Myth Buster: The Fiscal Cliff Spares the Poor

Some commentators have advocated for a position of going over the fiscal cliff to leverage a better compromise. Paul Krugman called for the recently reelected President Obama to "not make a deal." Matt Yglesias and others have also played down the harm from the cliff, arguing that it mostly affects the rich, sparing the poor.

But this is far from the truth. The poor would see a large tax increase, another recession and rising unemployment made worse by the expiration of extended unemployment benefits as a part of the cliff, and cuts to many income security and education programs as a part of sequestration. Lets look at each of these in turn.

The Tax Hike

On the tax side, while the overall tax increase as a result of the cliff would be progressive, the poor still get hit pretty hard. In fact, according to the Tax Policy Center, the bottom quintile would see their taxes rise by $412 on average, leading to a 3.7 percent reduction in their after-tax income.

This is a significant amount of money for those struggling to make ends meet. The payroll tax cut expiration, the expiration of the 10 percent tax bracket, and especially the expiration of the refundable credit expansions in 2001 and 2009 very much hit low income earners. Those expansions increased the earned income credit for married couples and families with three or more children, doubled the child tax credit and made it much more refundable, and created the American Opportunity Tax Credit for college students. The overall tax effect of the cliff might be progressive, but it clearly does not spare the poor.

Source: Tax Policy Center

A Double Dip Recession

The fiscal cliff will also likely trigger a double-dip recession, with the economy due to contract 0.5 percent in 2013 (from the fourth quarter of 2012 to the fourth quarter of 2013) with the unemployment rate to rise to 9.1 percent by the fourth quarter of 2013. The economy is already slowing from uncertainty in Europe and weak growth in China, so the fiscal cliff would be devastating.

In the recent economic downturn, the number of people experiencing extended periods of unemployment has increased, and extended unemployment has led to much higher poverty rates. With 4.8 million people, as of 2011, between 100 and 125 percent of federal poverty levels, the tax and spending policies of the fiscal cliff, a double dip recession, and higher unemployment would likely increase poverty in a notable way.

Cuts to Programs that Benefit the Poor in Sequestration

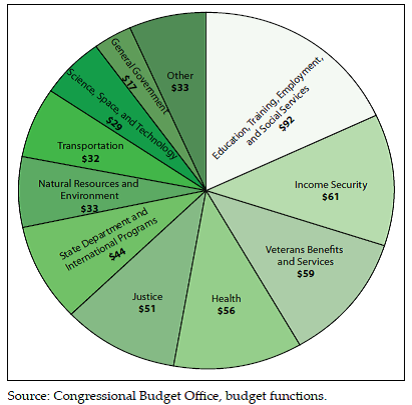

While low-income mandatory programs are largely exempt from the sequester, it does hit discretionary programs that serve low-income people. As the table below shows, education and income security programs are a significant part of discretionary spending and across the board cuts would hinder the effectiveness of many of these programs. The OMB report on the sequester showed that many housing support programs, heating assistance, nutrition programs, and federal education programs are sequestrable and included in the nearly 8 percent across the board cuts to non-defense spending. The cuts to spending under the sequester may exclude low-income mandatory spending, but are otherwise untargeted and do not hold the poor harmless.

For these three reasons, it is clear the fiscal cliff certainly does not spare lower-income households. Some critics charge that proposed replacement plans would be just as bad if not worse for the poor as the fiscal cliff. But if bipartisan plans such as Simpson-Bowles or Domenici-Rivlin are any indication, a comprehensive plan could easily be more progressive than the fiscal cliff and protect low earners. We will show you how in the next blog of our mythbuster series.