Major Trust Funds Headed for Insolvency Within 11 Years

A number of important federal programs, such as Social Security and Medicare, are financed through dedicated revenue sources and managed through federal trust funds. Prior to the COVID-19 pandemic and subsequent economic crisis, most major trust funds were already headed toward insolvency.

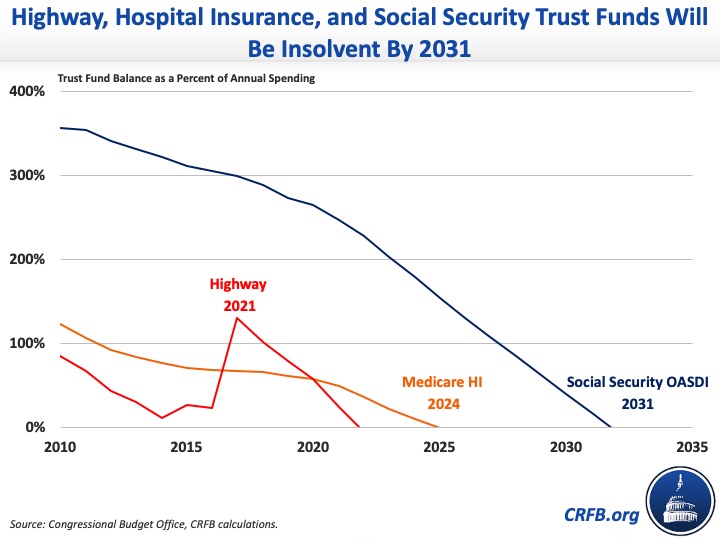

As a result of the current crisis, our recent estimates suggest each trust fund will exhaust its reserves sooner than previously projected. Using the Congressional Budget Office's (CBO) latest economic projections, we estimate all major trust funds will be depleted by 2031. Lawmakers must take action soon to prevent abrupt benefit and spending cuts.

According to our latest estimates, the Highway Trust Fund (HTF) will be depleted by 2021, the Medicare Hospital Insurance (HI) trust fund by the beginning of 2024, the Social Security Disability Insurance (SSDI) trust fund in the 2020s, the Pension Benefit Guarantee Corporation (PBGC) Multi-Employer fund at some point in the mid-2020s, and the Social Security Old-Age and Survivors Insurance (OASI) trust fund by 2031. We estimate the theoretically combined Social Security OASDI Trust fund will run out of reserves by 2031.

Absent new legislation, highway spending will be cut by 30 percent, Medicare spending by 11 percent, and Social Security spending by 23 percent immediately upon insolvency of their respective trust funds. As a result, today's youngest retirees will see their benefits precipitously cut by one-quarter when they turn 73.

These estimates – based on CBO's March trust fund projections and its latest economic forecast – show all of these funds will deplete their reserves earlier than under CBO’s pre-COVID projections. Those projections show the Highway Trust Fund depleting its reserves in Fiscal Year (FY) 2022, the Hospital Insurance trust fund in FY 2026, and the combined Social Security trust funds in FY 2032.

Earlier depletion dates are driven by declining gas tax revenue as a result of reduced driving, declining payroll tax revenue as a result of higher unemployment and lower wages, lower interest rate payments on trust fund reserves, and more disability applications. These factors are partially offset by savings from lower Social Security benefits and smaller cost-of-living adjustments, slower assumed growth in health care costs, and higher mortality rates. Our projections did not attempt to estimate the effect of the current crisis on hospital utilization.

Impact of the COVID-19 Crisis on the Major Trust Funds

| Trust Fund | Pre-COVID Insolvency Date (CBO) | New Projected Insolvency Date (CRFB) | Shortfall at Insolvency (% of Spending) |

|---|---|---|---|

| Highway Trust Fund | 2022 | 2021 | 30% |

| Medicare Hospital Insurance (Part A) Trust Fund | 2026 | 2024 | 11% |

| Pension Benefit Guaranty Corporation Multi-Employer Fund | 2027 | mid-2020s | No estimate |

| Social Security Disability Insurance Trust Fund | 2030s* | 2020s | No estimate |

| Social Security Old-Age & Survivors Insurance Trust Fund | 2032 | 2031 | No estimate |

| Theoretical Combined Social Security Trust Funds | 2032 | 2031 | 23% |

Source: Congressional Budget Office and CRFB calculations.

*CBO's ten-year projections showed SSDI being solvent through at least 2030 but did not indicate the exact insolvency date.

Importantly, these estimates are based on CBO projections and would differ if pegged to the Social Security and Medicare Trustees' projections. Before the crisis, the Trustees projected that Social Security would deplete its reserves by 2035. The Social Security Chief Actuary recently said the crisis could advance that date to 2034, assuming a rapid recovery. Meanwhile, the Penn Wharton Budget Model (PWBM) has estimated – based on the depth of the Great Recession – that the current crisis could advance the insolvency date of the theoretically combined Social Security OASDI trust fund from 2036 to between 2032 and 2036. The Bipartisan Policy Center (BPC) has run simulations suggesting an insolvency date of 2026 or 2029 for the OASDI trust fund, also based on the effects of the Great Recession. Joseph Antos and James Capretta of the American Enterprise Institute (AEI) have estimated the Medicare Hospital Insurance trust fund could run out between 2022 and 2023, assuming the effect of the current crisis is similar to that of the Great Recession.

Fortunately, many options exist to restore solvency to these trust funds. For the Highway Trust Fund, policymakers could raise the gas tax, identify new revenue sources like a vehicle miles traveled tax, and/or reduce excess spending. Many of these options are featured in our Budget Offsets Bank, our 2015 illustrative plan for the Highway Trust Fund, and a CBO options report from this year. We have also outlined numerous options to reduce pension risk, increase PBGC premiums and funding, and reduce PBGC costs.

For Medicare, lawmakers could raise new payroll tax revenue and enact reforms that would reduce overall health care costs. We recently identified a number of potentially bipartisan health-related budget options – many from the President's budget – which could reduce overall health expenditures by $900 billion over a decade, with some of those savings accruing to Medicare Part A. Other health-related options can be found in our Budget Offsets Bank, while new ones are currently being developed by our Health Savers Initiative.

For Social Security Disability, lawmakers could consider a number of options – such as those proposed by the President or as part of our SSDI Solutions Initiative – to improve the determination and adjudication process, address interactions with other programs, and support workers with disabilities to remain in the workforce.

For the old age program, options to increase the payroll tax rate or base, adjust the benefit formula, or increase retirement ages are well-known. Our Social Security Reformer tool allows users to design their own combination of policies to restore 75-year solvency.

For Social Security, there are several options to bring spending and revenue into line. Lawmakers could reduce benefits in targeted ways or raise payroll tax revenue. The SSDI trust fund may need to be specifically addressed earlier, and many smart options to improve the system's finances already exist.

Securing any of these trust funds for the long-term will require the will to act and negotiate the tradeoffs inherent in these efforts. Legislation like the TRUST Act would help aid these efforts by establishing bipartisan and bicameral commissions to address each threatened trust fund.

While policymakers are rightly focused on the response to the current crisis, it is imperative that they turn their attention to saving these vital trust funds from insolvency once the crisis has passed. The longer action is delayed, fewer solutions will be available, and the necessary adjustments will be much costlier and more painful.