Poll Shows Economists Believe Grand Bargain Could Help Growth

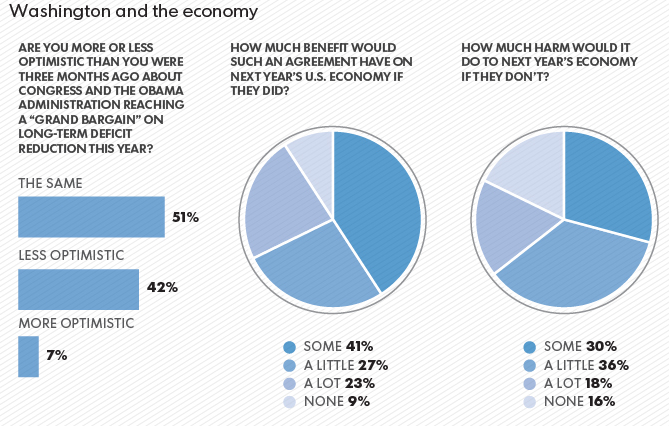

Yesterday, we highlighted the consensus between economists and leaders in both parties on the need to replace the sequester. Today, a USA Today poll of top economists shows strong support for a "Grand Bargain" that could help economic growth. The poll of 46 economists found that "64% say a deal that would close tax loopholes, change policies such as the way Social Security benefits are adjusted for inflation, and curtail Medicare and Medicaid spending growth would help the economy 'some' or 'a lot' in 2014." If lawmakers enact pro-growth reforms to the tax code and spending programs, the economic benefit would be particularly pronounced.

Source: USA Today

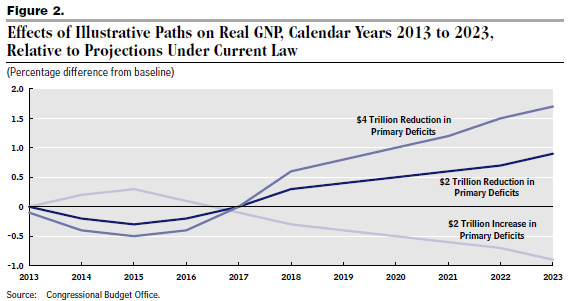

Other reports have shown long term benefits to a significant deficit reduction plan. Most recently, a study from CBO showed a $2 trillion deficit reduction plan could raise output (GNP) by nearly 1 percent by 2023. But this new survey suggests many economists believe the benefits to deficit reduction could come even earlier, perhaps due to the increased confidence and certainty boosting investment.

As mentioned above, the economic benefits of deficit reduction could also come as a result of pro-growth tax reform. Our current tax code is outdated, overly complex, and inefficient. Reforming it presents an opportunity to simplify the code and raise revenue. For example, former Chairman of the Council of Economic Advisers Martin Feldstein proposes raising revenue from tax expenditures in an op-ed in today's Wall Street Journal. Feldstein argues that a cap on expenditures coupled with entitlement reforms would generate significant savings and reduce the deficit. He believes the move to limit tax expenditures could forge common ground among national leaders and reduce partisanship that surrounds discussions geared towards a bipartisan deal. He enumerates two principal approaches towards limiting tax expenditures:

- Limiting the tax savings from all deductions and two major tax exclusions to 2% of an individual's adjusted gross income: Feldstein projects such a move would reduce the deficit by $220 billion in 2013. This approach is further discussed here.

- Modifying the 2% cap to retain the existing deduction for all charitable contributions and allow employees to exclude the first $8000 of employer-paid health-insurance premiums for the cap: This approach is expected to reduce the deficit by $141 billion in 2013 and by $2.1 trillion over the next decade.

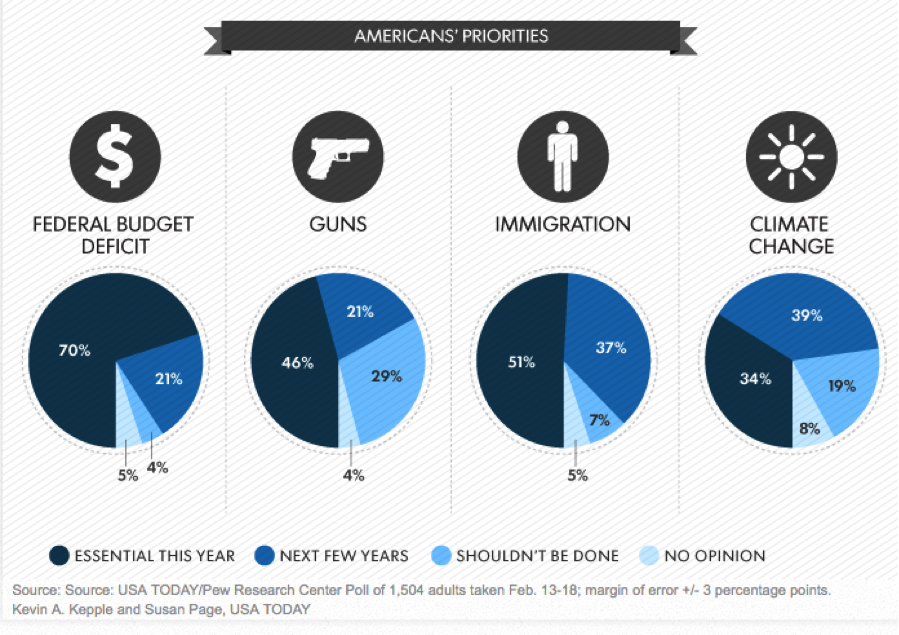

But it's not just economists who are advocating the benefits of smart deficit reduction, many Americans outside of Washington see getting our budget under control as an important priority for the country. In another USA Today poll, 7 out of 10 Americans believed that the administration and Congress need to push through legislation that would significantly reduce our deficit. Those polled saw deficit reduction as a more urgent priority than other high profile issues, including gun control, climate change, and immigration.

Source: USA Today

With many benefits to deficit reduction, we hope lawmakers are listening to economists and citizens. We strongly urge lawmakers to seize the opportunity being presented by the March 1 deadline of sequestration -- only eight days away -- and come together on a bipartisan comprehensive plan that would reduce our debt as a share of our economy and avoid harm to the economic recovery.