Online Sales Tax Debate Heats Up

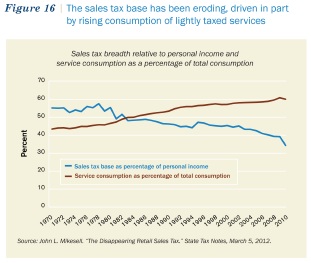

Last week, our "Spotlight on the States" blog post highlighted structural challenges for the states, one of them being an eroding sales tax base. The inability of states to collect sales taxes on online sales, which we also have previously discussed, is one factor in that erosion (in addition to the growth of service consumption). In Quill Corp. v. North Dakota, a 1992 Supreme Court case, the Court ruled that states could not collect sales taxes on sellers who did not have a physical presence in the state. Only legislation from Congress could allow states to collect sales taxes from out-of-state sellers.

Yesterday, the House Judiciary Committee held a hearing on that very legislation, the Marketplace Equity Act, co-sponsored by Reps. Steve Womack (R-AR) and Jackie Speier (D-CA). Both Members testified at the hearing, arguing that allowing states to tax online sales would level the playing field for online retailers and "brick-and-mortar" stores with a physical presence in the state. Rep. Womack pointed out that the sales tax loophole turned stores into show rooms where people would examine merchandise and then go home and buy it online. Rep. Speier also pointed out that the increasing share of sales done online would financially burden states and localities as their revenue eroded.

Gov. Bill Haslam (R-TN) and state Rep. Wayne Harper (R-UT) echoed the points about state revenue and brick-and-mortar competitiveness; Haslam specifically said that the estimated revenue loss is about $20 billion per year. Both also addressed issues of complexity for retailers having to comply with different state and local tax codes by saying that tax software had advanced enough to handle that. In addition, Harper argued that federal requirements that states simplify their sales taxes could mitigate that concern--something the Act contains. Joseph Henchman of the Tax Foundation agreed that taxing internet sales may be desirable, but only if it is paired with conditions for the states and sales tax simplification efforts to prevent damaging interstate commerce.

However, Steve DelBianco, executive director of NetChoice (representing online commerce groups), argued that the Act would not level the playing field between online and offline sales. He said that traditional sales taxes are levied by the residence of the seller, but the Act would treat out-of-sales differently by levying it based on the residence of the buyer. He also pointed out the complexity issue of complying with many different state and local sales taxes, a conern that a few Members of the Committee also echoed. Finally, DelBianco argued that the $1 million exemption from the collection requirement was not high enough to prevent an undue burden on small businesses, that it should be raised to $15 million.

Considering that there is bipartisan support but also bipartisan concerns, it will be interesting to see where this bill goes in Congress.