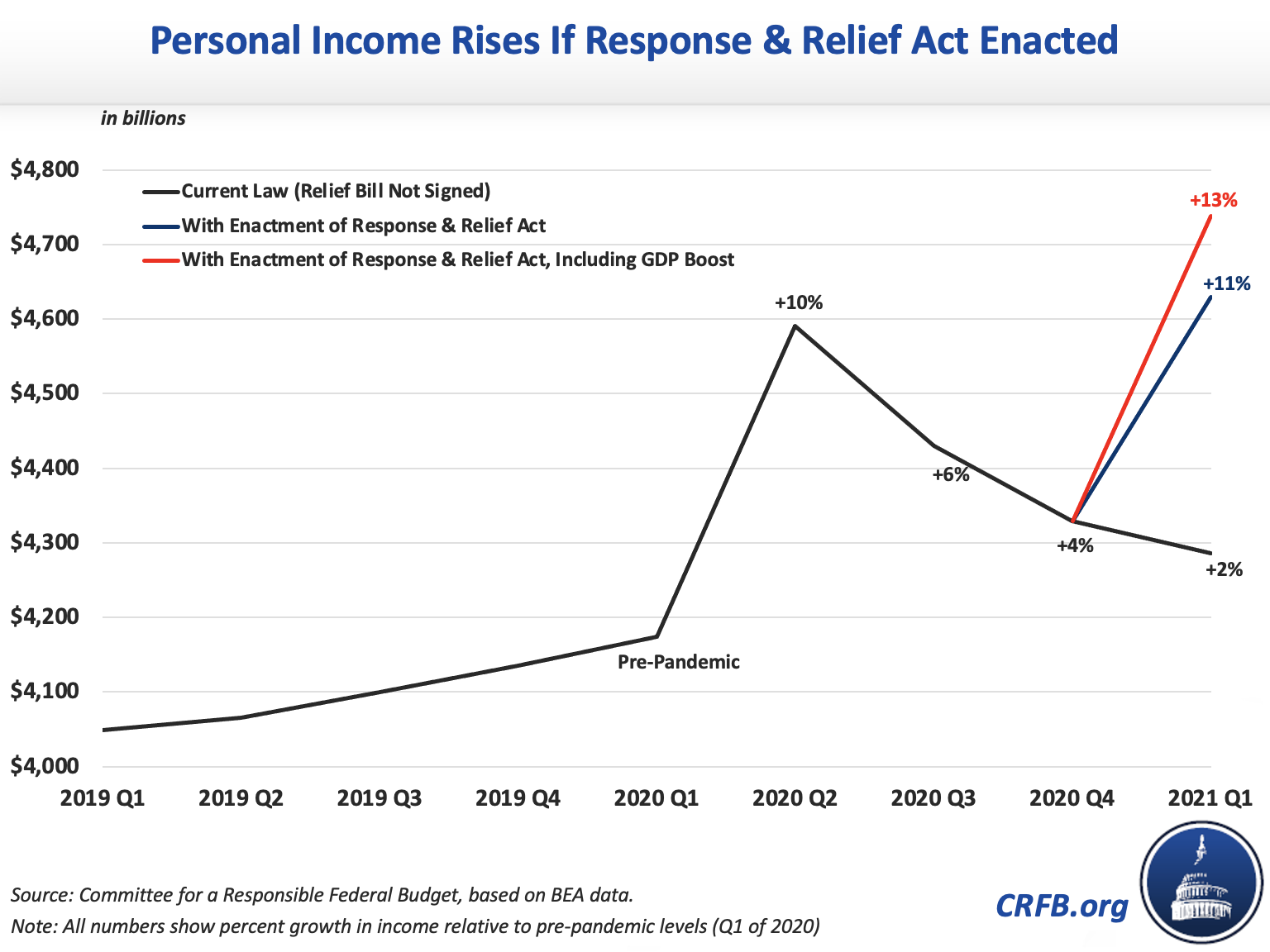

When the pandemic took hold in March, personal incomes immediately fell as millions of Americans lost their jobs. Due largely to expanded unemployment benefits and one-time stimulus checks, however, overall income quickly grew. According to the Bureau of Economic Analysis (BEA), personal disposable income grew by 10 percent even as GDP fell by 10 percent and "market income" shrank by a similar amount. Even without stimulus checks in the third quarter, income remained 6 percent above pre-pandemic levels as a result of a strong partial economic recovery, continued payment of unemployment benefits (and the Lost Wages Assistance), and other fiscal support.

However, both the fiscal support and economic recovery are stalling. In November, income was just 3 percent above pre-pandemic levels. For the fourth quarter as a whole, we estimate income will be less than 4 percent above pre-pandemic levels — about what it would have been absent the crisis. With expanded unemployment benefits and other support expiring this week, we estimate income in the the first quarter of next year will be just 2 percent above pre-pandemic levels — only enough to keep pace with inflation.

