Heritage and CBPP Agree: Pension Smoothing is a Gimmick

This afternoon, the Senate is expected to vote on an extension of unemployment insurance, offset with so-called "pension smoothing" - a timing shift which doesn't actually reduce the debt. The criticism against using pension smoothing as an offset is growing louder, as both the right-leaning Heritage Foundation and the left-leaning Center on Budget and Policy Priorities have declared it a gimmick.

CBPP warns that the savings from a pension smoothing offset are merely illusory, and that it fails to serve as an offset outside the 10-year budget window.

This proposed change in pension funding rules can’t “pay for” anything. While it would raise money at first, it would lose money in later years. Although it would offset some or all of the cost of ending the medical device tax for several years, it would swell deficits and debt for some years after that.

The proposal could produce a net revenue gain within the ten-year budget window, but produce subsequent revenue losses. As a result, it would cease to function as an offset, and the package would then increase deficits and debt in all future decades.

The Heritage Foundation warns that changing the pension interest rate calculation could put taxpayers on the hook for bailouts, and increase the deficits that the Pension Benefit Guaranty Corporation runs.

The proposal to “smooth” pension contributions would merely shift tax revenue from the future into the present while destabilizing pensions even further and increasing the risks of a taxpayer pension bailout.

Senator Reed’s claims that the proposal would reduce the deficit by $1.2 billion are bogus, as they are based on a budget window accounting gimmick. The proposal would increase revenue in the short term but reduce revenue in future years. And by worsening some firms’ pension underfunding problems, it could actually increase the deficit in the long run.

We also have recently warned against using this gimmick as well, in a press release issued yesterday, where CRFB President Maya MacGuineas criticized pension smoothing.

"The bleak recent budget projections highlight the tremendous need to at least pay for new spending or tax cuts so we don't make the situation worse. Relying on phantom savings and timing shifts undermines the credibility of pay-as-you-go budgeting and, more broadly, fiscal responsibility."

"These are gimmicks, plain and simple...collecting more taxes now and less in taxes later doesn't help our bottom line."

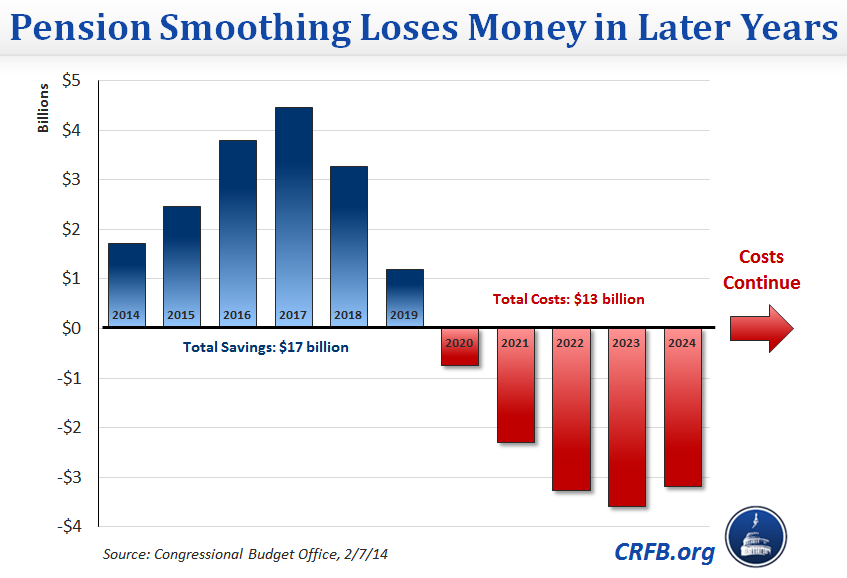

On February 7, CBO estimated that the provision would raise $17 billion over the first six years, but lost money afterward. The losses in the next five years reduce the net savings to $4 billion. However, the provision continues to lose money outside the 10-year projection window. If lawmakers extend the pension smoothing gimmick to "raise" $4 billion, it will save $4 billion over the next ten years only, but lose money over the long term.

Legislators must understand the long-term implications of using the pension smoothing payfor, and that it is unequivocally a gimmick. There are plenty of real offsets that Congress should turn to instead.

Confused about what pension smoothing is? Read a more detailed description here.

Update 2/7/14: This post has been updated to reflect the Congressional Budget Office score for the actual pension smoothing provision used in the unemployment insurance legislation, released on February 7.