The Path to $165 Billion of Savings

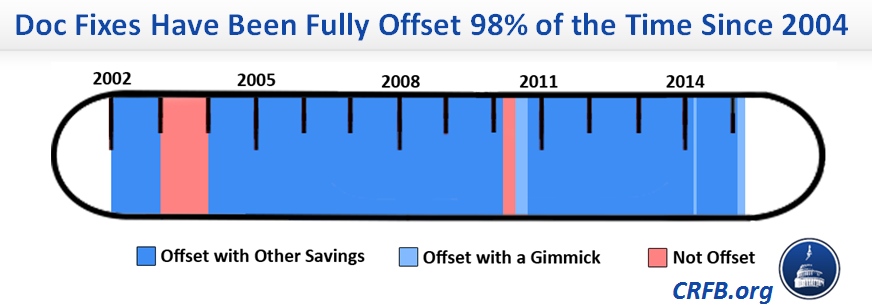

We have spent much space on this blog highlighting the fact that temporary delays of the cuts dictated by Medicare's Sustainable Growth Rate (SGR) formula have almost always been offset (98% of the time since 2004), producing $165 billion in deficit reduction all told, almost entirely from health care programs.

And despite assertions to the contrary, these health savings shouldn’t be dismissed lightly. There have been numerous recommendations put forward by the Medicare Payment Advisory Commission (MedPAC), Health and Human Services' Office of the Inspector General (OIG), the Government Accountability Office (GAO), and others that likely would have been ignored but for the need to replace savings from the SGR.

MedPAC, for instance, has warned for years that Long-Term Care Hospitals (LTCHs) and Inpatient Rehabilitation Facilities (IRFs) are paid more than is necessary for many of the cases they handle. To offset the 10% cut dictated by the SGR in 2008, Congress adopted MedPAC recommendations to reduce payment updates for both IRFs and LTCHs, and also modified the prospective payment system for LTCHs. Then again in the 2013 “doc fix” bill, in line with recommendations under discussion by MedPAC at the time, Congress applied site-neutral payments for certain conditions treated in LTCHs.

The latest “doc fix” exemplifies this trend. The largest savings in the bill, from allowing the Department of Health and Human Services (HHS) to collect and use data on values of physician services to more accurately set Medicare payments, is a variant of a direct recommendation from MedPAC the last two years.

Reducing Medicare lab test payments to bring them in line with those from private payors jumps right off a recent study and recommendations from HHS’ Office of Inspector General (OIG). And basing payment rates for skilled nursing facilities (SNFs) in part on measures of avoidable readmissions has been recommended by MedPAC and had been included in President Obama’s last three budgets.

It’s hard to imagine any scenario other than offsetting SGR in which any of these reforms would have been seriously considered.

What follows is a compilation of all the policies used to offset doc fixes.

Small Structural Reforms

- Electronic prescribing: Provided incentives for physicians to do a certain amount of electronic prescribing (MIPPA 2008)

- ESRD bundled payments: Created bundled payment for end-stage renal disease (ESRD) services, and later updated bundles to account for utilization changes and to include quality measures for oral-only ESRD drugs in quality incentive payments (MIPAA 2008, ATRA 2013, PAMA 2014)

- Diabetic supply payments: Promoted competitive bidding to set payment rates for diabetic supplies (ATRA 2013)

- SNF Value-Based Purchasing: Established a value-based purchasing program for skilled nursing facilities (SNFs), incorporating readmission measures (PAMA 2014)

- Clinical lab payments: Set Medicare payment for clinical labs equal to competitively-determined rates from private payors (PAMA 2014)

- Physician fee schedule: Allowed HHS to collect information to adjust RVUs/misvalued codes with 0.5% target reduction (PAMA 2014)

- Diagnostic imaging: Created quality incentives for certain CT services and specified development of appropriate use criteria of imaging services (PAMA 2014)

Medicare Hospitals

- 3-day payment window: Applied 3-day payment window to non-diagnostic inpatient services (PACA 2010)

- Bad debts: Reduced Medicare's coverage of hospital bad debts from 70% to 65% (MCTRJCA 2012)

- IPPS documentation and coding: Reduced payments for hospital inpatient services in 2014-2017 to account for upcoding in 2008-2010 (ATRA 2013)

