Full Repeal of Obamacare Would Hasten Medicare's Insolvency

Earlier this week, we released a report estimating the cost full repeal of the Affordable Care Act (ACA), also known as Obamacare, and the savings from various partial repeal options.. But in addition to the impact on the unified budget deficit, ACA repeal could increase deficits facing the Medicare Hospital Insurance (HI) Trust Fund, which funds Part A of Medicare, and accelerate its insolvency.

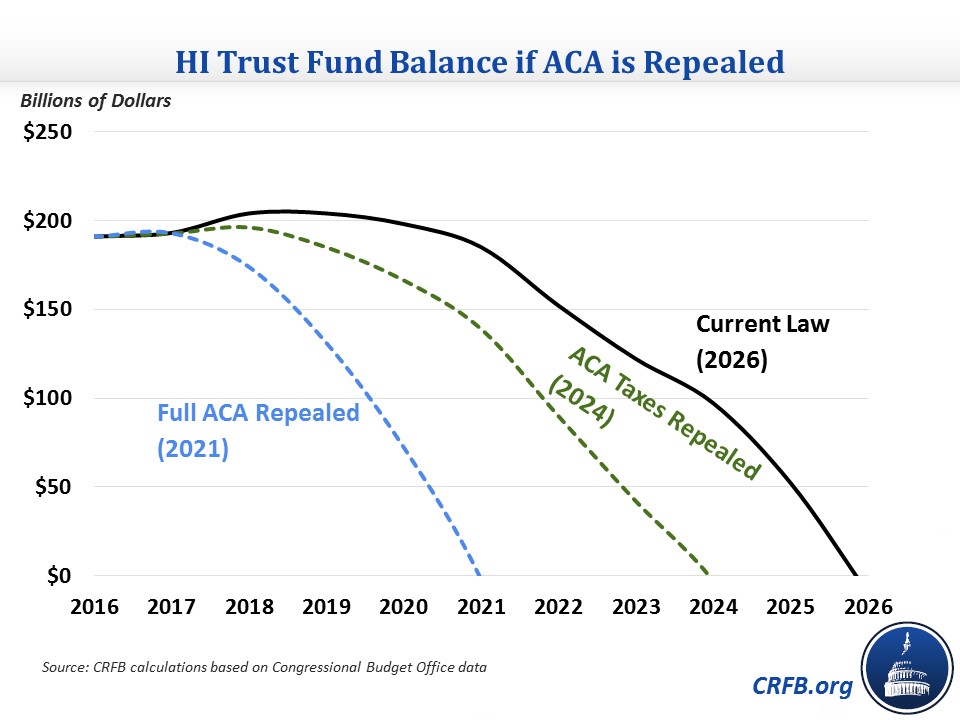

Under current law, CBO projects Medicare's HI, or Part A, trust fund will exhaust its reserve by 2026. By our estimate, full repeal of the ACA would advance that insolvency date to 2021 and more than triple the program's 10-year deficit. Repealing the ACA's coverage and tax provisions but retaining its Medicare cuts would advance its insolvency date to 2024 and increase its deficit by half. And either change would significantly worsen Medicare HI's long-term financial outlook.

These findings are in line with those from Loren Adler and Paul Ginsburg of the Brookings Institution, who found that repealing the law's tax increases, under the Medicare Trustees assumptions, would advance insolvency from 2028 to 2024.

The negative trust fund impact of repeal stems from offsets in the Affordable Care Act that improved Medicare's financial state.

On the revenue side, the ACA raised the HI payroll tax rate from 2.9 to 3.8 percent for wage income over $200,000 ($250,000 for couples). Repealing that measure alone would cost about $150 billion and increase the HI shortfall over the next decade (2018-2027) from less than $350 billion to about $500 billion.

On the spending side, the ACA reduced HI costs through reduced provider payments, "productivity adjustments" that slow the growth of payment increases, cuts to Medicare Advantage reimbursements, and other smaller reforms. Ending these changes going forward would cost about $600 billion over a decade, and along with repealing the higher HI tax would lead to a $1.1 trillion HI deficit over the next decade.

| Scenario | 2018-2027 Deficits | Insolvency Date |

| Current Law | $350 billion | 2026 |

| ACA Taxes Repealed | $500 billion | 2024 |

| Full ACA Repealed | $1.1 trillion | 2021 |

Source: CRFB calculations based on Congressional Budget Office data

Improvements to Medicare from the ACA come largely from essentially double-counting (from a trust fund perspective) the same savings and revenue to both improve the HI trust fund and simultaneously finance new health care spending. Nonetheless, repealing these provisions today would worsen finances of the HI trust fund.

When the ACA was debated and enacted, many Republicans rightly pointed out that the same resources cannot be used twice. Yet now that repeal is under discussion, some have discussed dedicating any net savings toward the HI trust fund and then using those savings again to finance a replacement plan – essentially doubling down on double-counting.

Instead, given the financial shortfalls facing the HI trust fund, policymakers should retain (or replace) the ACA policies that improve HI's solvency and indeed build upon them. Doing so would not only maintain the strength of the HI trust fund, but likely result in better unified budget outcomes as well.