How Much Would Clinton and Trump Increase Our $19 Trillion Gross Debt?

Our report Promises and Price Tags: A Fiscal Guide to the 2016 Election estimates that debt held by the public would rise from about $14 trillion today to $23.9 trillion by 2026 under Secretary Clinton's plan ($250 billion above current law), and $35.2 trillion under Mr. Trump's plan ($11.5 trillion above current law). But what about gross debt?

Though most estimators prefer to use debt held by the public, a more economically meaningful measure of debt, the nation's $19 trillion gross debt is more commonly cited by politicians and the media. That number includes not only what the federal government owes individuals, businesses, central banks, and foreign countries, but also what it owes itself through various trust funds such as those for Social Security, Medicare, and federal retirement programs.

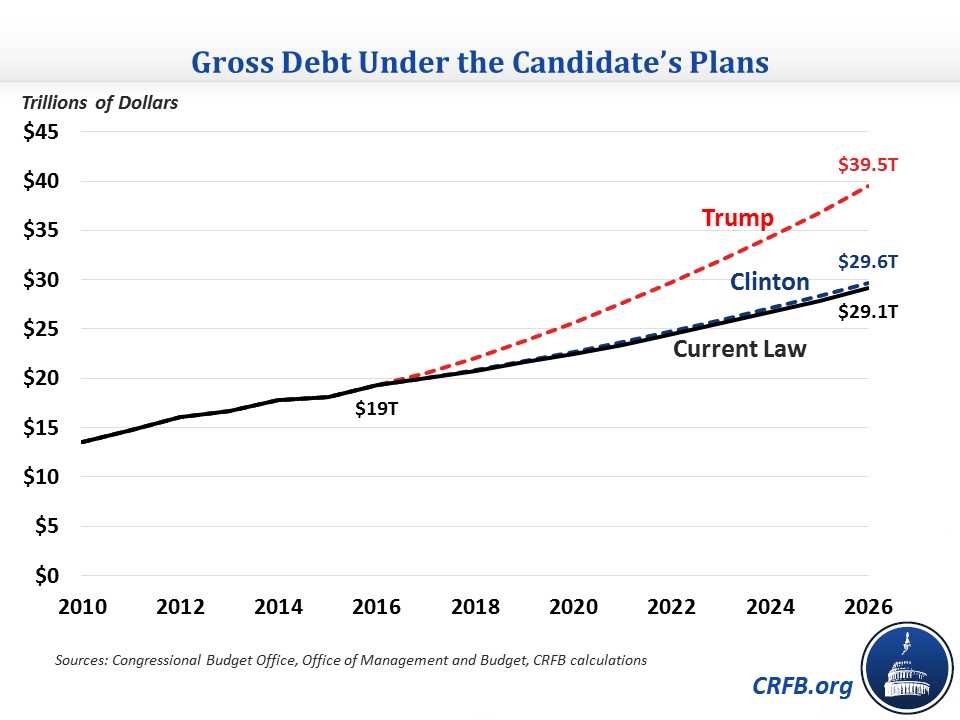

Under current law, gross debt is projected to rise from about $19 trillion today to about $29.1 trillion by 2026, a 50 percent increase.

Trump in particular often expresses concern about the dangers of our current $19 trillion debt. Yet his plan would increase that number significantly. Under our central estimate of Trump's plan, we find very roughly that gross debt would rise from $19 trillion today to $39.5 trillion by 2026. In other words, gross debt would more than double under Trump's plan.

The increase under Clinton's plan would be much smaller but still significant. Under our central estimate of Clinton's plan, we find very roughly that gross debt would rise from $19 trillion today to $29.6 trillion by 2026. In other words, gross debt would rise by over 50 percent.

Interestingly, Clinton's policies would increase gross debt relative to current law more than it would increase debt held by the public. This is largely because the deficit reduction from her immigration reform plan is more than entirely attributable to increased revenue for Social Security and Medicare, which have no impact on gross debt. Trump's policies, on the other hand, would increase gross debt less than public debt, largely due to lower revenue going to the Social Security and Medicare Hospital Insurance trust funds and higher spending from the Hospital Insurance trust fund as a result of repealing the Affordable Care Act.

As a share of GDP, under current law gross debt is projected to remain relatively flat over the next decade, ticking up slightly from 104 percent of GDP today to 105 percent by 2026. Under Clinton's plan, it would rise to 107 percent by 2026, and under Trump's, it would rise to 143 percent.

Although these numbers may be less economically meaningful than debt held by the public, they do show the additional obligations both candidates will be placing on future taxpayers. We hope that as the campaign continues the candidates find ways to reverse the growth of both gross debt and debt held by the public as a share of the economy.