How the Sequester Looks After the Fiscal Cliff Deal

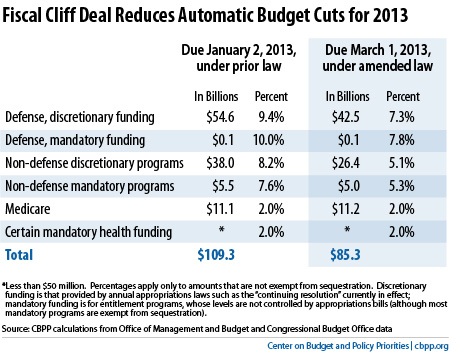

Along with a two month delay until March 1, the fiscal cliff deal reduced the across-the-board cuts under sequestration for 2013 by $24 billion. Reducing the cuts from $109.3 billion to $85.3 billion was paid for with a reduction in discretionary caps in 2013 and 2014 and a tax gimmick to allow for more conversions to Roth IRAs. As a result, the remaining cuts under sequestration are now slightly smaller.

The Center for Budget and Policy Priorities has recalculated the percentages by which each funding category will be cut. All programs now face smaller cuts, except for Medicare, which would still be cut by the maximum two percent allowed for by law. CBPP also adjusted their percentages for the extension of expanded unemployment insurance and likely additional disaster relief funding for areas damaged by Hurricane Sandy, since some of that spending will fall under the ax.

While the relative magnitude of sequestration may be smaller now, it still is not the best policy. The blunt and indiscriminate nature of sequestration was designed to force a deal rather than be used as deliberate deficit reduction. With many deficit reducing options available to reform our tax code and entitlement programs, policymakers should work to enact a bipartisan and comprehensive plan that will do the least harm to the recovering economy in the short term while putting the debt on a downward path as a share of the economy in the long term. At minimum, lawmakers should pay for any further delay that would be needed to continue such negotiations.