New Study Finds Student Loan Pause is Regressive

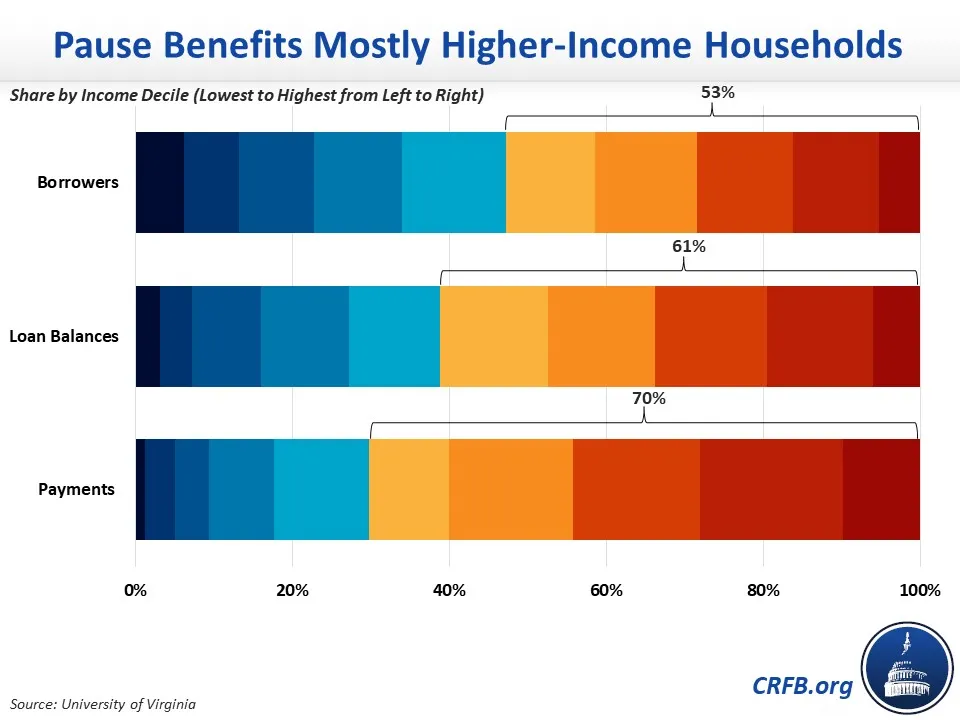

A recent analysis by Diego Briones, Sarah Turner, and Eileen Powell of the University of Virginia found that the current student loan payment pause, which has now been extended nine times, benefits high-income households the most. The study shows that the top half of earners enjoyed 70 percent of the benefit from paused payments, while the top quintile has enjoyed nearly 30 percent (despite representing only 16 percent of borrowers). This makes the pause far more regressive than the Administration’s debt cancellation plan, which we’ve shown also disproportionately benefits higher-income households.

The new study uses data from the 2019 Survey of Consumer Finances to organize households by income decile and then estimate the share of total households with debt, loan balances, and pre-pause loan payments. This provides a helpful but imperfect picture of the distribution of benefits, both due to some issues with the underlying data and the fact that the share of the pause that goes toward forgiving interest or accelerating forgiveness varies by borrowers.

The authors find that while borrowers are concentrated more toward the upper-middle of the income spectrum - 81 percent in the 4th through 9th deciles – both loan balances and especially payments are concentrated more towards the top. Specifically, the top half of households are responsible for 61 percent of loan balances and 70 percent of loan payments. This peaks at the 9th decile, which is responsible for 14 percent of balances and 18 percent of payments.

The authors also find that nearly half of payments are made by those with graduate degrees (who make up less than 30 percent of borrowers), and 70 percent are made by white Americans (who constitute 61 percent of borrowers).

Driving this disparity is the fact that higher earners borrow more and do so at higher interest rates, especially to attend graduate school. As we’ve shown, those with medical, law and other graduate degrees benefit far more from the pause (and inflation) than those with 4-year degrees or less. The authors find that the mean annual loan payment is $5,535 for those in the top decile, compared to $2,660 for those in the middle and $545 for those in the bottom decile.

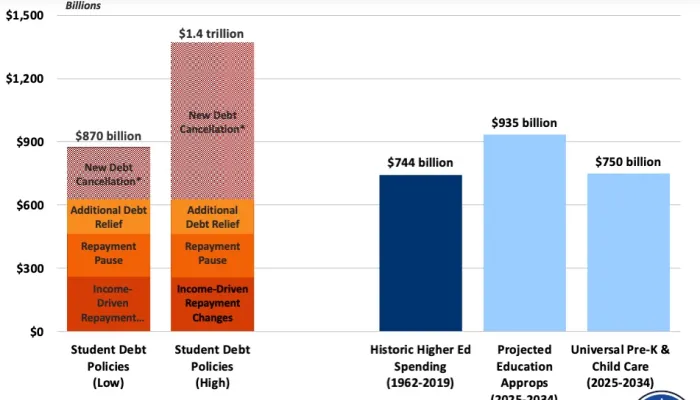

And although the benefits would skew upward, the cost is diffuse. The authors cite a number of budgetary estimates, including our own, that the pause could end up costing as much as $195 billion and has added up to 20 basis points to inflation. It is also difficult to justify with the country experiencing the lowest unemployment rate in fifty years, and college graduates enjoying an especially low rate.

The authors also argue that “these many extensions threaten the government’s future credibility to administer student loan programs or, indeed, any government lending initiative,” and that they “may have made other avenues of relief…less salient.”

The paper makes a powerful case for restarting student loan payments as soon as possible, regardless of what the court rules on the President’s broader cancellation plan. Further extensions of the pause would be increasingly damaging to the economy, the budget, and the student loan system.