Entitlement Reform Proposals Offered by BPC and AEI

The Bipartisan Policy Center’s (BPC’s) Commission on Retirement Security and Personal Savings released its recommendations to improve retirement security and savings late last week, and several experts gathered by the American Enterprise Institute (AEI) released proposals to reform entitlement programs. While these two reports differ in many ways – including their ideological starting point and the topics covered – there are also several commonalities. Most notably, both reports put forward comprehensive plans to reform and make solvent Social Security, and both plans would significantly reduce the senior poverty rate by slowing benefit growth for higher earners while enhancing benefits for those most in need. You can try your own hand at stabilizing the debt and reforming our entitlement program by using our Budget Simulator.

BPC’s Commission, co-chaired by CRFB board member and former Senator Kent Conrad (D-ND) and former Deputy Commissioner of Social Security James Lockhart, made several recommendations designed to improve savings and retirement security across six key areas:

- Improve Access to Workplace Retirement Savings Plans

- Promote Personal Savings for Short-Term Needs and Preserve Retirement Savings for Older Age

- Facilitate Lifetime-Income Options to Reduce the Risk of Outliving Savings

- Facilitate the Use of Home Equity for Retirement Consumption

- Improve Financial Capability Among All Americans

- Strengthen Social Security’s Finances and Modernize the Program

You can read the BPC Commission's detailed recommendations here and watch the release event here.

Perhaps most relevant to fiscal policy are their recommendations on Social Security, which would not only restore solvency to the program, but also promote work, improve progressivity, and reduce senior poverty. To promote work – and in turn economic growth – the plan would gradually raise the retirement age, increase the years used to calculate wage history, apply Social Security’s progressive formula on an annual rather than lifetime basis, and change some of the signals that may currently be encouraging early retirement. To further improve solvency, the plan would adopt the more accurate chained CPI to calculate cost-of-living adjustments (COLAs), cap spousal benefits for higher earners, increase the taxable maximum, and raise the payroll tax rate by 1 percentage point. And finally, to improve progressivity and reduce poverty, the plan would make the benefit formula much more progressive, increase benefits for widows and widowers, and create a generous income-based Basic Minimum Benefit for those above the full retirement age.

BPC Commission on Retirement Security and Personal Savings Social Security Plan

| Proposal | % of Solvency Gap Closed* | % of 75th Year Shortfall* |

|---|---|---|

| Adopt the chained CPI for cost-of-living adjustments | 17% | 13% |

| Increase the number of years for calculating benefits and apply the benefit formula on an annual basis | 11% | 10% |

| Index the retirement age to longevity (review at age 69) | 18% | 29% |

| Make the benefit formula more progressive to enhance benefits for low- and middle-earners | 2% | 2% |

| Enhance widow(er)s benefits while capping spousal benefits | 6% | 2% |

| Increase the “tax max” to $195,000, then index to AWI+0.5% | 20% | 13% |

| Increase the payroll tax by 1% | 33% | 22% |

| Institute a Basic Minimum Benefit | -7% | -5% |

| Interactions and other policies | 6% | 8% |

| TOTAL | 106% | 94% |

*Based off a 75-year shortfall of 2.65 percent of payroll and a 75th year shortfall of 4.64 percent of payroll as a result of the Bipartisan Budget Act of 2015.

As a result of these changes, the Social Security Chief Actuary estimates that BPC’s plan would prevent the Social Security trust fund from running out of reserves in 2034, close 106 percent of Social Security’s 75-year gap, and bring spending and revenue closely in line over the long run. Although Social Security would face a very small cash deficit at the end of its 75-year projection window – about 6 percent of the current shortfall – this would be covered by interest earnings and could be virtually eliminated by continuing to index the retirement age to longevity beyond age 69, as the Commission recommends future lawmakers consider.

