Long-Term Estimate: Senate Health Care Bill Could Save $2.1 Trillion Over 20 Years

The Congressional Budget Office (CBO) estimates that the Senate health care bill, the Better Care Reconciliation Act (BCRA), would save $321 billion over ten years. But what about the long term?

According to our rough estimates, we find the Senate bill would save an additional $1.7 trillion in the second decade (2027-2036) for a total of $2.1 trillion over the next 20 years. Specifically, we estimate the bill would save $2.6 trillion in the second decade ($3.4 trillion over two decades) from its Medicaid cuts, save nearly $200 billion in the second decade from other coverage and spending provisions ($300 billion over two decades), and lose $1.1 trillion of tax revenue in the second decade ($1.6 trillion over two decades).

20-Year Estimate of the Better Care Reconciliation Act

| Category | 2017-2026 Cost/Savings (-) | 2027-2036 Cost/Savings (-) | 2017-2036 Cost/Savings (-) |

|---|---|---|---|

| Medicaid Changes | -$769 billion | -$2.6 trillion | -$3.4 trillion |

| Other Coverage/Spending Changes | -$102 billion | -$200 billion | -$300 billion |

| Affordable Care Act Tax Repeals | $550 billion | $1.1 trillion | $1.6 trillion |

| Primary Deficit Effect | -$321 billion | -$1.7 trillion | -$2.1 trillion |

| Interest | -$16 billion | -$470 billion | -$485 billion |

| Total Deficit Effect | -$336 billion | -$2.2 trillion | -$2.5 trillion |

| Debt Effect (% of GDP at End of Period) | -1% | -6% | -6% |

Source: CRFB calculations based on Congressional Budget Office data.

The net result is that the bill would save $1.7 trillion over the second ten-year period, an amount equal to about 0.5 percent of Gross Domestic Product (GDP). Combined with the first decade savings, the bill would save $2.1 trillion over 20 years, or $2.5 trillion including interest. As result, the bill would reduce debt by 6 percent of GDP in 2036 (from 112 percent to 106 percent). Beyond the second decade, savings would likely increase further.

Our estimate is rough,* but its direction and order of magnitude is clear. The BCRA's savings will grow over time far more quickly than its new spending and tax reductions, primarily because its per-capita Medicaid cap will become increasingly binding over time and also because some new spending in the bill ends after 2026 and the legislation only delays rather than repeals the Cadillac tax.

Importantly, the long-term savings could ultimately prove far less significant than our projections if policymakers continue temporary policies in the bill or ease up on cost containment. If policymakers repeal the Cadillac tax beyond 2025 (which is quite possible since the tax has already been delayed once and would be again in the BCRA), it would cost an additional $600 billion, and if they continue the stability program beyond 2026, it would cost another $50 billion (assuming they maintained the $5 billion the program spends in 2026). In addition, if policymakers continue to index the Medicaid per-capita caps to medical inflation after 2024 instead of general inflation, it could cost in the range of $500 billion through 2036. If policymakers did all three of these things, the legislation would save less than $1 trillion over two decades, rather than the $2.1 trillion we project.

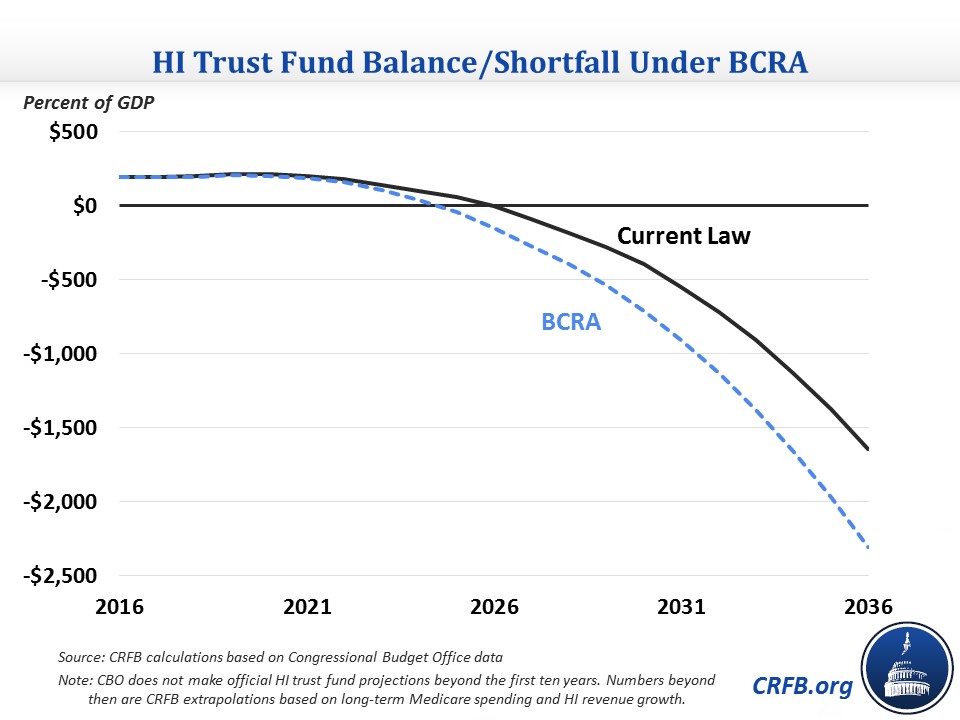

It is also important to note that though the bill would reduce deficits overall, it would adversely affect Medicare solvency. Medicare Part A's Hospital Insurance (HI) trust fund is financed primarily from a 2.9 percent payroll tax; the Affordable Care Act ("Obamacare") instituted a 0.9 percent surtax on wage income above $200,000 ($250,000 for families). The BCRA would repeal this surtax beginning in 2023, losing about $59 billion through 2026, and other interactions with the HI tax would cost another few billion. The BCRA would also result in about $42 billion more of Medicare spending on Disproportionate Share Hospital (DSH) payments, which are tied to the number of uninsured.

These changes would advance Medicare Part A's 2025 insolvency date by at least several months and up to a year or so. By our estimates, the changes would also cost the trust fund about $400 billion over the next 20 years (excluding interest) and increase the program's average shortfall by about 0.1 percent of GDP in the second decade, the equivalent of roughly 5 percent of the program's spending and 6 percent of its revenue in 2027.

Policymakers should improve the BCRA so it no longer worsens Medicare's solvency. But it is encouraging that the legislation includes significant long-term deficit reduction. One way or another, health care cost growth will need to be slowed in order to put the country on a fiscally sustainable path. As senators continue to debate and possibly amend the bill, we hope they keep in mind the long-term outlook, especially considering how central health care spending is to the budget.

*Our long-term projections are based on a number of sources. For Medicaid, we used a long-term model to calculate the impact of the bill's per-capita cap; our estimates were confirmed by recent CBO estimates of percent Medicaid reductions in 2036. For tax revenue, our estimates extrapolate the near-term score based on previous CBO projections. For provisions that end in 2025 or 2026, we assume no long-term impact. Other parts of the legislation were generally extrapolated based on the growth of savings or costs late in the budget window. There is some uncertainty about how changes in the individual insurance market would affect the long term, in particular because of the expiration of funds for the Long-Term State Stability and Innovation Program. Our estimate essentially assumes that the individual market continues to operate as it does at the end of the ten-year window, so any potential changes in that market over time would affect our estimate.