Over Half the COVID Fiscal Support is Now Out the Door

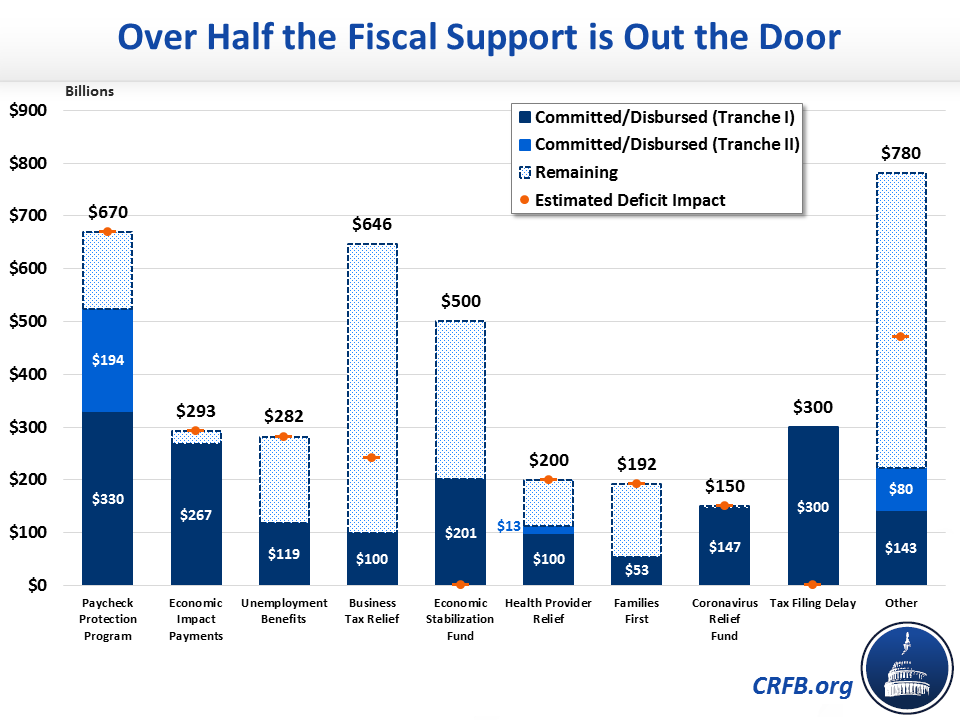

In response to the current pandemic and economic crisis, Congress and the President have enacted $4 trillion in spending, benefit payments, grants, loans, tax cuts, tax deferrals, and other measures to support the economy. So far, over half that money — $2.1 trillion — is out the door. The remaining dollars are largely flowing as expected.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

Since the beginning of March, Congress and the President have enacted five pieces of legislation to address the current economic and public health crisis. In total, these bills will provide as much as $3.6 trillion of near-term support to the economy, and cost $2.4 trillion over a decade (the difference is attributable to loans, loan guarantees, and tax deferrals – which offer substantial support up front but recover most of these dollars). Administrative actions, most significantly delaying tax filing deadlines, offer an additional $400 billion of fiscal support.

Using our COVID Money Tracker, we estimate that $2.1 trillion of this $4 trillion in enacted support has already been disbursed or committed. Just two and a half months after passage of the CARES Act, in other words, over half of enacted fiscal support is out the door. As a share of estimated net cost, roughly 80 percent is out the door. The rest is largely flowing as intended.

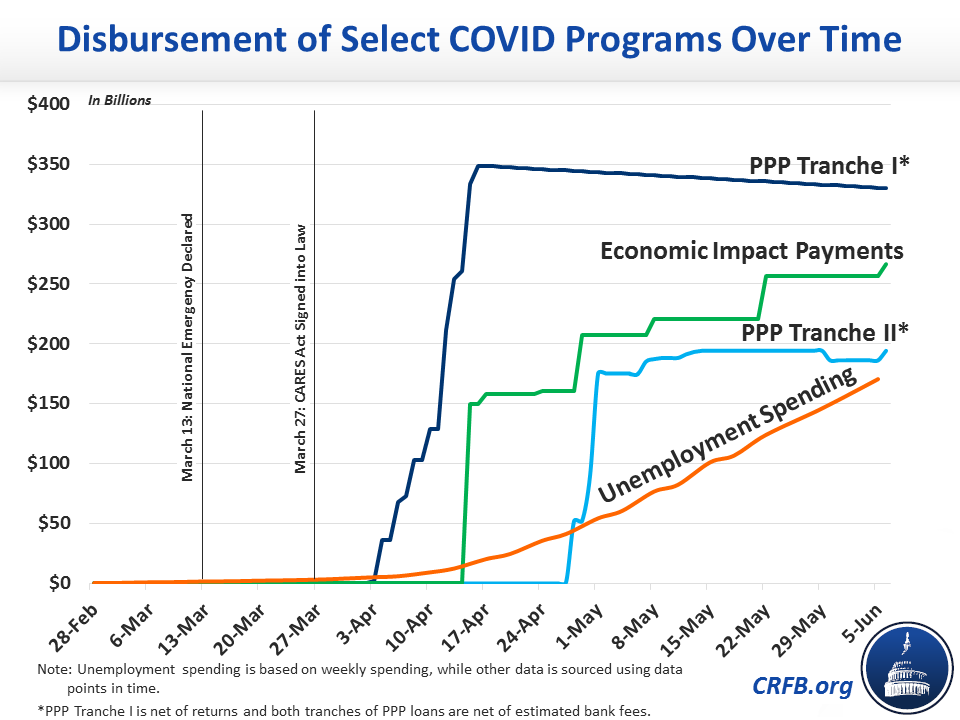

While several programs and policies got off to a rocky starts, including the Paycheck Protection Program and expanded unemployment benefits, disbursement appears to be moving at record speed. For comparison, it took 14 months for half of the American Recovery and Reinvestment Act to be disbursed in 2009 and 2010.

Of the $2.1 trillion committed or disbursed, about $525 billion is from the Paycheck Protection Program, $300 billion is from delaying tax filing season, nearly $270 billion is from $1,200 per person Economic Impact payments, and $200 billion is from the Economic Stabilization Fund which is primarily for standing up Fed facilities. These dollar figures represent 78, 100, 91, and 40 percent of the total available fiscal support in each of their categories, respectively. Another $147 billion (out of $150 billion) has been allocated to states through the Coronavirus Relief Fund, and $120 billion (out of an estimated $282 billion) has gone toward expanded unemployment benefits.

The money that has not been spent, for the most part, was specifically allocated to be spent later this year or next. For example, various business tax cuts and deferrals will disburse gradually over time as businesses continue to make reduced tax payments. Expanded unemployment benefits will continue to disburse weekly – through July and through the end of the year.

To be sure, not all fiscal support is moving quickly. There still appear to be unemployment backlogs in many states, including for retroactive payments and for Pandemic Unemployment Assistance (PUA) claims, for example. But the vast majority of money is now either committed, disbursed, or flowing as expected. As a result, incomes are up in April despite output being down significantly, and incomes will likely remain relatively stable through the end of July.

We will continue to track all of the federal response to the current pandemic, including disbursements and commitments, as part of our ongoing COVID Money Tracker initiative.