Goldman Sachs On the Fiscal Cliff

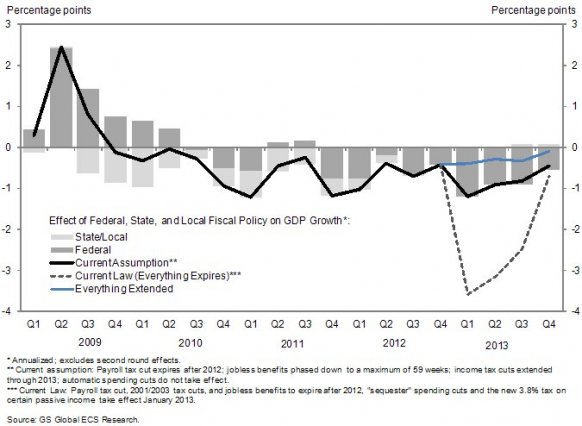

In a new investor note, Alec Philips of Goldman Sachs produced a useful new chart comparing three different scenarios for extending all the fiscal cliff and letting them all expire. Philips shows what would happen if the fiscal cliff hit (the current law scenario in the chart); if the 2001/2003 tax cuts, AMT patch, payroll tax cut, unemployment benefits, and sequester were all extended/turned off (the everything extended scenario); and if the "everything extended" scenario did not include the payroll tax cut and unemployment benefits (the current assumption scenario).

The chart below shows the results and the total direct effect of government fiscal policy on growth since 2009.

As you can see, combined state, local, and federal fiscal policy has been subtracting from growth (at least directly) since late 2009, generally in the range of 0 to 1.25 percent. With the fiscal cliff, the hit on growth would be more like 4 percent in the first quarter of next year and be closer to 3 percent in the second quarter. Under the "everything extended" scenario, the hit would only be between 0 and 0.5 percent. Under Goldman Sach's current assumption, the hit would be around 0.5 to 1 percent.

But the fear of the fiscal cliff will likely have an impact before we reach next year. According to Vincent Reinhart, a poll from Morgan Stanley found that more than 40 percent of companies surveyed in July agreed that the fiscal cliff was causing them to be much more cautious. Many business executives are citing the cliff as the cause of gloomy projections for next year. And it's not just those in defense-related industries. CEO Alexander M. Cutler of Eaton, which produces electrical components, warned that the fiscal cliff is having much wider effects.

We’re in economic purgatory. In the nondefense, nongovernment sectors, that’s where the caution is creeping in. We’re seeing it when we talk to dealers, distributors and users.

At the same time, some think that these fears may be overstated. On the defense portion of the sequester, Zachary Fryar-Briggs writes in Defense News:

But the magnitude of the cuts — millions of jobs, according to the [Aerospace Industries Assocation], and the industry’s destruction — is overblown, according to several senior industry executives. Even some of the declarations about the complete lack of guidance on how sequestration would be implemented are excessive, one senior executive said.

Of course, any short-term damage from the cliff would be minor compared to the longer-term effects of putting everything off and allowing our debt to grow unchecked. You can see from the chart that the effect on growth from the fiscal cliff compared to having everything extended starts to converge in the last quarter of 2013, and CBO has shown that the economy would be larger by 2022 under the cliff scenario than one in which most of the cliff is averted.

This is not to say that going over the cliff is the right move. Replacing the cliff with more gradual cuts that still have our debt on a downward path is the way to go.

Click here to read CRFB's analysis of the fiscal cliff.