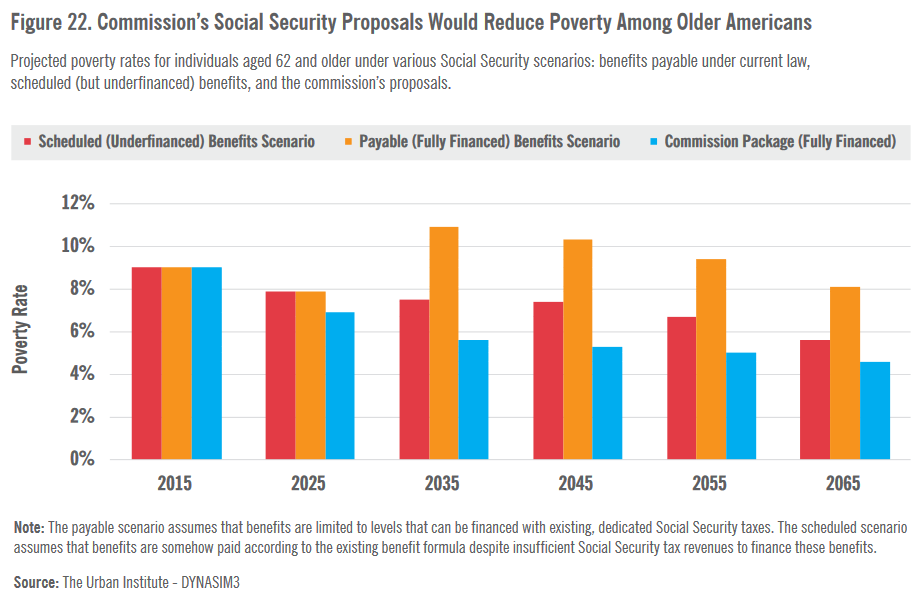

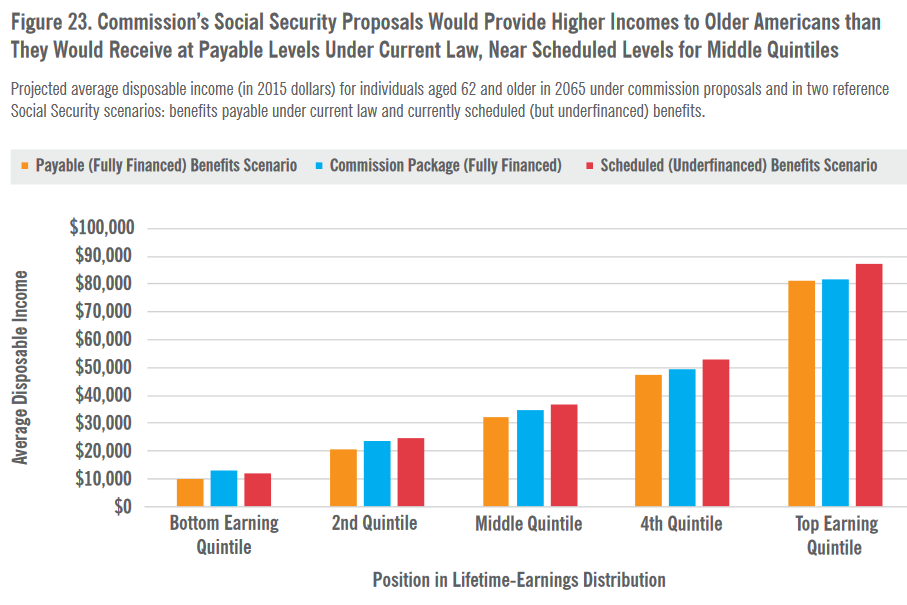

Importantly, the Commission’s Social Security plan would progressively increase disposable income for nearly all seniors compared to currently-payable Social Security benefits and compared to currently-scheduled benefits for the lowest earners while substantially reducing the poverty rate. Including their other proposals, only the highest earners would see a significant reduction in disposable income relative to scheduled (but currently unpayable) benefits.

Although it is quite different structurally, the AEI proposal by Andrew Biggs, James Capretta, Robert Doar, Ron Haskins, and Yuval Levin contained a thoughtful Social Security plan last week to make the program solvent while improving work incentives and reducing poverty. The central element of this plan would be to transition towards a universal flat benefit set at the poverty threshold and indexed to wage growth. This element alone would slow benefit growth for the top two thirds of beneficiaries while enhancing it for the bottom third and virtually eliminating senior poverty.

In addition to this change, which would be phased in very gradually through 2075, the authors propose to increase Social Security’s early eligibility age from 62 to 65, eliminate the payroll tax for workers over age 62, adjust COLAs for current retirees so they grow faster for lower earners and slower for higher earners, cover all newly hired state and local workers, promote increased use of 401(k) retirement accounts, and reform the disability insurance program to encourage work.

According to AEI’s estimates, this plan would not only restore the program to solvency but also generate large surpluses after 2050 that would allow lawmakers (by AEI’s recommendation) to actually reduce payroll taxes.

In addition to their Social Security plan, Biggs, Capretta, Doar, Haskins, and Levin put forward proposals to repeal and replace the Affordable Care Act, reform Medicare and Medicaid, expand health savings accounts, test block grants and wage subsidies, improve the Earned Income Tax Credit, reform food stamps, and make a variety of changes to low-income support programs like Temporary Assistance to Needy Families (TANF), Supplemental Security Income (SSI), child support enforcement, and child care programs and tax benefits.

You can read AEI's plan here and watch the release event here.