Economic Effects of the President's Budget: It's All About Immigration Reform

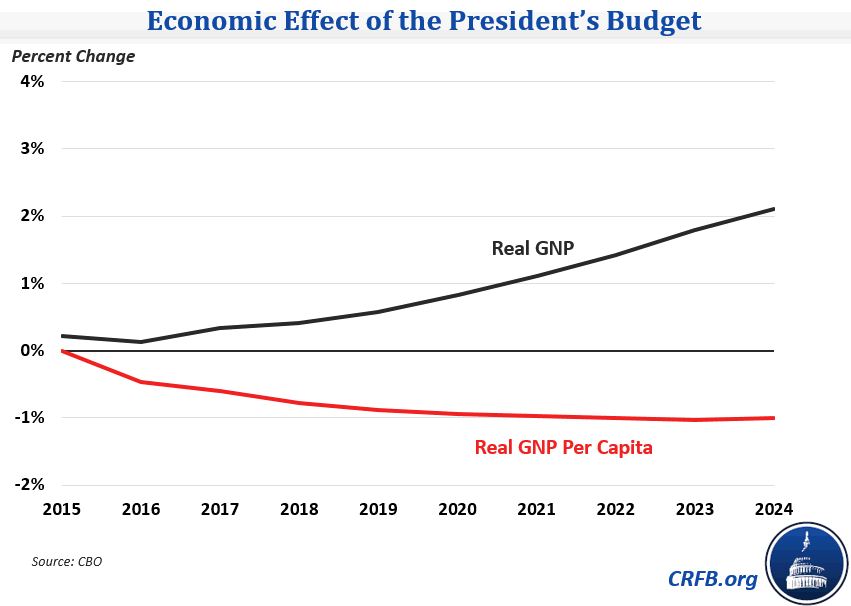

In its release this week of the economic effects of the President's budget, CBO found it would increase the size of the economy, mainly due to immigration reform. As a result, under the President's budget Gross National Product (GNP) would be about 2.1 percent higher in 2024 than before the enactment of the budget, though GNP per capita would be about 1 percent lower. Importantly, higher economic growth would lead to additional revenue collection and lower deficits. Because CBO accounted for certain economic effects of immigration in its analysis of the President's budget, the additional economic effects would actually increase the deficit by less than $100 billion over ten years.

In analyzing the economic impact of the President's budget, CBO finds six main ways in which the budget would affect economic growth:

- Increasing the size of the U.S. population, thus raising the number of workers;

- Increasing federal budget deficits in the short term, mainly through higher government spending, which would boost aggregate demand and the use of labor and capital;

- Reducing federal budget deficits in the long term, which would increase national saving and private investment;

- Raising the marginal tax rate on labor income, thereby discouraging work;

- Raising the marginal tax rate on capital income, thereby discouraging saving; and

- Increasing federal investment in ways that would increase productivity and the skill level of the workforce.

Immigration reform by far has the largest effect, with the impact of lower deficits but higher tax rates slightly lowering economic growth.

In the first five years of the analysis, CBO expects real GNP would increase by 0.6 percent but cause real GNP per capita to fall by 0.5 percent. Immigration reform plays a major factor in these totals, boosting real GNP by increasing the population but lowering real GNP per capita since the new workers would be less skilled and earn lower wages than the overall population. The other policies in the President's budget would boost GNP in 2015 through short-term stimulus but reduce it thereafter by a small amount, slightly offsetting the increase from immigration reform. By 2019, effective marginal tax rates on labor and capital income would increase by 0.6 and 1.4 percentage points respectively.

In the final five years of the analysis, the economic effects would continue in broadly the same manner as the first five. Real GNP would increase by 2.1 percent by 2024, but real GNP per capita would be lowered by 1 percent. The effects described in the preceding paragraph would be larger, since most of the budget's net deficit reduction takes place during this period, the population increase would continue to grow, and the effective rate increases would also grow compared to the early years (although they are the same as the 2019 increases).

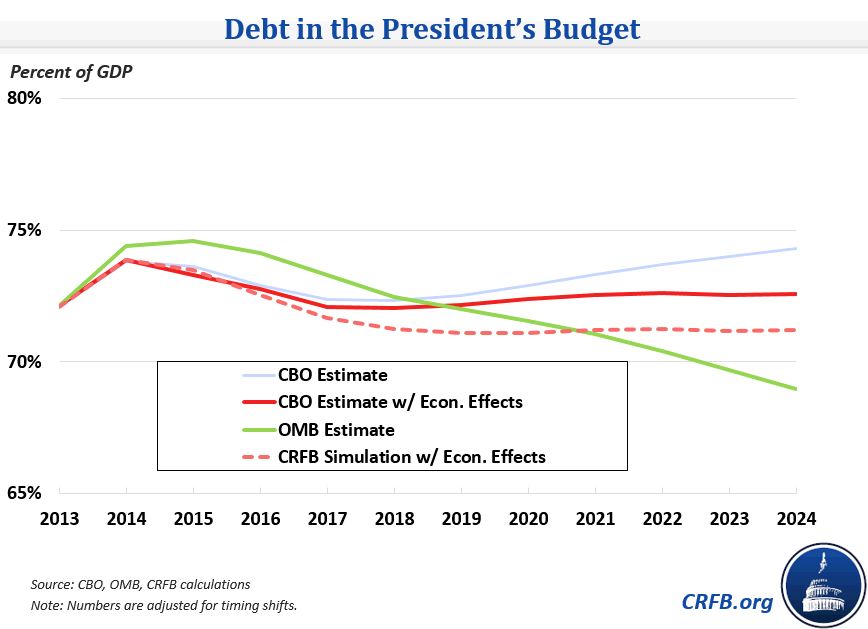

Incorporating the change in real GNP and the slightly higher deficits would also change what debt-to-GDP looks like for the budget compared to CBO's current law estimate. Debt would be on a stable path at about 72.5 percent of GDP rather than being on a slight upward path to 74 percent of GDP by 2024. Their estimate is similar in path to what we anticipated based on CBO data back in April, although debt in our path is slightly lower since unlike CBO, we count the $150 billion of temporary revenue from corporate tax reform.

Including economic effects shows a slightly improved debt picture for the President's budget, but it would likely not prevent an upward path for debt; at best, it would stabilize debt at a historically high level. The President could book more economic gains and lower debt by going further on deficit reduction, particularly entitlement reform.