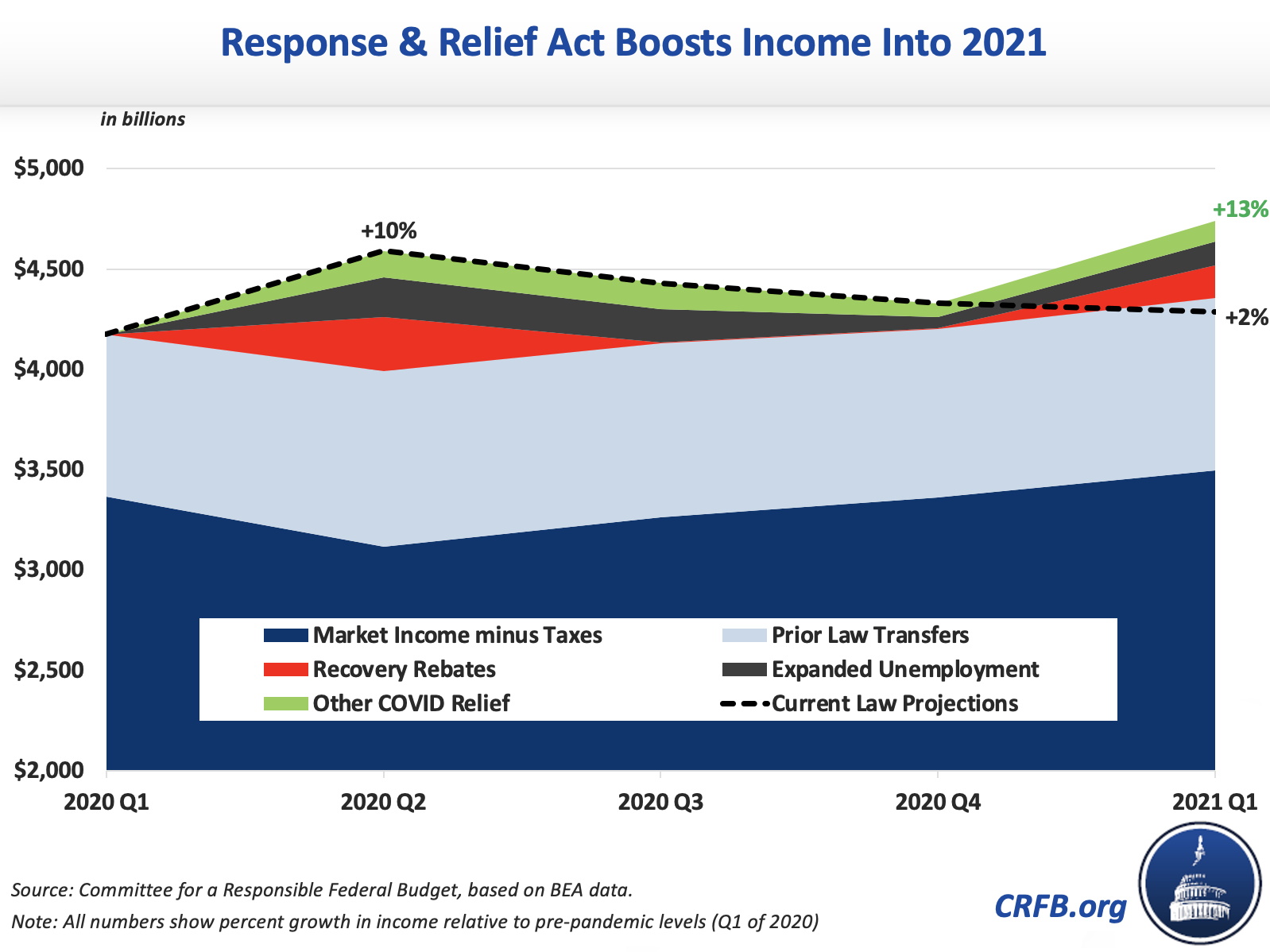

Enactment of the relief package would substantially boost income. We estimate the fiscal support alone will increase income in the first quarter of next year to 11 percent above pre-pandemic levels. Incorporating the likely economic boost, it would lift income to 13 percent above pre-pandemic levels. Despite the recession and pandemic, personal income would be higher than any time in American history.

Overall, we estimate disposable income in the first quarter of 2021 would be about $550 billion higher than the same quarter last year. Driving that boost is about $350 billion of recovery rebates (stimulus checks), expanded unemployment benefits, Paycheck Protection Loan payments, and other COVID-related measures found in the Response & Relief Act. We estimate an additional $200 billion boost from rising market income, remaining COVID relief enacted in 2020, and prior law transfers.

While this boost will not last through the second quarter of next year, higher household savings in the first quarter and a robust economic recovery as the weather warms and vaccines are distributed could make a huge difference for the remainder of 2021.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.