The President's Budget Stabilizes Debt Over the Long Term...Maybe

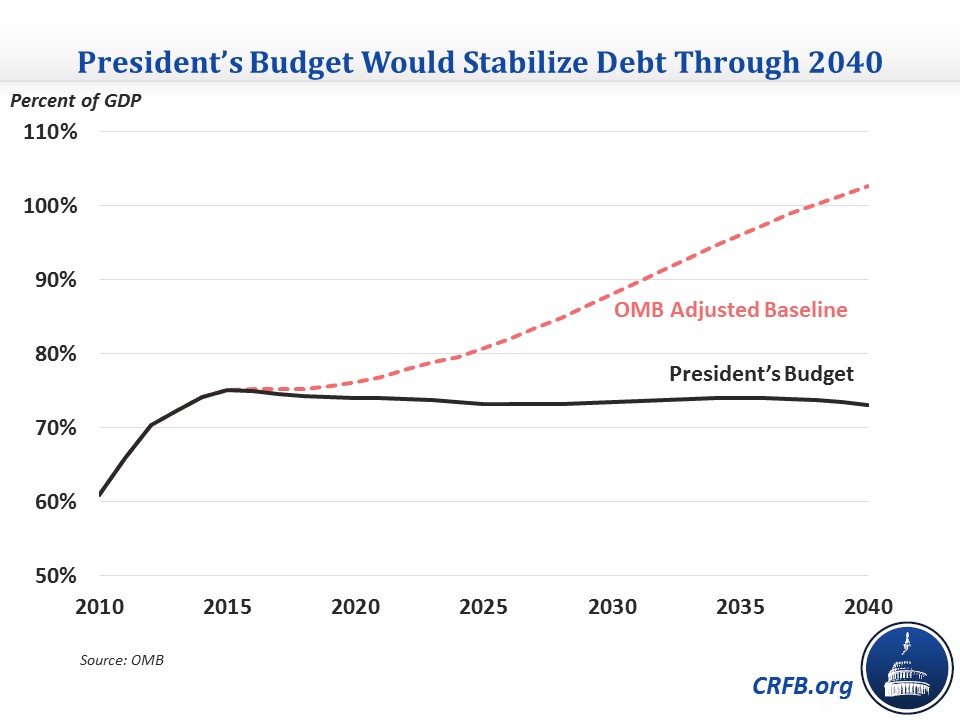

In addition to showing estimates over the next ten years, the President's budget includes in its lengthy Analytical Perspectives section a 25-year estimate of the important budget metrics. This long-term outlook shows the budget stabilizing debt between 73-74 percent of GDP over the entire period, compared to an increase to over 100 percent by 2040 in their "adjusted baseline." This stabilization is a clear improvement from the sharp upward path of debt in current law, but it would still leave debt at a high level, and the estimate relies on some assumptions that may be optimistic.

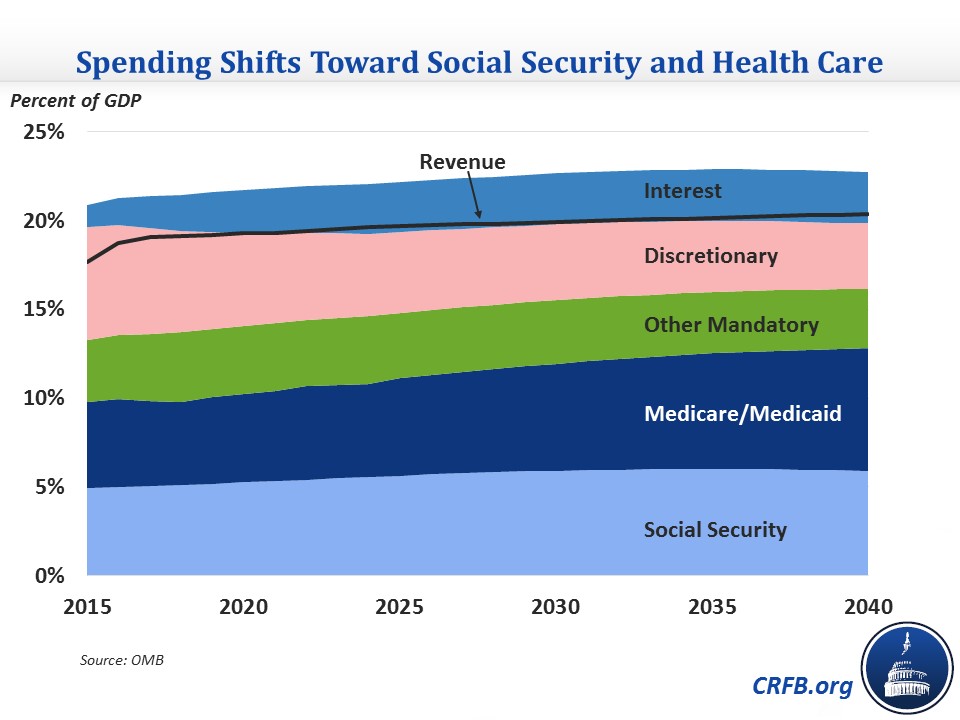

At the end of the first ten years, spending and revenue sit at 22.2 percent and 19.7 percent of GDP, respectively, for a 2.5 percent of GDP deficit. Over the following 15 years, both spending and revenue increase gradually by similar amounts, ending up at 22.7 percent and 20.4 percent, respectively, in 2040. Deficits, like debt, remain stable in the 2-3 percent range throughout this period.

