Dynamic Scoring Explained

What is dynamic scoring? How are legislative proposals currently scored? CRFB's latest policy paper details the process and methods that the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) use to estimate the budget impact of legislation and the pros and cons of supplementing that process with "dynamic scoring."

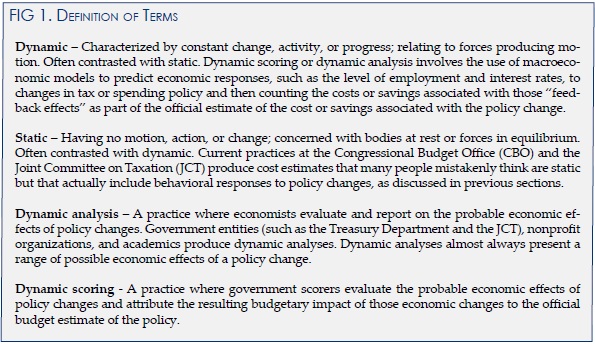

As we explain in the paper, the current process for evaluating legislation does not take into account the effects that legislation could have on macroeconomic variables like GDP or unemployment. However, contrary to what some claim, CBO and JCT do not score on a purely "static" basis, meaning they take no other effects into account. Rather, they incorporate behavioral (or "microeconomic") effects such as shifts in the timing of economic activity, shifts between taxable and nontaxable forms of income, and effects on supply and demand within a specific market.

Incorporating the macroeconomic effects of a proposal into a budget estimate is what is commonly referred to as "dynamic scoring." Dynamic scoring would not only detail how a proposal affected the economy, it would also translate any economic effects into budgetary effects. Although proponents of some policies (especially tax cuts) have occasionally gone as far as to claim that using dynamic scoring would show a deficit-increasing policy would pay for itself, official dynamic estimates have shown these effects to be much more modest than claimed.

There are a number of arguments both for and against dynamic scoring. Proponents state that dynamic scoring provides fuller information about legislation, removes a bias against pro-growth policies, and takes advantage of better technology and economic modeling that has been achieved since CBO was formed in 1974. Detractors state that dynamic scoring would create a large amount of additional work for scorekeepers, would require choosing one model to use for evaluation when no consensus has been achieved about a superior one, would require making assumptions about future policy, and could politicize the scorekeepers who are supposed to be non-partisan and damage their credibility.

We note that it is always better to have more information about legislation, but that it may be practically difficult for dynamic scoring estimates to be incorporated into the official budget process. If Congress does make dynamic estimates more prominent, they should not interfere in the estimates and be willing to live with whatever CBO and JCT produce. Furthermore, as we state:

Importantly, policymakers should be pursuing pro-growth policies regardless of how they are accounted for. In addition to having benefits in its own right, faster economic growth will lead to higher revenue, lower spending on safety net programs, a greater capacity for individuals and businesses to bear tax and spending changes, and a greater capacity of the economy as a whole to carry debt (i.e. higher GDP will lower the debt-to-GDP ratio) – all of which can help the country address its fiscal challenges. Even if scorers do not account for these effects directly, pro-growth policy changes can yield a bonus in the form of lower than projected deficits and debt. Currently, we are faced with making painful choices that, unfortunately, can no longer be avoided. Higher growth will not make painful choices go away, but it will make them relatively less painful.

Click here to read the full paper.