GAO Releases Its Long Term Fiscal Outlook

The Government Accountability Office has updated its long-term budget outlook, showing once again that our budget deficit needs to seriously be addressed on both the revenue and the spending side. The problem is too big to not put everything on the table.

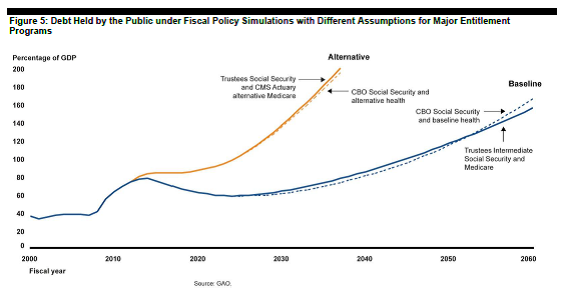

Like CBO's projections, GAO includes both a current law scenario (or Extended Baseline) and a current policy scenario (or Alternative Fiscal Scenario). GAO's projections are based in part on the CBO long-term budget assumptions--explained here--with some slight adjustments. There are two main differences between GAO's and CBO's assumptions:

- Revenue: GAO assumes revenue grows in their current law baseline until 2022, after which it is held constant at its 2022 level of 21.4 percent of GDP. In contrast, CBO's current law projection shows revenue continuing to grow as a percent of GDP due to features of the tax code which naturally affect growth. As you can see here, the assumption to freeze revenue or not makes a sizeable difference in the long-term budget projections.

- Social Security and Medicare: GAO uses the Social Security and Medicare Trustees' projections for spending under both scenarios, while CBO uses their own projections and methodology. Over the long term, GAO's projections for the two programs end up being somewhat lower (initially they are higher), particularly due to their health care growth assumptions.

The graph below shows the two projections side by side.

Source: GAO

GAO also provides a very useful table that shows how difficult it will be to close the gap on the revenue or spending side alone, particularly if the can is kicked down the road a few years before lawmakers address the problem. Under the alternative baseline, if lawmakers wished to control the debt by only raising revenue, revenue would have to increase by 46 percent. If they wished to only decrease spending, a 32.3 percent decrease is required. The problem becomes even larger if lawmakers wait to act.

| Average Percentage Change Required To Close Gap | |||||

| If Action is Taken Today | If Action is Delayed Until 2022 | ||||

| Scenario | Fiscal Gap 2012-2086 (Percentage of GDP) | Solely Through Increases In Revenue | Solely Through Decreases In Non-Interest Spending | Solely Through Increases In Revenue | Solely Through Decreases In Non-Interest Spending |

| Baseline Extended | 2.1 | 10.0 | 9.4 | 11.8 | 10.9 |

| Alternative | 8.3 | 46.0 | 32.3 | 54.7 | 37.2 |

Source: GAO

These projections provides further support for two points that we often repeat on this blog. The first point is that a comprehensive deal has to address both spending and revenue -- not just to gain bipartisan support, but also because the magnitude of the changes required from just one side of the budget would likely be greater than either party would want. The second point is that lawmakers cannot continue to kick the can down the road because the longer they wait, the more severe it will become and the quicker changes will need to be implemented.

Putting the country on a sustainable fiscal path is already a great challenge for lawmakers, so we cannot afford to let this become a bigger problem before we put a plan together.