The relative stability of the budget between 2025 and 2040 over time masks the change in its composition over time. Population aging and health care cost growth push up spending on Social Security and health care, particularly the latter, by nearly 2 percentage points of GDP while other categories of spending gradually fall over time. Revenue increases come from the individual income tax as increases in income push people into higher tax brackets.

Interestingly, OMB apparently does not anticipate or does not attempt to estimate whether some of the budget's policies would grow faster or slower than their category of spending. In particular, one would expect the Medicare beneficiary cost-sharing changes to slow Medicare spending by increasing amounts since the changes grandfather current beneficiaries and don't start for a few years. Other policies might push the other way, but it is not clear.

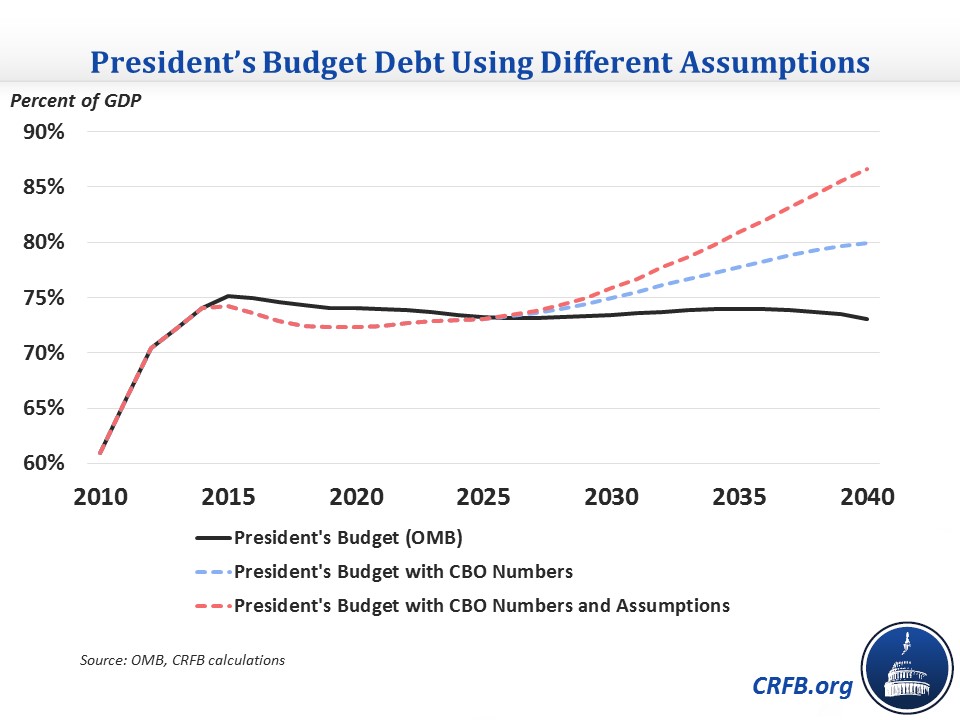

Notably, the budget incorporates some assumptions that are more favorable than the ones CBO uses in its long-term budget outlook. First, the budget assumes that discretionary spending grows slower -- with inflation and population growth rather than GDP growth --a decline which may not necessarily be realistic over the long term. According to the budget, growing discretionary spending with GDP over the long term instead would add 7 percentage points of GDP to debt in the adjusted baseline by 2040.

Second, the budget uses the Social Security and Medicare Trustees long-term estimates -- adjusted for the budget's proposals -- which are more favorable than CBO's projections because of more optimistic assumptions on life expectancy and health care cost growth. Using the Social Security Trustees' projections is certainly reasonable, but Medicare Chief Actuary Paul Spitalnic has questioned whether the Medicare Trustees' default baseline is sustainable given the significant restraint in payment growth built into current law. Whether that would become an issue within 25 years is arguable, but it adds uncertainty about whether spending might ultimately be higher than presented.

We estimate that using CBO numbers but the same policy assumptions, the budget would not stabilize debt but would instead have it on a slight upward path to 80 percent of GDP by 2040, after which it would turn around and start falling. But if we also use CBO's assumption that discretionary spending stays constant as a share of GDP, debt would be on an upward path to 87 percent by 2040 and continue rising after that.

Overall, the budget would reduce and possibly prevent the long-term growth in debt levels projected under current law, thanks in large part to proposed Medicare savings as well as significant new revenue. However, to achieve fiscal sustainability and ensure the necessary amount of flexibility, debt should be on a clear downward path relative to GDP. To meet this goal, policymakers should pursue further health reforms beyond those in the President’s budget, as well as comprehensive Social Security reform to make that program solvent for 75 years and beyond.

As we’ve mentioned before, focusing on the long term is hugely important to truly bring the fiscal situation under control.