Progressive Caucus Releases Alternative Budget

The Congressional Progressive Caucus (CPC) threw their hat into the budget ring last week with the release of their “People’s Budget”. This is the fifth time the CPC has released an alternative to the official House budget. The progressive budget offers a more liberal alternative than that proposed by either party or the President.

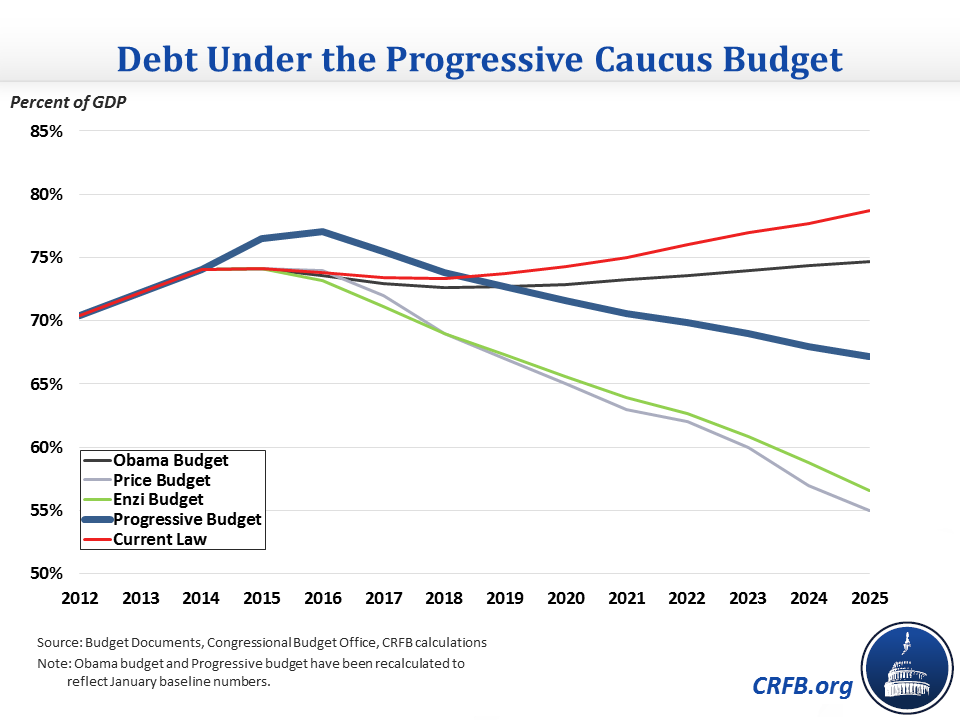

The CPC's budget proposes both higher taxes and greater spending in most areas. The budget calls for $7.4 trillion of savings via revenue and spending changes and $5.1 trillion in investments over ten years, resulting in $2.3 trillion of deficit reduction over the next decade, including interest savings. This deficit reduction would be sufficient to put debt on a downward path from 74 percent of GDP today to 66 percent of GDP in 2025. By contrast, CBO estimated that debt under the President's budget would be 73 percent, or about where it is today.

Under the People’s Budget, revenues would rise to 21.5 percent of GDP by 2025, 3 percent higher than under current law. Outlays would reach 23.1 percent of GDP in 2024, or almost 2 percent higher than under current law. As a result, deficits fall below 2 percent of GDP after 2016 and end up at 1.5 percent of GDP at the end of the decade, which is lower than the President's budget. Because of significant short-term stimulus, the 2015 deficit would shoot up to 5 percent, about 2.5 percent of GDP higher than current law.

This short-term package would revive expired unemployment benefits through 2017, when CBO projects the unemployment rate to be 5.3 percent. It would create a temporary refundable tax credit, giving up to $800/$1200 to workers making up to $95,000/$190,000 (single/married) in 2015 and 2016 modeled after the Making Work Pay credit. Additional stimulus includes a public works jobs program, $300 billion for education programs, and additional funding to states for Medicaid, first responders, and other priorities.

Beyond the initial stimulus investment, the Progressive budget also envisions a dramatic increase in non-defense discretionary spending. It repeals both the sequester and the original Budget Control Act spending caps and increases discretionary spending above that, for total of $1.9 trillion of NDD increases.

The budget raises revenue by significantly changing tax rates. For very high earners, the budget raises top rates from 39.6 percent to a range of 45 and 49 percent for incomes over $1 million and over $1 billion, respectively. The budget would also tax capital gains as ordinary income and increase the estate tax rate from 40 percent to between 55 and 65 percent. A 15 cent increase in the gas tax would close the shortfall in the Highway Trust Fund, which will become insolvent at the end of September without action. We have written about the importance of finding solutions to the Highway Trust Fund issue.

The budget also includes several proposals from the President's budget, including expanding the Earned Income Tax Credit (EITC) for childless workers, increasing the foreign ownership threshold to 50 percent to prevent inversions, providing universal preschool, and decreasing subsidies for crop insurance companies.

The CPC budget would also tax carbon at $25/ton to combat climate change. Notably, the potential fiscal impact of climate change was included for the first time time in the President’s budget this year.

The plan also makes a number of significant reforms to the nation's health care system. The plan would repeal the SGR and pay for its elimination with revenue found elsewhere in the budget. A repeal of the SGR without offsets was proposed by Speaker Boehner and Minority Leader Pelosi last week. The budget also gives the Department of Health and Human Services authority to negotiate prescription drug costs related to Medicare Part D, and expands the Children's Health Insurance Program (CHIP). It also repeals the Cadillac tax on expensive health care plans that the Affordable Care Act put into place, saying it inspired providers to cut benefits rather than costs.

| Major Proposals in CPC Budget | |

| Policy |

2015-2025 Savings/Costs (-) |

| Deficit Reduction Proposals | |

| Increases tax rates on income above $250K and increase refundable credits | $1,443 billion |

| Enact carbon tax and repeal fossil fuel tax preferences | $1,352 billion |

| Implement financial transactions and financial institution taxes | $1,033 billion |

| Enact worldwide taxation system | $706 billion |

| Repeal step-up basis and institute estate tax reform | $530 billion |

| Cap the value of itemized deductions at 28% | $566 billion |

| Enact public option and prescription drug savings | $373 billion |

| Enact immigration reform | $237 billion |

| Increase gas tax by 15 cents | $206 billion |

| Reduce defense spending | $134 billion |

| Other policies | $436 billion |

| Interest savings | $350 billion |

| Subtotal, Deficit Reduction | $7.4 trillion |

| New Investment Proposals/Other Costs | |

| Repeal NDD cuts and mandatory sequester | -$694 billion |

| Further increase NDD spending | -$1,562 billion |

| Increase infrastructure spending | -$820 billion |

| Enact or expand tax credits | -$428 billion |

| Refinance student loans and other college cost proposals | -$392 billion |

| Enact temporary stimulus measures | -$388 billion |

| Repeal SGR | -$135 billion |

| Repeal Cadillac tax | -$88 billion |

| Other new investment proposals | -$565 billion |

| Subtotal, New Investments | -$5.1 trillion |

| Total, Progressive Budget |

$2.3 trillion |

| War Drawdown | $761 billion |

| Total, Progressive Budget | $3.1 trillion |

Source: Congressional Progressive Caucus

Note: Totals may not add due to rounding.

The budget is certainly heavy on tax and spending increases, but we welcome new additions to budget season and appreciate that it puts debt on a downward path. We've written already on both the House and Senate budget resolutions, which would do the same. We hope that this focus on deficit reduction is maintained throughout this year's budget debate.

Update: this blog has been updated to correct a typographical error in the People's Budget.