Medicare Post-Acute Care

- IRF payments: Froze inpatient rehabilitation facility (IRF) payments for 2008-2009 and required 60% compliance with classification rule for getting IRF designation (MMSEA 2007)

- LTCHs: Made several rule changes, froze long-term care hospital (LTCH) payments for 2008 (MMSEA 2007):

- LTCH payments: Applied site-neutral payments to certain cases phased in from FY 2016-2018, among other changes (Pathway 2013)

Other Medicare

- Recovery audit contractors: Authorized HHS to contract with private parties to identify incorrect Medicare payments for recoupment (TRHCA 2006)

- Medicare secondary payor: Required entities to provide data on whether they have been a primary Medicare payor and penalizes those don’t submit the information (MMSEA 2007)

- Part B drugs: Changed calculation of average sales price for Part B drugs (MMSEA 2007)

- Diagnostic lab payments: Equalized payment rates for similar lab tests (MMSEA 2007)

- Medicare Improvement Fund: Reduced money in Medicare Improvement Fund (DoD Act 2010, MMEA 2010, ATRA 2013)

- Multiple service payment policies for therapy: Increased reductions for multiple service payments for therapy performed on the same day from 25% to 50% (ATRA 2013)

- Certain radiology service payments: Equalized payment rates for similar radiology services (ATRA 2013)

- Advanced imaging services: Increased assumption for utilization rates of advanced imaging services from 75% to 90% (ATRA 2013)

- Non-emergency ambulances for ESRD: Reduced payments for non-emergency ambulance transports for ESRD beneficiaries by 10% (ATRA 2013)

- Collection of overpayments: Increased period of time when overpayments can be collected from three years to five years (ATRA 2013)

- SGR Transitional Fund: Eliminated $2.3 billion placed into the SGR Transitional Fund from savings achieved through extending the sequester of mandatory spending (PAMA 2014)

Medicare Advantage (MA)

- MA Stabilization Fund: Reduced MA stabilization fund (TRHCA 2006, MMSEA 2007)

- MA payment reductions: Phased out indirect medical education costs from capitation rates and required private-fee-for-service (PFFS) plans to establish provider networks (MIPPA 2008)

- MA coding intensity: Increased coding intensity adjustments by 0.25 percentage points per year from 2015-2018 (ATRA 2013)

Medicaid

- Provider tax: Temporarily reduced provider tax limit from 6% to 5.5% of patient revenues between 2008 and 2011 (TRHCA 2006)

- Medicaid DSH cuts: Extended Medicaid DSH cuts for four years to 2024 (MCTRJCA 2012, ATRA 2013, Pathway 2013, PAMA 2014)

Affordable Care Act

- Exchange subsidy recapture: Increased allowed exchange subsidy recaptures from $400 to $600-$3500 and applied recaptures to people over 500% of the FPL (MMEA 2010)

- Prevention Fund: Reduced Prevention and Public Health Fund by $5 billion from 2015-2019 (MCTRJCA 2012)

- CO-OP cuts: Rescinded 90% of funding for CO-OP (ATRA 2013)

Miscellaneous

- Establish CMS-Treasury coordination (PACA...2010): Allowed Treasury to give HHS information on delinquent tax debt for providers applying to enroll in Medicare

- Mortgage guarantee fees and premiums: Increased Federal Housing Financing Administration fees to guarantee mortgages (MCTRJCA 2012)

Key

MMA 2003=Medicare Prescription Drug, Improvement, and Modernization Act of 2003

DRA 2005=Deficit Reduction Act of 2005

TRHCA 2006=Tax Relief and Health Care Act of 2006

MMSEA 2007=Medicare, Medicaid, and SCHIP Extension Act of 2007

MIPPA 2008=Medicare Improvements for Patients and Providers Act of 2008

DoD Act 2010=Department of Defense Appropriations Act of 2010

PACA...2010=Protecting Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010

MMEA 2010=Medicare and Medicaid Extenders Act of 2010

MCTRJCA 2012=Middle Class Tax Relief and Job Creation Act of 2012

ATRA 2013=American Taxpayer Relief Act of 2012

Pathway 2013=Pathway for SGR Reform Act of 2013

PAMA 2014=Protecting Access to Medicare Act of 2014