House GOP Floats 2-Stage Process for Tax Reform

Via the Washington Post, it seems that the House majority is looking at creating a fast track procedure for passing tax reform in 2013. This will enable a tax reform bill to be passed by an up-or-down vote with no amendments once it is formulated.

House Ways and Means Committee chairman Dave Camp (R-Mich.) said Thursday that he has two goals with respect to the tax code: "One, block massive, job-killing tax increases" at the end of the year, when the George W. Bush-era tax cuts are set to expire. "And two, enact — not just pass — comprehensive tax reform."

There is strong support to use the expiration of the [Bush tax cuts] as leverage to force action in 2013 on comprehensive tax reform,” Camp told the Federal Policy Group’s annual tax seminar. "How? Simple: In addition to extending current low-tax policies originally enacted in 2001 and 2003, we should enact fast-track procedures to compel comprehensive tax reform next year."

Camp said he is mulling what form those procedures might take. He and House Speaker John A. Boehner (R-Ohio), who endorsed the idea this week, made comparisons to the process by which lawmakers adopt trade agreements negotiated with other nations. Under that system, Congress has 90 days to reject or approve a pact in its entirety without amendment.

Although we do not support extending the tax cuts without offsetting the cost of enacting a comprehensive fiscal plan, the discussion of a two-stage process by House Republicans may indeed be helpful. An oft-cited critique of enacting tax reform to replace the fiscal cliff--or more generally in reaction to action-forcing events--is that reform is too complex to be done in such a short timeframe. The House Republicans offer a model for tax reform to instead come in pieces. In a deal at the end of the year, legislation could combine a temporary partial or full extension (fully paid for) with a fast-track process to enact tax reform by a certain time with agreed-upon parameters and especially a revenue target. To ensure that the revenue target is met and to facilitate a deal, the process could be backed up with a credible trigger that enacts across-the-board tax expenditure cuts or other revenue increases -- something proposed as part of the Simpson-Bowles plan.

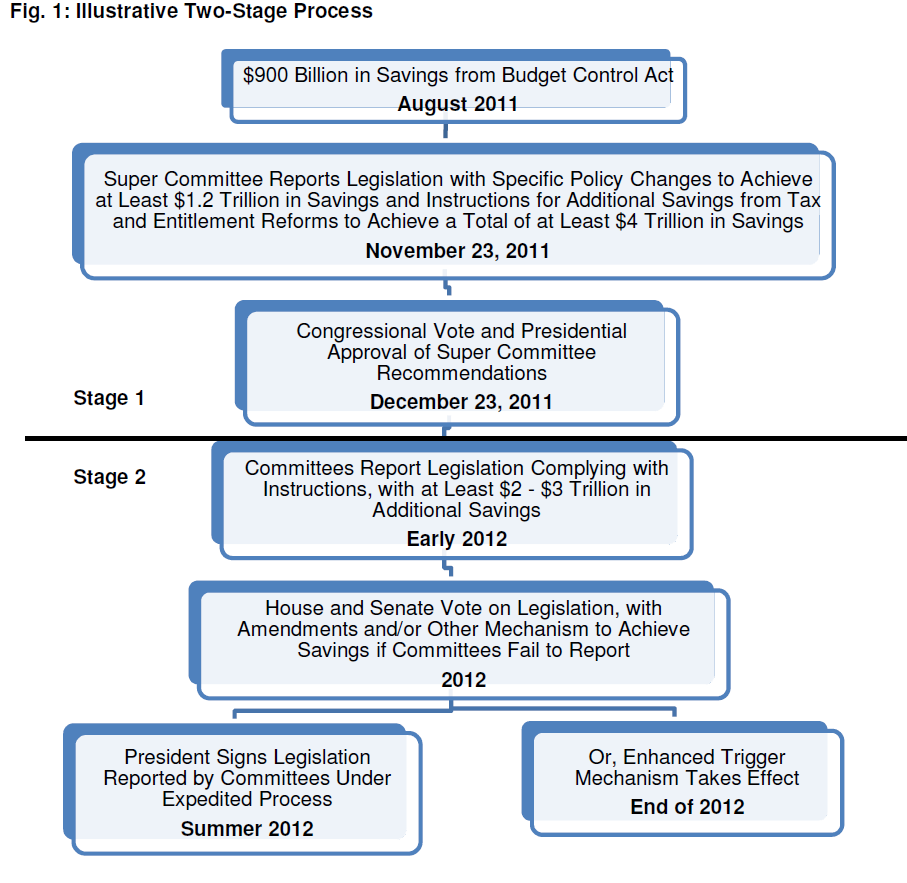

We have discussed how the a two-stage process could work with regards to the Super Committee in a paper last November. We said:

If the Super Committee only agrees to a small plan or needs more time to work out the technical details of a larger plan, it is likely to require either extending the deadline for the Super Committee or using a two-stage process. A credible process must:

- Go Big: Achieve savings large enough to stabilize and reduce the debt as a share of the economy;

- Include a large and meaningful down payment;

- Include a detailed framework for the second stage;

- Put in place an expedited process to achieve additional savings within the next three to six months, with fast-track status;

- Allow for the consideration of other plans if larger plan is not adopted;

- Establish a credible enforcement mechanism to ensure the required savings are achieved.

We also showed how the process might play out. Move forward the dates by a year, and it would be a relatively accurate timeline of what could happen in a cliff-averting deal.

It is good to see that tax reform is getting some attention and priority on Capitol Hill, although we would like to see tax reform contributing significantly to deficit reduction. The House has shown that the complexity and work required for tax reform should not be an excuse not to include in a cliff-averting deal. A two-step process backed up by a trigger would be a very useful component in a fiscal plan.